Unlisted Shares Investment in India: How to Get Started Step by Step

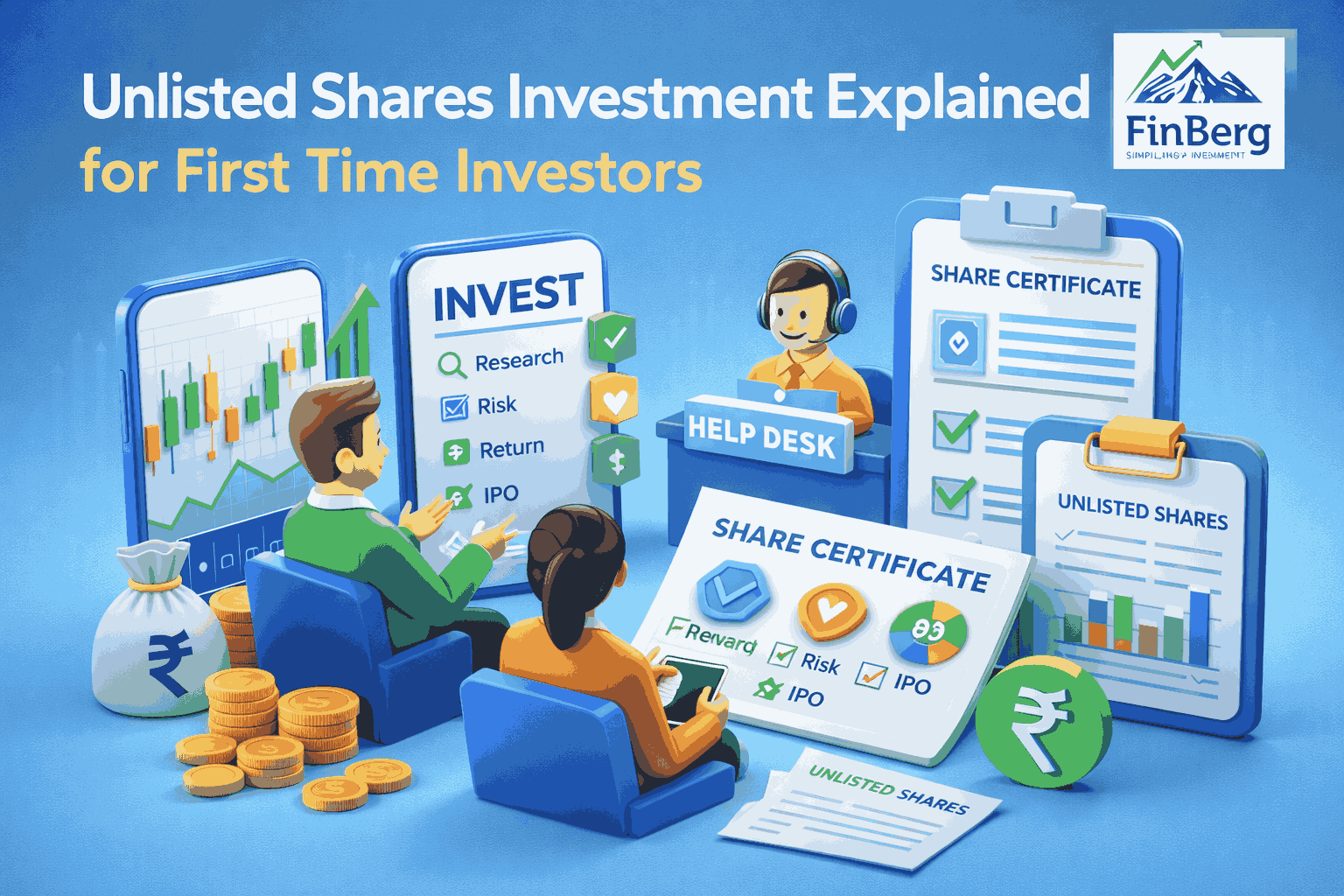

Unlisted shares are increasingly attracting investors who want access to promising companies before they reach the stock market. As awareness grows beyond traditional equities and mutual funds, many investors are exploring unlisted shares investment in india to diversify portfolios and capture early stage growth opportunities. These investments allow participation in companies that are not yet publicly traded but may have strong future potential.

However, investing in unlisted companies is very different from buying listed stocks. It requires deeper research, patience, and an understanding of risks, pricing, and legal processes. A clear step by step approach to unlisted shares investment in india and knowing how to buy unlisted shares in india can help investors avoid common mistakes and make informed decisions aligned with long term goals.

