How to Buy and Sell Unlisted Shares in India: A Step-by-Step Investor’s Guide

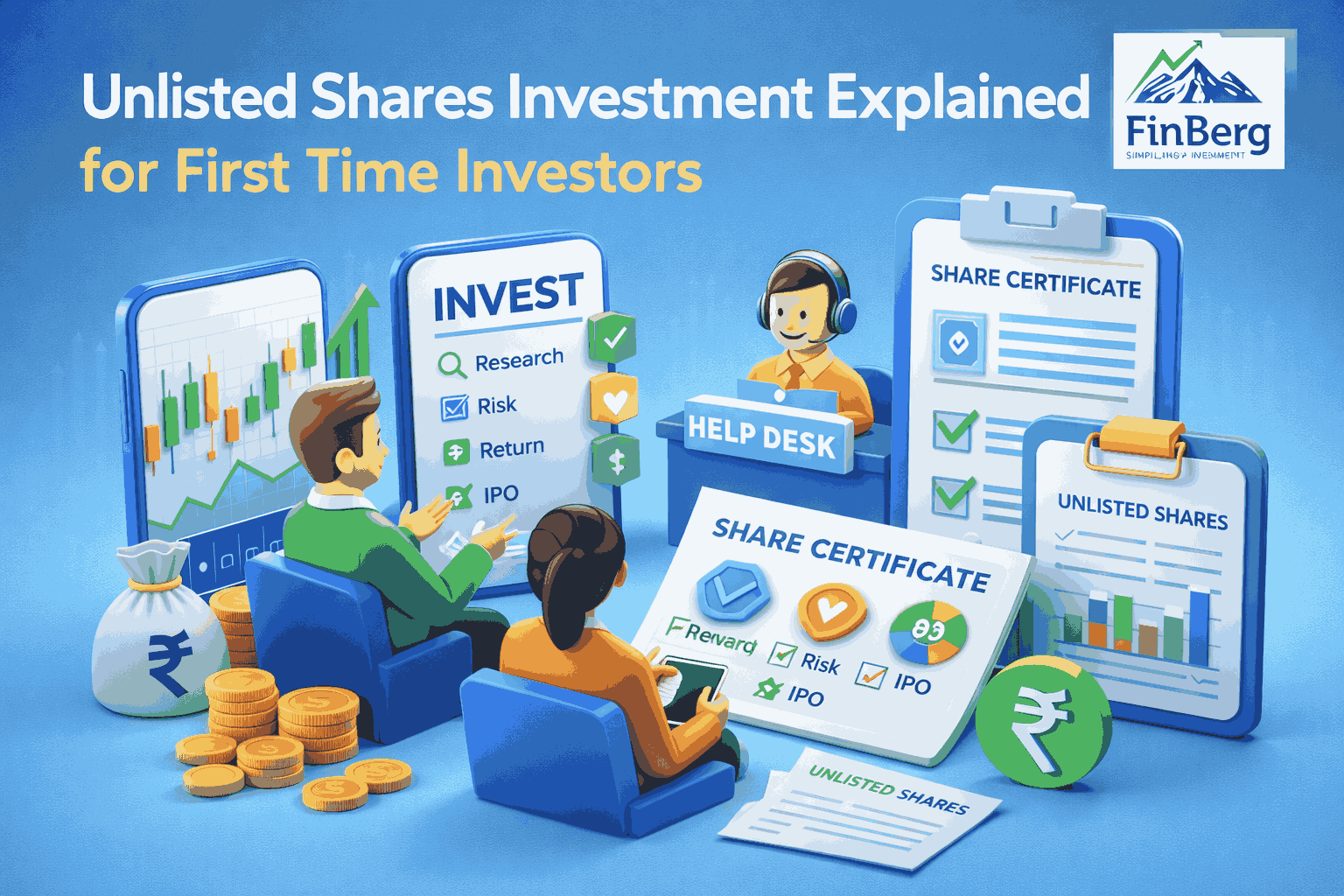

Investing is no longer limited to stocks and mutual funds. Many investors are exploring early opportunities in companies that have not yet listed on the stock exchange. This is why demand for the best unlisted shares in India is growing rapidly. Investors want early entry at lower valuations so they can benefit when a company becomes bigger or announces its IPO.

