Unlisted Shares Investment Explained for First Time Investors

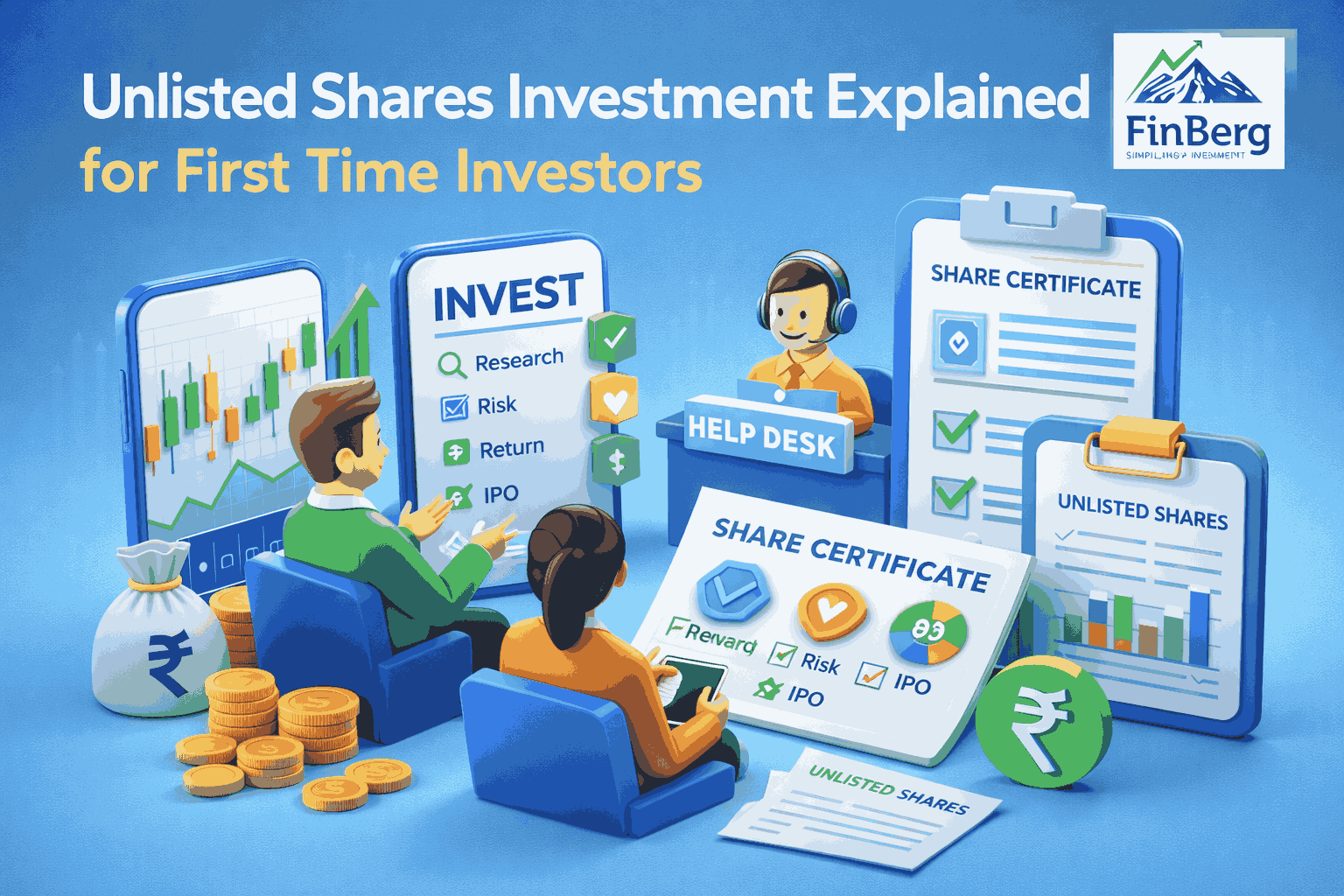

Unlisted shares are gaining attention among investors who want to go beyond traditional stocks and mutual funds. For many beginners, this space looks attractive because it offers early access to companies before they enter the stock market. Unlisted shares investment allows investors to participate in the growth journey of private companies that may later become publicly listed, creating opportunities for long term wealth creation.