Get expert support to invest smartly in unlisted shares

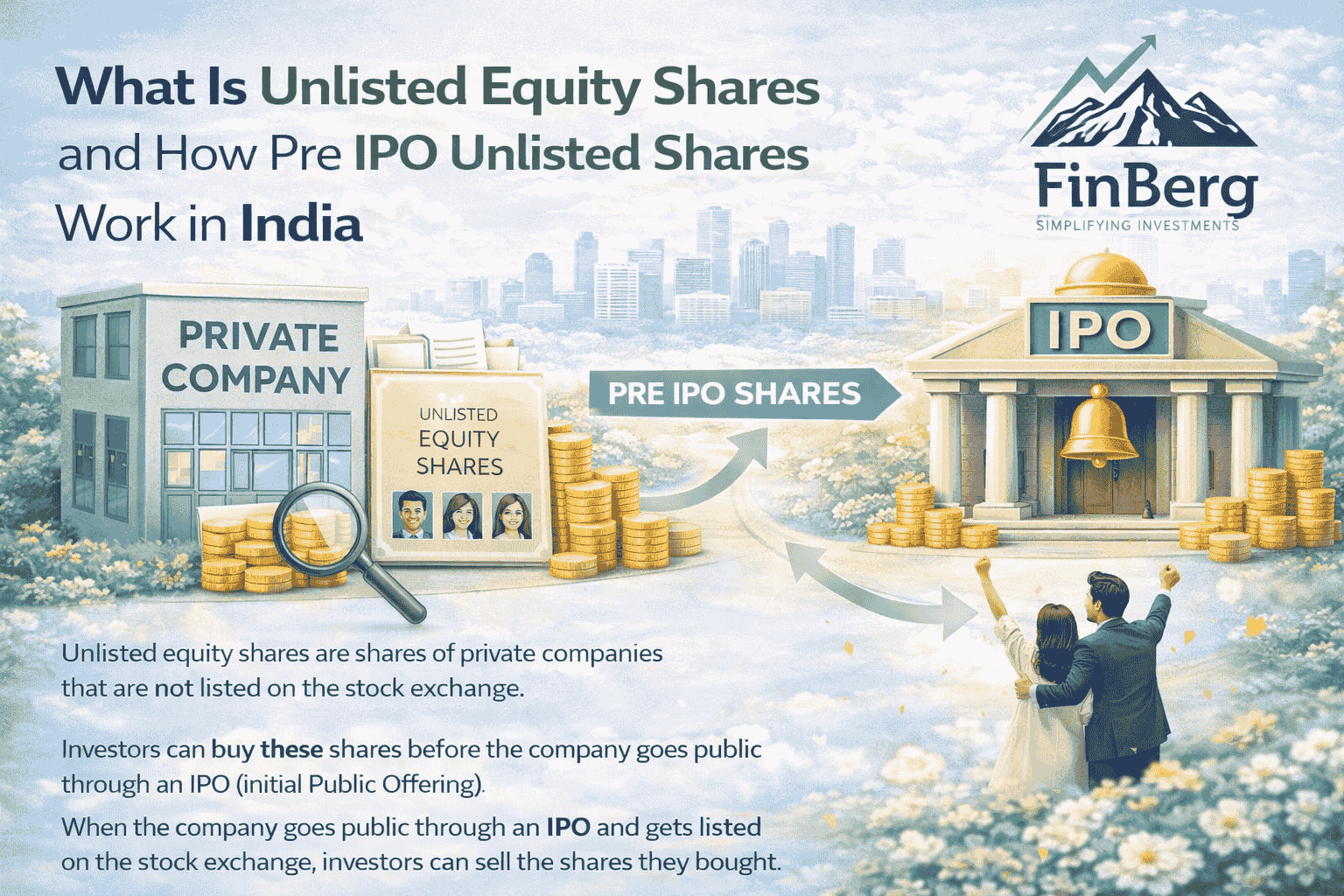

What Are Unlisted Shares in India

This section explains what unlisted shares are and how they differ from listed shares traded on stock exchanges.

Unlisted shares are equity shares of companies that are not listed on recognized stock exchanges such as NSE or BSE. These companies may be startups, private limited companies, or large firms planning a future IPO. Transactions in unlisted shares usually happen through private arrangements rather than open market trading.

Key characteristics of unlisted shares

• Not traded on public stock exchanges

• Limited liquidity compared to listed shares

• Price discovery based on demand, supply, and negotiations

• Often associated with longer investment horizons

Understanding these basics is essential before exploring unlisted shares investment in india or deciding to buy unlisted shares in india.