However, many new investors do not know how to buy unlisted shares India or where to buy unlisted shares safely. Buying and selling unlisted shares involves a simple process, but it must be done carefully to avoid fraud or legal issues. This complete guide explains everything in detail, from how unlisted shares work to how to sell them later and calculate taxes.

By the end of this guide, you will clearly understand how to buy unlisted shares India, where to buy unlisted shares legally, how prices are decided, how to hold them, and how to sell them for profit. You will also understand the benefits and risks of investing in the best unlisted shares in India.

Your easy roadmap to buying and selling unlisted shares in India

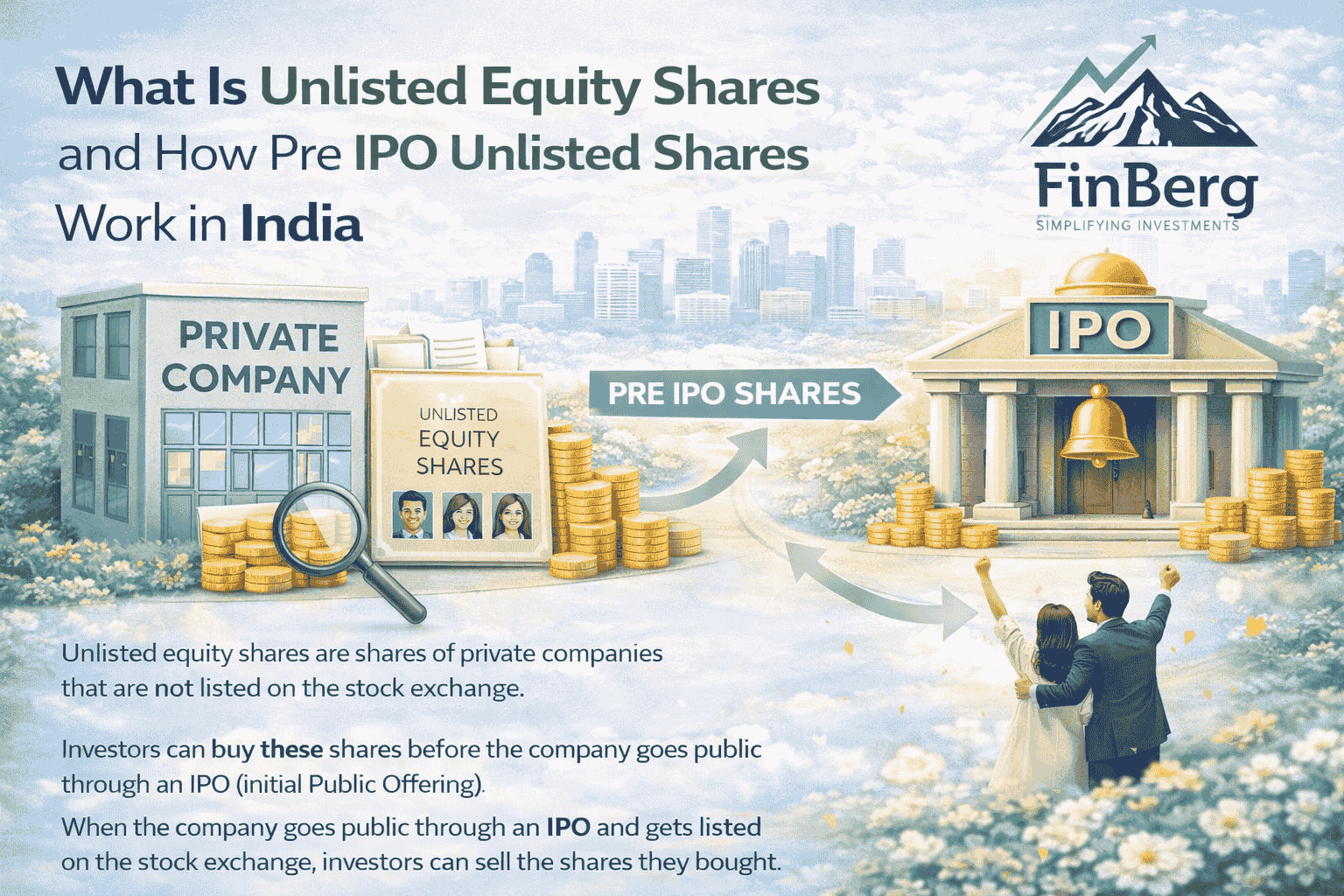

What Are Unlisted Shares

Unlisted shares are shares of companies that are not listed on NSE or BSE. These companies operate privately, and their shares are traded through authorized intermediaries instead of the stock exchange.

Examples include:

Growing startups

Pre-IPO companies

Subsidiaries of large corporations

Early stage tech firms

Companies backed by venture capital

Investors show interest in the best unlisted shares in India because these companies may become larger or eventually file for an IPO in the future.

Why Do People Invest in the Best Unlisted Shares in India

Early entry at a lower price

Potential for high returns during IPO

Opportunity to invest in fast-growing businesses

Diversification beyond listed stocks

Better valuation if the company performs well

Unlisted investments are attractive because early investors often see strong gains once the company grows or lists publicly.

Read More: Difference Between SIP and Mutual Fund Explained: A Complete Guide for New Investors

How Prices of Unlisted Shares Are Decided

Since unlisted companies are not traded on public exchanges, their prices are decided privately. Several factors influence pricing:

Company performance

Revenue growth

Profitability

Market demand

Funding rounds

Industry potential

Expected IPO timeline

Before purchasing the best unlisted shares in India, investors analyze valuation and financial performance to decide if the price is fair.