At the same time, unlisted investing is very different from buying listed shares. It involves limited liquidity, private transactions, and deeper research. For first time investors, understanding how unlisted shares investment works and how unlisted shares investment in india is structured is crucial before committing money. A step by step understanding helps beginners avoid common mistakes and invest with clarity and confidence.

Get expert support to invest smartly in unlisted shares

What Is Unlisted Shares Investment

This section explains the basic concept of unlisted shares and sets the foundation for beginners to understand this investment category.

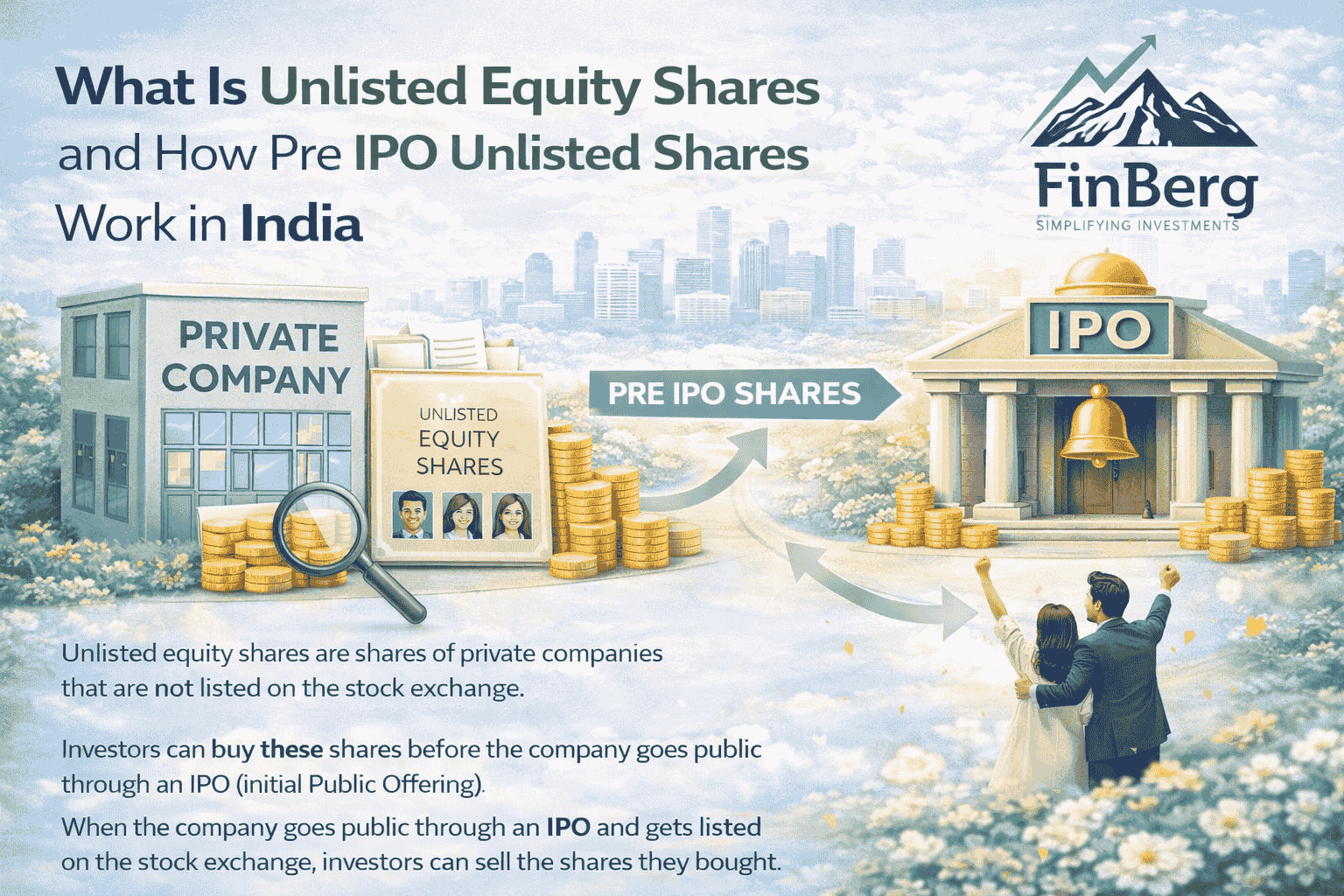

Unlisted shares investment refers to investing in equity shares of companies that are not listed on stock exchanges like NSE or BSE. These companies may be startups, private limited firms, or large companies planning a future IPO. Transactions happen privately rather than through public trading platforms.

Key features of unlisted shares

• Shares are not traded on recognized stock exchanges

• Buying and selling happens through private agreements

• Liquidity is limited compared to listed stocks

• Investment horizon is usually medium to long term

Understanding these features helps first time investors approach unlisted shares investment and unlisted shares investment in india with realistic expectations.

Unlisted Shares Investment in India: How to Get Started Step by Step

Why First Time Investors Are Attracted to Unlisted Shares Investment

This section explains why beginners are increasingly curious about unlisted shares and what draws them to this segment.

Unlisted shares investment offers early stage exposure to companies that may have strong growth potential. Many well known listed companies once existed as unlisted firms, and early investors benefited significantly after public listing.

Reasons beginners consider unlisted shares

1 Opportunity to invest before a company lists on the stock exchange

2 Potential to enter at relatively lower valuations

3 Exposure to innovative and fast growing businesses

4 Diversification beyond traditional listed equity investments

While these benefits are attractive, beginners must remember that unlisted shares investment in india requires patience, research, and the ability to handle uncertainty.

Categories of Portfolio Management in India: A Complete Classification Guide

How Unlisted Shares Investment in India Works

This section explains the process of buying and holding unlisted shares in the Indian market.