Categories of Portfolio Management in India: A Complete Classification Guide

Why Investors Choose Unlisted Shares Investment in India

This section explains the reasons behind the growing interest in unlisted equity investments among Indian investors.

Unlisted shares investment in india offers access to companies at an early stage of growth, often before they attract public market attention. Many well known companies were once available only as unlisted shares before delivering strong returns post listing.

Reasons investors prefer unlisted shares

1 Opportunity to invest before an IPO

2 Potential to buy shares at lower valuations

3 Exposure to high growth private companies

4 Portfolio diversification beyond listed equities

While returns can be attractive, investors must remember that unlisted shares investment in india also involves higher risk and requires careful analysis before deciding to buy unlisted shares in india.

Categories of Mutual Funds in India: A Complete Classification Guide

Risks Involved in Unlisted Shares Investment in India

This section highlights the major risks that investors should evaluate before entering this segment.

Unlisted shares do not offer the same liquidity and transparency as listed stocks. Investors must be prepared for longer holding periods and uncertain exits.

Common risks involved

• Limited exit opportunities due to lack of active markets

• Difficulty in accurate valuation of shares

• Lower availability of public financial information

• Regulatory and compliance uncertainties

Because of these factors, unlisted shares investment in india is suitable mainly for investors with higher risk tolerance who understand the challenges involved when they buy unlisted shares in india.

How Unlisted Shares Are Priced in India

This section explains how pricing works in the absence of stock exchange trading.

Unlike listed shares, unlisted shares do not have real time market prices. Pricing is influenced by several internal and external factors.

Key pricing factors include

• Company financial performance and profitability

• Recent funding rounds and investor interest

• Industry growth prospects

• Demand and supply among buyers and sellers

Pricing factors

Understanding pricing mechanisms helps investors approach unlisted shares investment in india more realistically when planning to buy unlisted shares in india.