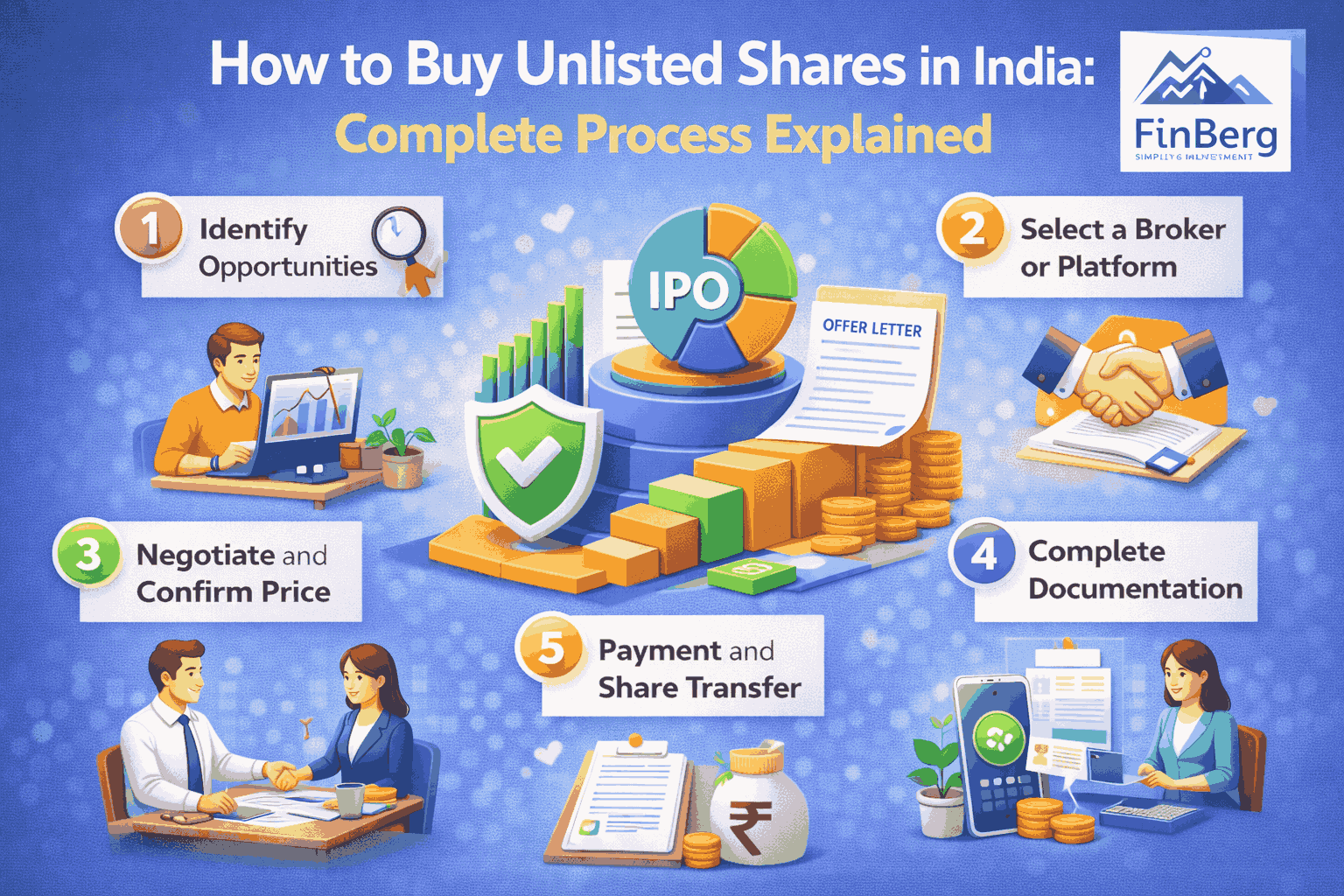

How to Buy Unlisted Shares India: Step-by-Step Guide

Many investors believe the process is complicated, but buying unlisted shares is simple when done correctly. Here is a complete step-by-step process that shows how to buy unlisted shares India safely.

Step 1: Research and Select the Company

Choose companies that show strong growth potential. Investors often start by creating a list of the best unlisted shares in India based on sector performance, management quality, and future expansion.