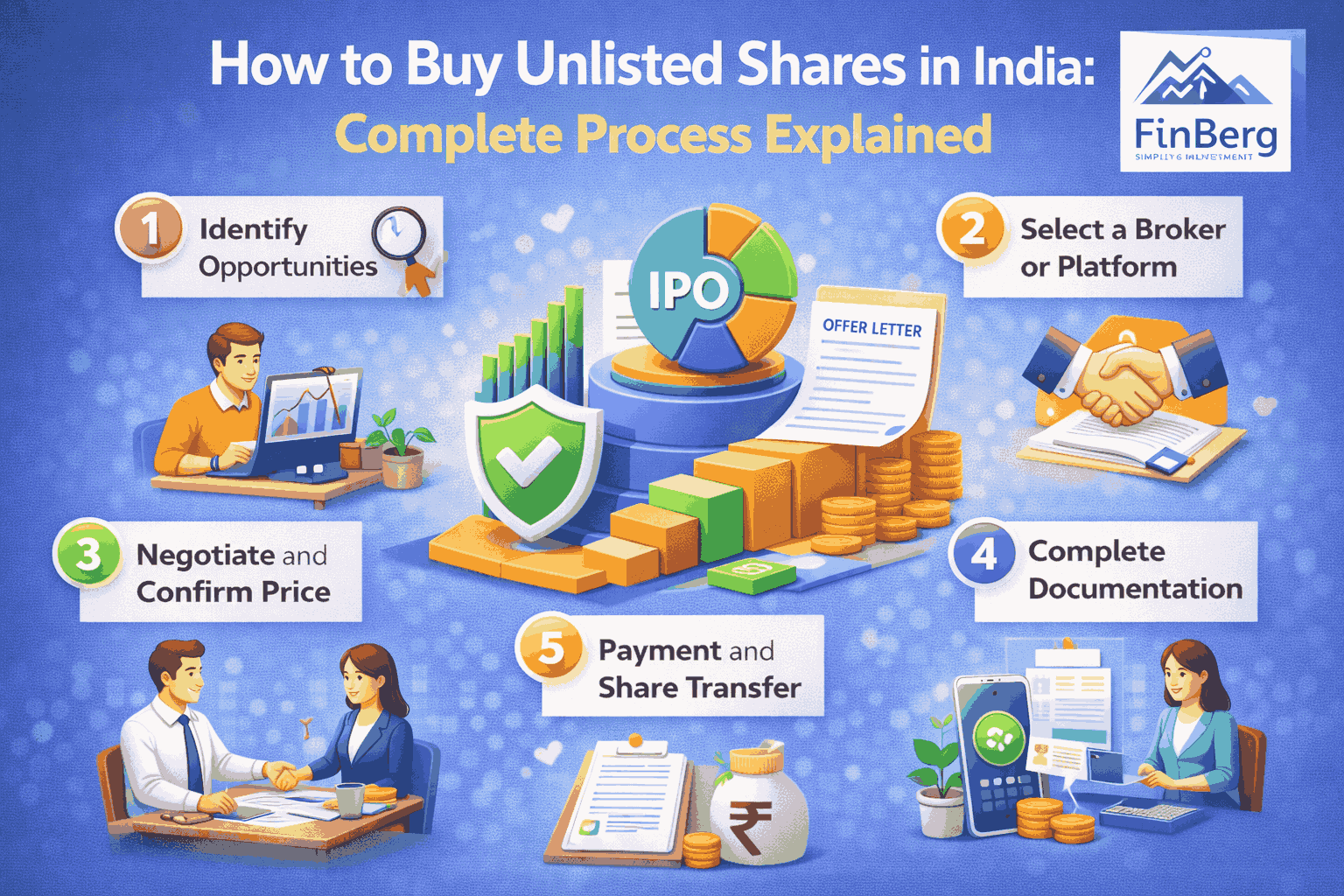

Unlisted shares investment in india operates through private transactions rather than open market trading. Buyers and sellers connect through intermediaries, wealth platforms, or private networks. Once both parties agree on price and quantity, shares are transferred through proper documentation.

How transactions usually take place

• Buyer identifies an unlisted company and seller

• Price is negotiated based on demand and valuation

• Payment is made through banking channels

• Shares are transferred to the buyer’s demat account

Understanding this process helps first time investors navigate unlisted shares investment smoothly and avoid confusion during execution.

Risks Every Beginner Should Know Before Unlisted Shares Investment

This section highlights the major risks that beginners must understand before investing.

Unlisted shares investment carries higher risk compared to listed equities due to lower transparency and liquidity. Beginners should be aware that returns are not guaranteed and exits may take time.

Common risks beginners face

• Limited liquidity, making it difficult to sell shares quickly

• Valuation uncertainty due to lack of public price discovery

• Limited access to detailed financial information

• Delays or uncertainty around IPO timelines

Because of these risks, unlisted shares investment in india is more suitable for investors who can commit capital for the long term and tolerate uncertainty.

Categories of Mutual Funds in India: A Complete Classification Guide

How Unlisted Shares Are Valued

This section explains how unlisted shares are priced without stock exchange mechanisms.

Unlike listed shares, unlisted shares do not have daily market prices. Valuation depends on internal company performance and external demand from investors.

Key valuation factors include

• Company revenue growth and profitability

• Industry potential and competitive positioning

• Recent funding rounds and investor interest

• Demand and supply in the private market

Valuation factors

Understanding valuation helps beginners make informed decisions during unlisted shares investment and assess opportunities in unlisted shares investment in india.