Why Mutual Funds Are Popular in India: Benefits, Risks and Long Term Potential

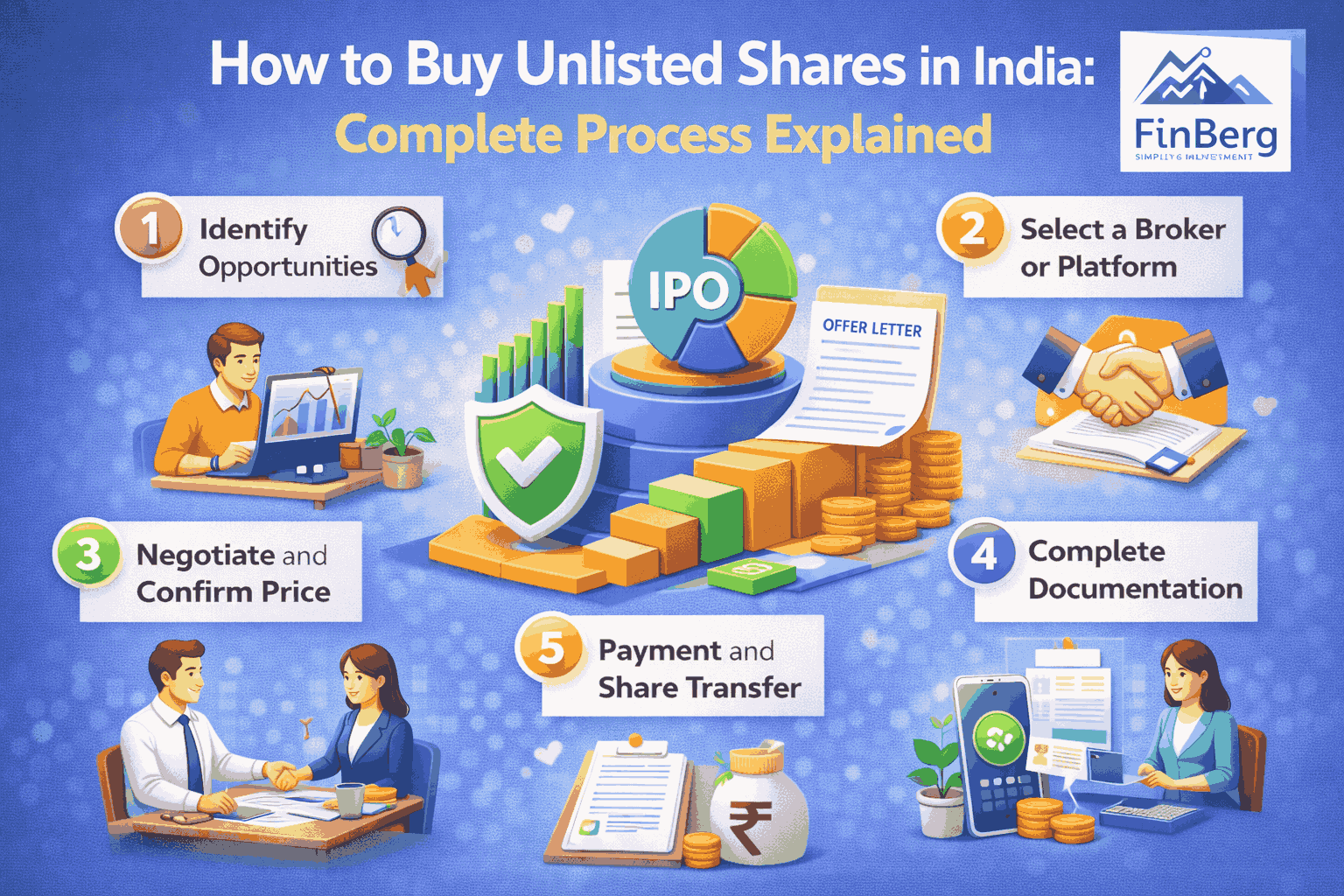

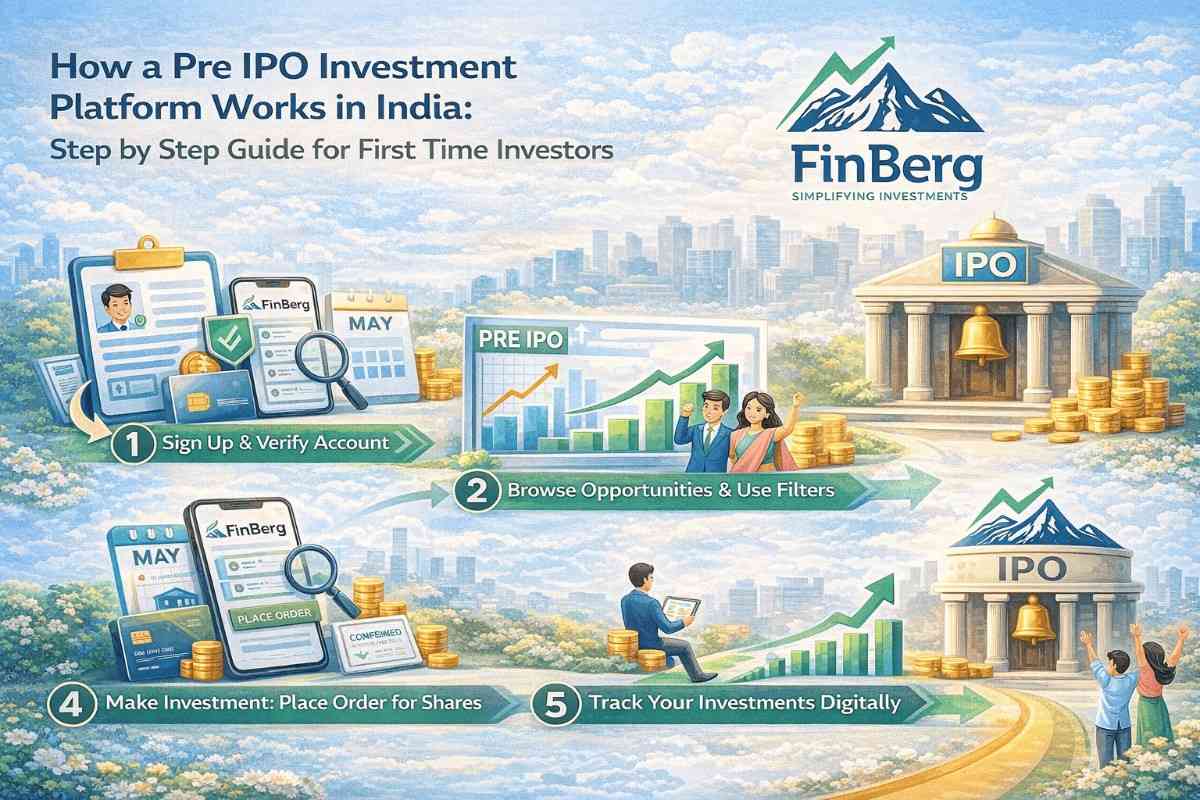

Step by Step Process for Unlisted Shares Investment in India

This section provides a structured approach to investing in unlisted shares, from research to execution.

Unlisted shares investment in india requires discipline and a methodical process to reduce risks and improve decision making.

Identify the Right Unlisted Company

Choosing the right company is the most important step in unlisted investing.

