What Happens to Unlisted Shares After an IPO in 2025? A Complete Investor Guide

In recent years, more Indian investors have started exploring opportunities in unlisted shares, hoping to profit when those companies go public. However, few understand what happens to unlisted shares after IPO and how it affects liquidity, taxation, and valuation.

With 2025 expected to see record-breaking listings, it’s crucial to understand this process in detail. Whether you are an early investor, employee, or retail buyer, knowing what happens to unlisted shares after IPO helps you make smarter investment decisions.

Unlock the Future of Your Unlisted Shares After IPO

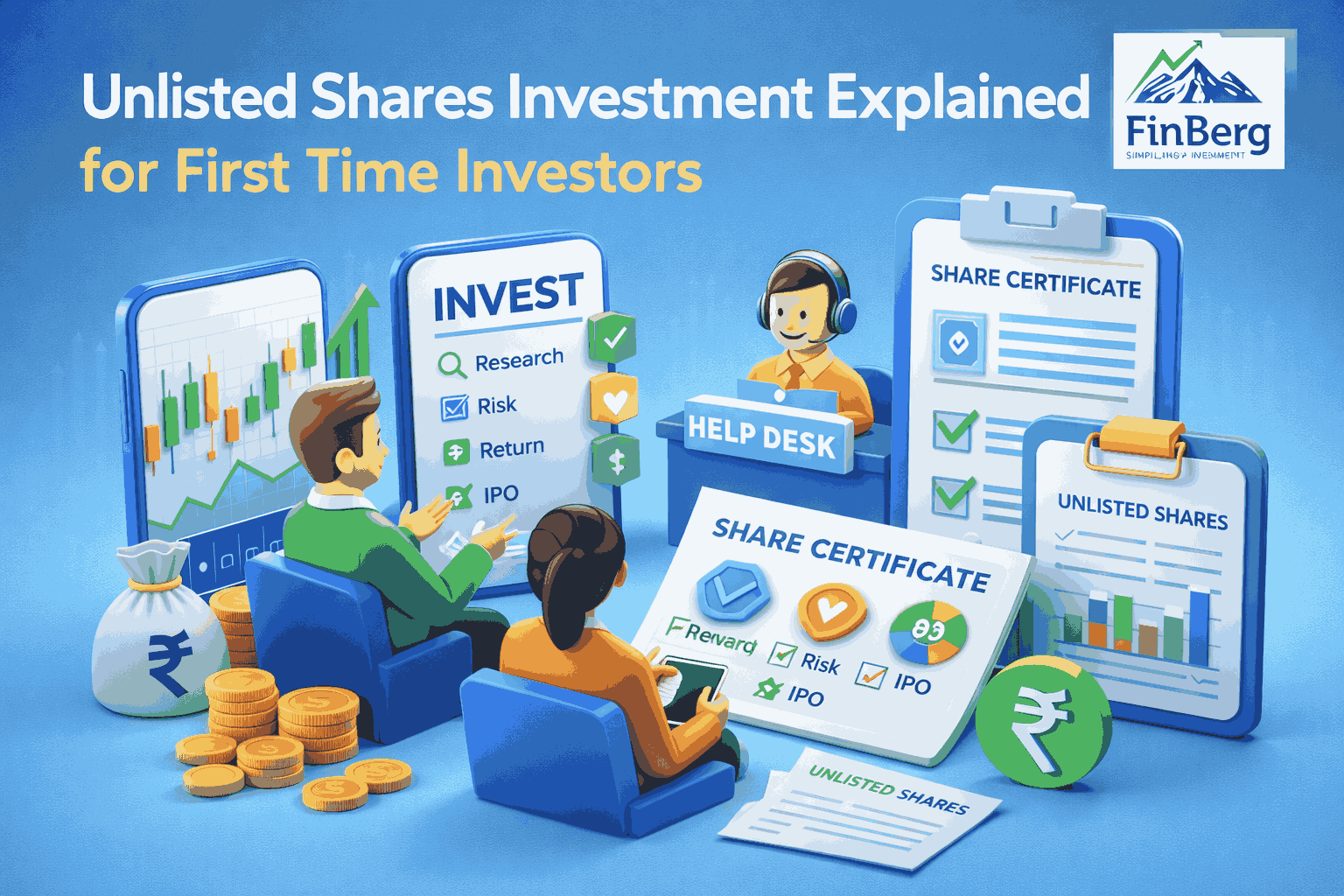

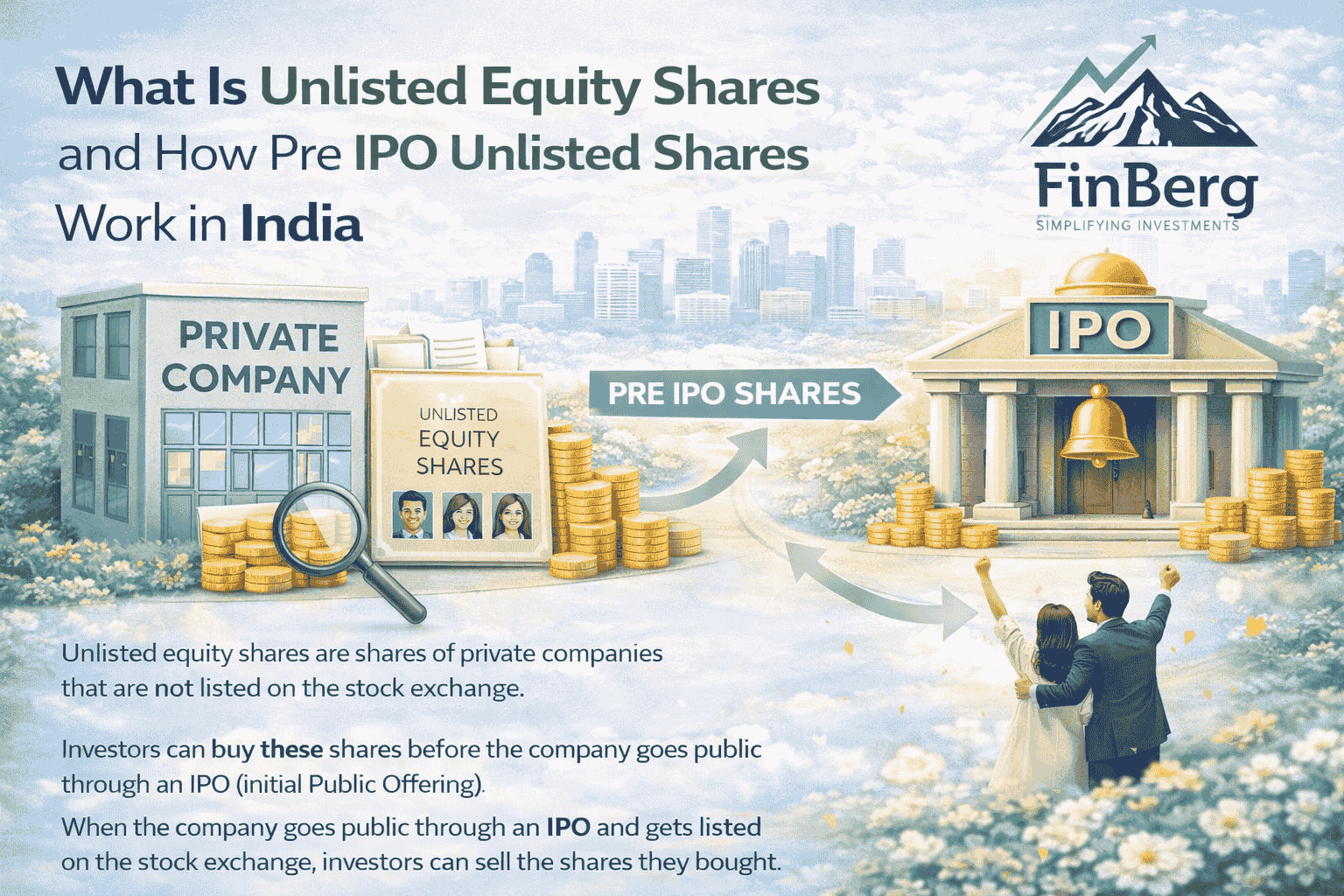

Understanding Unlisted Shares

Unlisted shares represent ownership in private companies that are not yet listed on public exchanges like NSE or BSE. They are typically held by early investors, promoters, or employees who receive them as part of ESOPs.