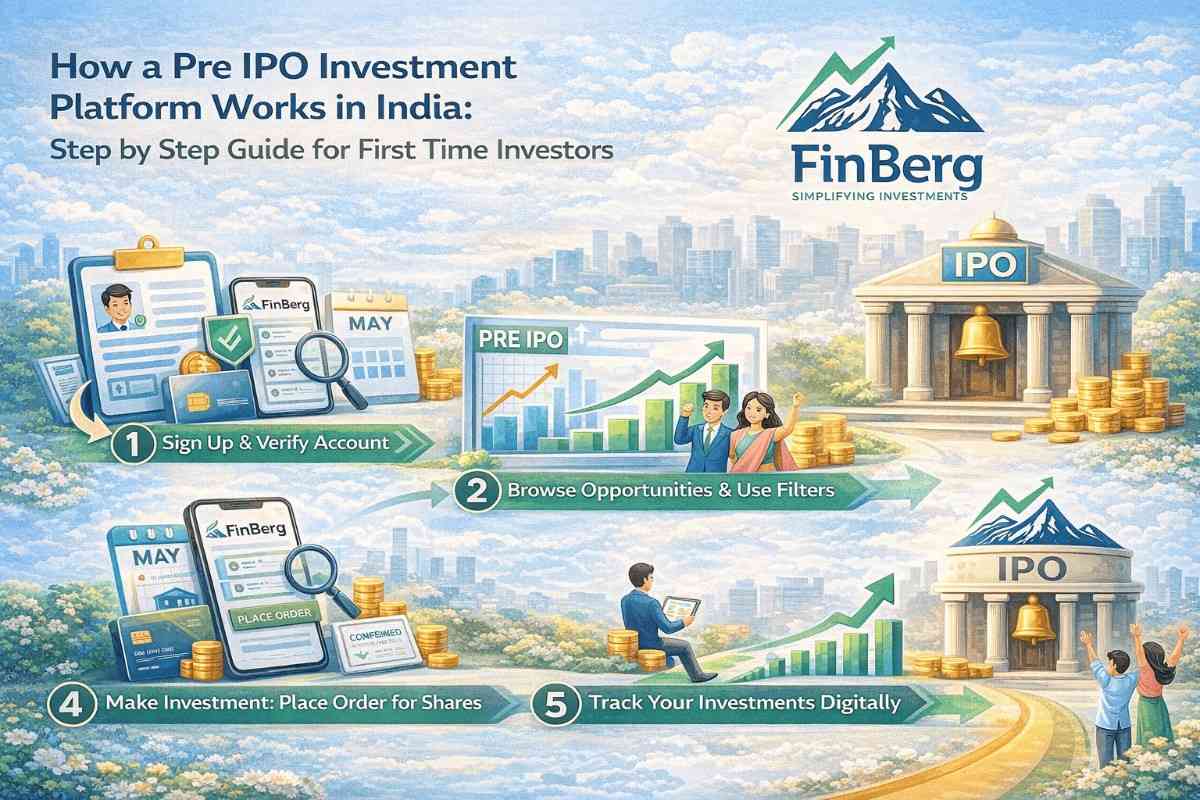

Step 2: Find a Trusted Platform

The most important part of learning how to buy unlisted shares India is ensuring safety. Always choose verified intermediaries and platforms.

Reliable sources include:

SEBI-registered brokers

Private equity intermediaries

Authorized unlisted share platforms

Official companies selling ESOP shares

Knowing where to buy unlisted shares safely reduces risk.

Step 3: Complete the KYC Process

You must complete KYC and provide:

PAN

Aadhaar

Bank details

Demat account

Unlisted shares cannot be held physically. They must be transferred to a Demat account.

Step 4: Payment and Order Confirmation

Once documentation is complete, payment is made through banking channels. The investor receives a contract note that proves ownership. This is helpful for tax and legal records.

Step 5: Shares Transferred to Demat

After payment confirmation and verification, the shares are transferred to your Demat account. The timeline depends on the seller, company, and volume of shares.

Step 6: Hold Until IPO or Sell Privately

Once unlisted shares are received, the investor can:

Hold until the company files for IPO

Sell privately to another buyer

Sell through authorized platforms

Most investors prefer holding the best unlisted shares in India until listing because the price often increases after IPO.

Read More: Comparing the Best PMS Companies in India: Performance, Fees, and Services Explained

Where to Buy Unlisted Shares Safely

Many small investors do not know where to buy unlisted shares safely. Buying directly through unknown sellers is risky. Instead, use regulated platforms.