Key aspects to evaluate

• Company business model and revenue sources

• Management quality and leadership experience

• Growth potential within its industry

• Competitive advantages and scalability

A strong foundation improves the chances of success in unlisted shares investment in india.

SIP vs Mutual Fund Know Where to Start Your Investment Journey

Find a Reliable Seller or Platform

Transactions in unlisted shares usually happen through intermediaries or private networks.

Common sources to buy unlisted shares in india

• Authorized intermediaries and brokers

• Wealth management platforms

• Employees or early investors selling ESOP shares

Choosing a reliable source reduces counterparty risk when investors buy unlisted shares in india.

Complete Due Diligence

Due diligence is essential before finalizing any unlisted share transaction.

Important checks include

• Shareholding pattern and ownership clarity

• Company compliance and regulatory filings

• Past transaction prices and volumes

• Any pending legal or financial issues

Thorough due diligence strengthens decision making in unlisted shares investment in india.

Execute the Transaction

The execution process involves documentation, payment, and share transfer.

Key steps involved

• Agreement on price and quantity

• Payment through banking channels

• Share transfer through demat accounts

• Completion of legal documentation

Proper execution ensures a smooth experience when investors buy unlisted shares in india.

Documents and Accounts Required to Buy Unlisted Shares in India

This section explains the basic requirements needed to participate in unlisted share transactions.

To invest in unlisted shares, investors must have appropriate accounts and documentation in place.

Key requirements include

• Demat account to receive shares

• PAN card and completed KYC

• Share transfer forms and agreements

Having these documents ready simplifies unlisted shares investment in india and avoids delays when investors buy unlisted shares in india.

Learn More: Why You Need a Health Insurance Advisor in 2025: Smart Planning for Rising Medical Costs

Taxation on Unlisted Shares Investment in India

This section explains how gains from unlisted shares are taxed in India.

Tax treatment depends on the holding period and nature of gains.

Capital gains classification

• Short term capital gains apply if shares are sold within the prescribed holding period

• Long term capital gains apply for longer holding periods

Understanding taxation is critical for effective planning in unlisted shares investment in india, especially before deciding to buy unlisted shares in india.

Read More: Comparing the Best PMS Companies in India: Performance, Fees, and Services Explained

Who Should Consider Unlisted Shares Investment in India

This section explains the investor profile best suited for unlisted investments.

Unlisted shares are not suitable for everyone due to higher risk and lower liquidity.

Ideal investors include

• Individuals with long term investment horizons

• Investors with higher risk tolerance

• Those seeking portfolio diversification

• Investors with surplus capital

Such investors are better positioned to benefit from unlisted shares investment in india when they buy unlisted shares in india thoughtfully.

Have questions about unlisted share investments? Contact us for expert assistance

Conclusion

Unlisted shares offer a unique opportunity to participate in the growth journey of companies before they enter public markets. While the potential returns can be attractive, investors must approach unlisted shares investment in india with caution, research, and patience.

By understanding the step by step process, risks, pricing, and taxation, investors can make informed decisions. When done thoughtfully, unlisted shares investment in india and a disciplined approach to buy unlisted shares in india can add meaningful value to a long term investment portfolio.

FAQs on Unlisted Shares Investment in India

1. What is unlisted shares investment in India?

Unlisted shares investment in India refers to investing in equity shares of companies that are not listed on stock exchanges and are traded privately.

2. Is it legal to buy unlisted shares in India?

Yes, it is legal to buy unlisted shares in India through proper channels and properly documented transactions.

3. How safe is unlisted shares investment in India?

The safety of unlisted shares investment depends on company quality, thorough due diligence, and individual risk tolerance. These investments generally carry higher risk compared to listed shares.

4. What is the minimum investment required?

The minimum investment required varies depending on the company’s valuation and the seller’s requirements.

5. Can unlisted shares be sold easily?

Selling unlisted shares can be challenging due to limited liquidity and a smaller number of buyers.

6. How are unlisted shares valued?

Unlisted shares are valued based on company fundamentals, funding history, and prevailing market demand.

7. What happens to unlisted shares during an IPO?

Unlisted shares usually convert into listed shares once the company completes its IPO.

8. Are unlisted shares taxable?

Yes, gains earned from unlisted shares are subject to capital gains tax as per applicable tax laws.

9. Do I need a demat account to invest in unlisted shares?

Yes, a demat account is required to hold and transfer unlisted shares.

10. How long should I hold unlisted shares?

A long-term holding period is generally recommended because unlisted shares have lower liquidity.

Powered by Froala Editor