What Are Unlisted Shares?

Unlisted shares belong to private limited companies that have not yet entered the IPO investment process. These shares are issued through private placements, venture funding, or internal employee programs.

When a company decides to go public, these unlisted shares are converted into listed holdings. This conversion is the foundation of what happens to unlisted shares after IPO and is vital for understanding post-listing value.

Learn More: Best Stock Advisory Firm in India [2025]

Why Investors Buy Unlisted Shares

Investors buy unlisted shares for early access to potential high-growth companies. The goal is to benefit from valuation jumps once the IPO is launched.

Early entry: Investors can buy shares before they trade publicly, usually at lower valuations.

High potential returns: When the company lists, share prices often multiply.

Diversification: Investing before the IPO provides exposure to private markets.

Employee benefits: Employees holding ESOPs can see their shares become valuable once listed.

Most investors enter the IPO investment process early because they anticipate long-term gains once the company lists publicly.

What Is an IPO and Why Companies Go Public

An Initial Public Offering (IPO) is the process by which a private company becomes publicly traded by offering its shares to the general public.

Understanding the IPO Investment Process

The IPO investment process is a multi-step journey that includes regulatory approvals, valuation, and price discovery. A company submits its Draft Red Herring Prospectus (DRHP) to SEBI, defines its price range, and opens bids for institutional and retail investors.

For those holding pre-IPO equity, the IPO investment process determines when and how their shares will appear in the stock market. Knowing this timeline helps them prepare for what happens to unlisted shares after IPO.

Learn More: Top Mutual Fund Distributors in India [2025]

Why Companies Choose the IPO Route

Companies go public to raise funds, improve transparency, and provide liquidity to existing shareholders. Some key reasons include:

Expanding business operations using raised capital.

Enhancing brand reputation through public visibility.

Rewarding employees and early investors with liquidity.

Setting a transparent market valuation benchmark.

All of these reasons play a role in shaping what happens to unlisted shares after IPO, as the transition impacts ownership and liquidity.

Step-by-Step: What Happens to Unlisted Shares After IPO

The transformation from unlisted to listed shares involves several technical and financial steps. Understanding this flow helps investors visualize what happens to unlisted shares after IPO more clearly.

Step 1: Conversion to Demat Form

Before the IPO, all unlisted shares must be converted from physical certificates to electronic Demat form. This ensures easy transferability and compliance with SEBI regulations. Investors must also update their KYC and bank details to avoid discrepancies.

This step marks the first real phase in what happens to unlisted shares after IPO, as it makes them ready for public trading.

Step 2: Valuation and Price Discovery

The IPO investment process determines the final issue price through a book-building mechanism. Underwriters and financial institutions assess company performance, market trends, and investor demand before setting a price band.

Investors who understand the IPO process for investors know that pre-IPO valuations often influence the eventual listing price. If market sentiment is strong, these shares may debut at a premium.

Learn More: How to Invest in Mutual Funds Online [Step-by-Step Guide in 2025]

Step 3: Allotment and Listing

Once the IPO closes, shares are allotted and listed on NSE or BSE. Investors holding unlisted shares will now see them appear as listed holdings in their Demat accounts.

At this stage, what happens to unlisted shares after IPO becomes clear: they gain liquidity and real-time market pricing.

Step 4: The Lock-In Period

The lock-in period prevents key shareholders from selling immediately after listing.

Promoters generally have an 18-month lock-in.

Institutional investors and VCs usually wait six months.

Employees under ESOPs may have custom restrictions.

The lock-in ensures that the stock price remains stable during early trading days. Investors aware of the IPO investment process plan accordingly, choosing the right time to sell post-lock-in.

Step 5: Post-Listing Valuation

Once the company lists, the stock price is determined by supply and demand. Prices may fluctuate depending on performance, sector trends, and investor sentiment.