1. SEBI-Registered Brokers

Registered brokers facilitate private transactions with transparency. They provide legal documentation and verified settlement.

2. Online Unlisted Share Platforms

Many websites list the best unlisted shares in India. These platforms complete KYC, show pricing, and allow secure transactions.

3. ESOP Transactions

Employees of private companies sometimes sell ESOP shares. These sales must be processed legally through proper channels.

4. Venture Capital and Private Equity Deals

Large investors enter through private placements. This method requires higher investment amounts.

Using verified channels is the safest option when deciding where to buy unlisted shares.

Learn More: Equity Fund Investment vs. Mutual Fund: Which Is Better for 2025?

Sources for Buying Unlisted Shares

This table helps beginners understand where to buy unlisted shares based on their investment style.

Read More: How a Life Insurance Advisor Can Help You Secure Your Family’s Future in 2025

How to Sell Unlisted Shares in India

Selling is as important as buying. Here is how to sell unlisted shares once you decide to exit.

Step-by-Step Selling Process

Check current valuation and market demand

Find a buyer through brokers or platforms

Agree on the sale price

Transfer shares from Demat

Receive payment in bank

Maintain contract note and records for taxation

Many investors wait until IPO because listed markets offer better liquidity. This is why the best unlisted shares in India often see price appreciation before listing.