Why Mutual Funds Are Popular in India: Benefits, Risks and Long Term Potential

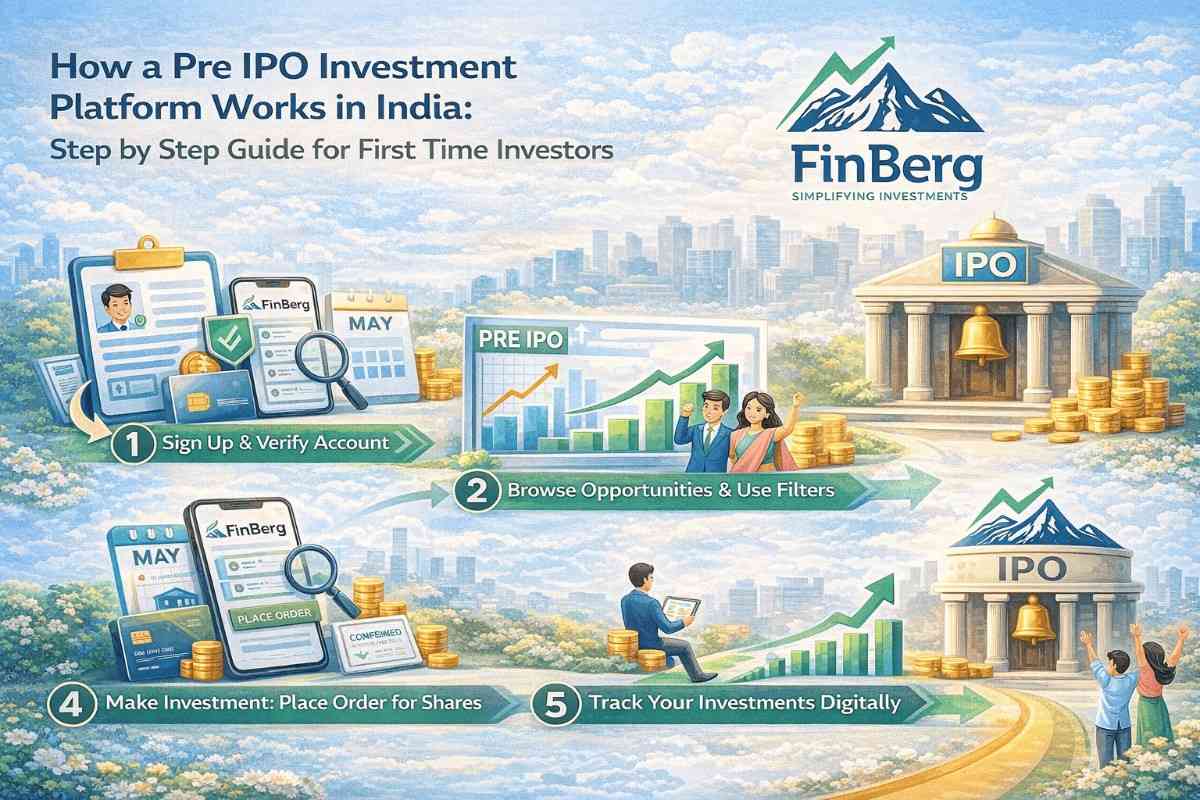

Step by Step Guide to Unlisted Shares Investment for Beginners

This section provides a structured roadmap for first time investors entering unlisted investing.

A disciplined step by step approach reduces mistakes and improves decision quality in unlisted shares investment.

Understand Your Risk Profile

Before investing, beginners must assess whether unlisted shares suit their financial situation.

Key points to consider

• Ability to handle long holding periods

• Comfort with limited liquidity

• Willingness to accept valuation fluctuations

• Availability of surplus capital

Knowing your risk profile ensures unlisted shares investment aligns with personal financial goals.

Select the Right Unlisted Company

Company selection plays a critical role in investment outcomes.