For those tracking what happens to unlisted shares after IPO, this is the phase where real returns materialize. A good company with strong fundamentals usually trades above its issue price.

Step 6: Tax Implications After Listing

The tax treatment of unlisted shares changes after listing. Before the IPO, long-term capital gains (LTCG) on unlisted shares are taxed at 20% with indexation. After listing, the rate reduces to 10% beyond ₹1 lakh of profit.

Understanding this difference is vital when planning exits. The IPO process for investors directly impacts how much post-listing profit they can retain after taxes.

Learn More: Why have Unlisted shares gained momentum in last few years

Impact on Different Types of Shareholders

Different shareholders experience different outcomes once the IPO is complete.

For Founders and Promoters

Promoters see a significant increase in paper wealth as their shares gain public value. However, due to lock-in rules, they cannot sell immediately. This restriction helps maintain confidence in the stock during early trading days.

For Early-Stage Investors

Venture capital and private equity funds often use the IPO as an exit opportunity. After the lock-in, they may sell a portion of their holdings to book profits or reinvest in other startups.

For Employees with ESOPs

Employee stock options (ESOPs) are one of the biggest wealth creators during IPOs. When a company lists, these options become tradable shares. Employees benefit from liquidity and profit potential but must also consider taxation.

For Retail Pre-IPO Investors

Retail investors who bought unlisted shares through intermediaries get the benefit of immediate liquidity after listing. They can decide to sell or hold based on post-listing performance.

Example: From Unlisted to Listed

This flow shows what happens to unlisted shares after IPO across every important milestone.

Key Factors That Affect Share Value

The post-listing performance of shares depends on multiple factors.

Company Fundamentals

Revenue growth, profitability, and management quality are major determinants of long-term performance.

Market Sentiment

Strong sentiment during the IPO investment process can lead to premium listings. Weak demand may result in underperformance.

Sector Growth

Sectors like technology, renewable energy, and fintech tend to attract strong investor interest.

Policy and Economic Conditions

Macroeconomic changes and policy reforms influence how shares behave after listing.

All these factors contribute to what happens to unlisted shares after IPO, shaping post-listing returns.

Read More: Best Financial Advisor in India [2025]

Risks After Listing

Every IPO carries risk, even for strong companies.

Market Volatility

Initial trading sessions often see sharp price movements. Investors should avoid emotional decisions and wait for stability.

Overvaluation

If the stock is overpriced during the IPO investment process, short-term corrections are likely.

Liquidity Management

Selling immediately after listing may reduce long-term profit potential. Those who understand the IPO process for investors plan their exits strategically.

Tax Implications of Unlisted Shares After IPO

Taxes can significantly impact total returns.

Pre-IPO Taxation

Before the IPO, LTCG on unlisted shares is taxed at 20% with indexation. Short-term gains are taxed as per the investor’s income slab.

Post-IPO Taxation

Once listed, LTCG above ₹1 lakh is taxed at 10%, and short-term gains at 15%. Investors who know what happens to unlisted shares after IPO can structure their sales more efficiently.