Learn More: Why You Need a Health Insurance Advisor in 2025: Smart Planning for Rising Medical Costs

What Happens After a Company Announces an IPO

When a company goes public, unlisted shares become listed in your Demat account. Once listed, they can be traded like any other stock.

Key Points

Listing improves liquidity

Share price depends on demand

Investors get the freedom to sell anytime

Taxation changes after listing

Investors who bought early often gain significant value once the company enters the market.

Tax Rules for Unlisted Shares

Taxation depends on holding period and whether the shares are still unlisted or listed.

Before Listing

If you sell unlisted shares before IPO:

Long-term capital gains tax is 20 percent with indexation

Short-term gains are taxed as per income slab

Proper documentation is required for tax filing

After Listing

Once the best unlisted shares in India are listed:

Long-term gains above one lakh rupees are taxed at 10 percent

Short-term gains taxed at 15 percent

Understanding tax rules helps investors plan their profit booking.

Read More: What Happens to Unlisted Shares After an IPO in 2025? A Complete Investor Guide

Lock-in Rules

Lock-in depends on investor category.

Promoters face longer lock-ins

Venture capital funds have defined periods

Retail unlisted share buyers usually do not have lock-in

ESOP holders may have internal company rules

Investors must check lock-in terms before buying.

Risks of Unlisted Shares

Although the best unlisted shares in India offer strong growth potential, investors should know the risks.

Liquidity is limited before IPO

Price is not updated daily

Company may delay or cancel IPO

Limited public information

Harder to track valuation

Doing research and using trusted platforms reduces risk.

Read More: Best Financial Advisor in India [2025]

How to Choose the Best Unlisted Shares in India

Selecting the right company is the most important step.

Factors to consider:

Strong business model

Large market size

Good financial health

Professional management team

Media coverage and brand trust

Funding history

Clear IPO planning

Investors often create lists of the best unlisted shares in India based on future potential and demand.

Example of How Investments Grow

If an investor buys at a private valuation and the company lists at a higher valuation, profits increase quickly. For example, a fintech company valued privately at a lower price may list on the exchange at a significant premium. This is why many investors keep searching for how to buy unlisted shares India at the right time.

Learn More: Best Stock Advisory Firm in India [2025]

Tips to Invest Safely

Buy only through verified sources

Check company reputation

Keep all documents and contract notes

Never make cash payments

Hold for long-term rather than short-term speculation

Track company announcements and news

Understand exit options before investing

These steps help investors make better decisions.

Conclusion

Unlisted shares have opened a new world of opportunities for investors. With proper research and planning, the best unlisted shares in India can offer strong long-term returns and wealth creation. Understanding how to buy unlisted shares in India and knowing where to buy unlisted shares safely helps investors avoid risk.

Investors who focus on verified platforms, documentation, and fundamentals can benefit from growth, private valuation gains, and potential IPO listing. As India continues to produce new startups and high-growth companies, unlisted shares will remain one of the most interesting investment opportunities for the future.

Start investing in unlisted shares the smart and simple way

Frequently Asked Questions

1. Why are investors interested in the best unlisted shares in India

Because they may offer strong growth and listing benefits in the future.

2. How to buy unlisted shares India legally

Buy through regulated brokers or unlisted share platforms that handle KYC and legal transfer.

3. Where to buy unlisted shares with minimum risk

The safest options are SEBI-registered brokers and authorized online platforms.

4. Do I need a Demat account for unlisted shares

Yes, shares are transferred electronically to your Demat account.

5. Can I sell shares before IPO

Yes, you can sell privately if you find a buyer and complete documentation.

6. Are unlisted shares suitable for beginners

They can be if bought through trusted channels and held long term.

7. What happens when the company gets listed

Your unlisted shares become listed and can be traded on stock exchanges.

8. Is there any lock-in period

Retail investors usually have no lock-in unless specified. Promoters and investors may have lock-ins.

9. How to check valuation before buying

Study company performance, funding rounds, and demand in the market.

10. Are taxes different for unlisted shares

Yes. Taxation depends on whether the shares are sold before or after the IPO.

Powered by Froala Editor