Important factors to evaluate

• Clear and scalable business model

• Consistent revenue growth or strong future potential

• Experienced management team and leadership

• Competitive advantage within the industry

Strong fundamentals improve the chances of success in unlisted shares investment in india.

Choose a Trusted Platform or Seller

Beginners should always transact through reliable sources.

Common ways to invest include

• Registered intermediaries dealing in unlisted shares

• Wealth management and private investment platforms

• Employees or early investors selling ESOP shares

Choosing trusted channels reduces risk when entering unlisted shares investment.

SIP vs Mutual Fund Know Where to Start Your Investment Journey

Complete Documentation and Transaction

Execution requires proper documentation and process adherence.

Key steps involved

• Opening and maintaining a demat account

• Completing KYC and identity verification

• Making payments through banking channels

• Transferring shares into the demat account

Following these steps ensures a smooth experience for first time unlisted shares investment in india.

Documents Required for Unlisted Shares Investment in India

This section outlines the basic documentation needed for unlisted share transactions.

Having the right documents ready avoids delays and complications.

Essential requirements include

• Demat account for holding unlisted shares

• PAN card and completed KYC process

• Share transfer forms and transaction agreements

Proper documentation is a critical part of unlisted shares investment and helps beginners transact confidently in unlisted shares investment in india.

Learn More: Why You Need a Health Insurance Advisor in 2025: Smart Planning for Rising Medical Costs

Taxation Rules for Unlisted Shares Investment

This section explains how gains from unlisted shares are taxed.

Tax treatment depends on how long the shares are held before sale.

Capital gains classification

• Short term gains apply if shares are sold within the specified holding period

• Long term gains apply when shares are held beyond the required duration

Taxation

Understanding taxation is essential for planning unlisted shares investment and avoiding surprises in unlisted shares investment in india.

Who Should and Should Not Invest in Unlisted Shares

This section helps beginners assess suitability for unlisted investing.

Unlisted shares are not suitable for everyone, especially those needing quick liquidity.

Ideal investors include

• Individuals with long term investment horizons

• Investors with higher risk tolerance

• Those seeking diversification beyond listed markets

• Investors with surplus capital

Those needing short term liquidity or low risk options should approach unlisted shares investment cautiously, particularly in unlisted shares investment in india.

Have questions about unlisted share investments? Contact us for expert assistance

Conclusion

Unlisted shares offer first time investors a unique opportunity to invest in companies before they enter public markets. While the potential rewards can be attractive, unlisted shares investment requires patience, careful research, and a clear understanding of risks.

FAQs on Unlisted Shares Investment

1. What is unlisted shares investment?

Unlisted shares investment refers to investing in equity shares of companies that are not listed on stock exchanges and are traded privately.

2. Is unlisted shares investment safe for beginners?

Unlisted shares investment can be suitable for beginners if they understand the risks, invest small amounts, and follow a long term approach.

3. How does unlisted shares investment in India differ from listed shares?

Unlisted shares investment in India involves private transactions, limited liquidity, and different pricing mechanisms compared to listed shares.

4. What is the minimum amount required?

The minimum investment depends on the company and seller, as there is no fixed minimum requirement.

5. How long should beginners hold unlisted shares?

A long term holding period is generally recommended due to limited liquidity and delayed exit options.

6. Can unlisted shares be sold easily?

Selling unlisted shares can be challenging because buyers are limited and transactions are private.

7. What happens if an IPO is delayed?

If an IPO is delayed, investors may need to hold the shares longer until a suitable exit opportunity arises.

8. Are unlisted shares regulated??

Unlisted shares are subject to corporate laws and regulations, though they are not traded on stock exchanges.

9. Do beginners need a demat account?

Yes, a demat account is required to hold and transfer unlisted shares.

10. Is unlisted shares investment suitable for long term goals?

Yes, unlisted shares investment is generally aligned with long term goals due to its growth focused nature.

Powered by Froala Editor