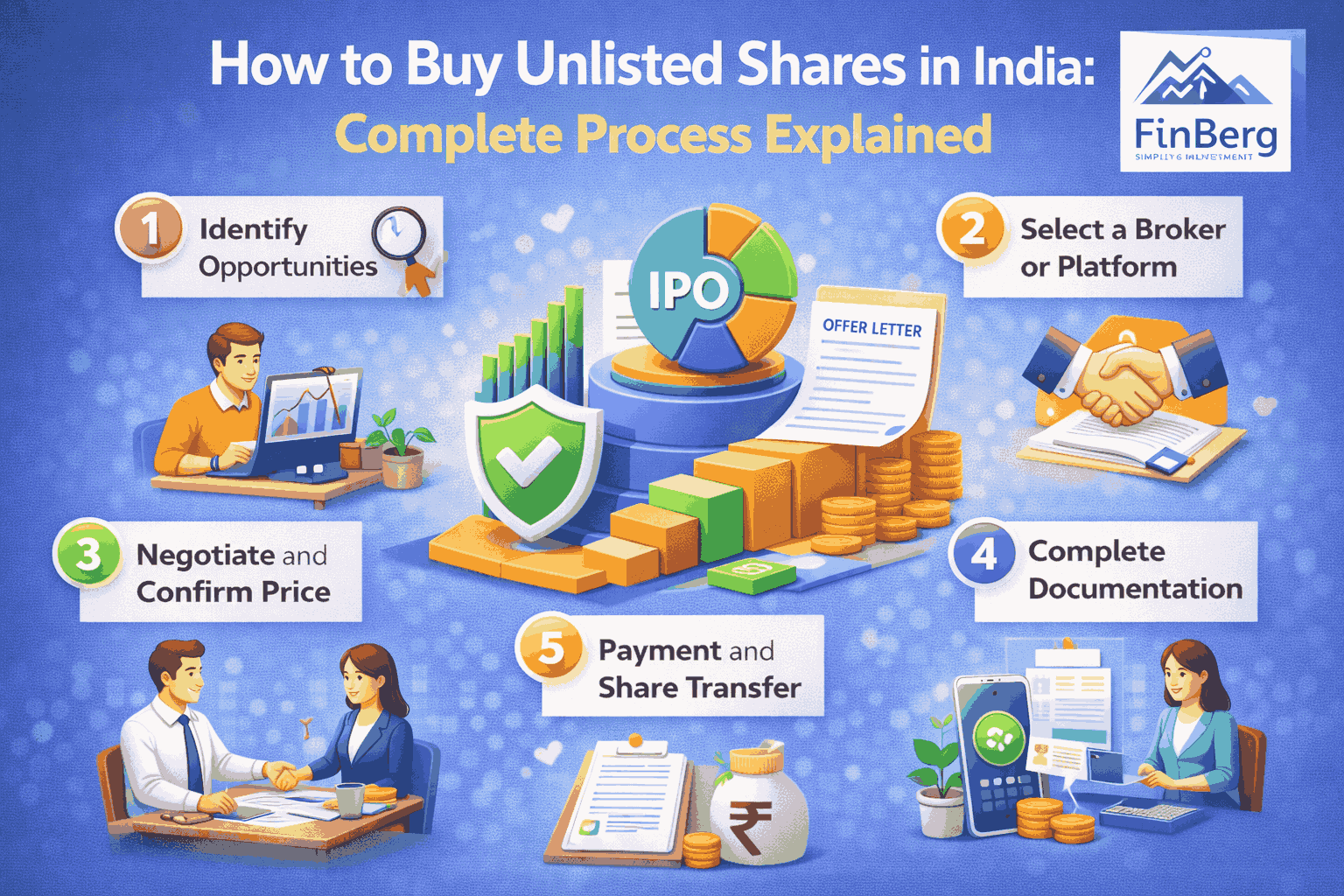

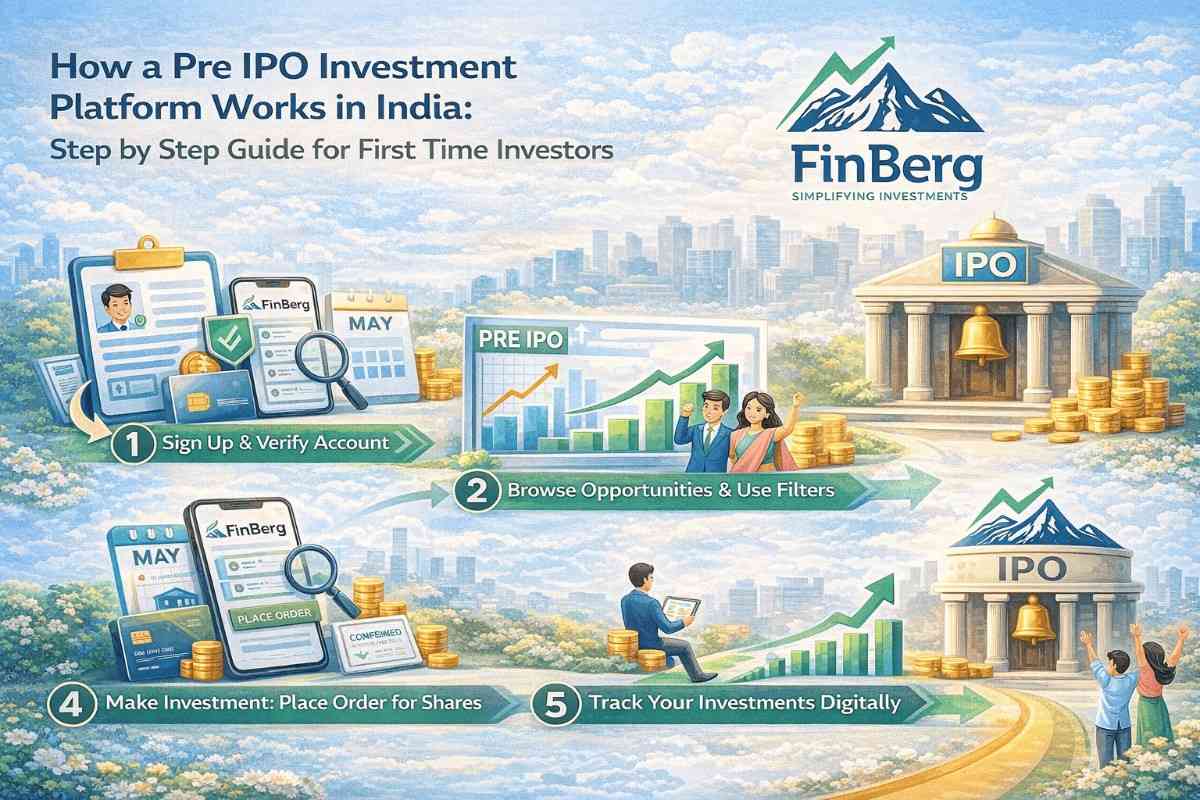

How to Participate in the IPO Investment Process

The IPO investment process offers several entry and exit opportunities.

Step 1: Research and Identify Companies

Look for firms that have filed DRHP with SEBI. Study financial reports, growth potential, and industry outlook.

Step 2: Buy Through Registered Platforms

Invest in unlisted shares through verified intermediaries to ensure transparency.

Step 3: Follow IPO Updates

Keep track of price bands, subscription levels, and listing timelines.

Step 4: Evaluate Post-Listing Performance

Once listed, analyze company performance before deciding to hold or sell. Understanding the IPO process for investors helps in making better long-term decisions.

Tips for Smart Investors

Keep transaction records and Demat details updated.

Monitor SEBI announcements and company filings.

Learn what happens to unlisted shares after IPO before investing.

Diversify across industries to reduce risk.

Consult financial advisors for exit and tax planning.

Turn Unlisted Shares into Public Profits in 2025!

FAQs

What happens to unlisted shares after IPO?

They are converted into listed shares and become tradable on NSE and BSE.How long is the lock-in period?

Usually six months for institutions and longer for promoters.What is the IPO investment process?

It includes valuation, SEBI approval, price band creation, and public listing.Can employees sell ESOPs after IPO?

Yes, once the company lists and the lock-in ends.Are taxes different before and after listing?

Yes, listed shares have lower capital gains tax rates.What if the IPO fails or gets delayed?

The shares remain unlisted until the next attempt.Is investing in unlisted shares risky?

Yes, due to illiquidity and valuation uncertainties.How does the IPO process for investors work?

It involves applying for shares, receiving allotments, and trading after listing.Can retail investors buy unlisted shares?

Yes, through authorized intermediaries before listing.Why should investors understand what happens to unlisted shares after IPO?

It helps plan better exits, manage taxes, and optimize profits.

Conclusion

In 2025, as India’s IPO market expands, understanding what happens to unlisted shares after IPO is more important than ever. Each stage from Demat conversion to taxation affects your returns.

By following the IPO investment process and staying informed about market trends, investors can make confident, data-driven decisions. The IPO process for investors isn’t just about listing; it’s about knowing how to maximize value once trading begins.

When you understand what happens to unlisted shares after IPO, you move from uncertainty to clarity and from potential risk to long-term financial growth.

Powered by Froala Editor