Step by Step Tutorial: How to Invest in Mutual Funds Using Top Mutual Fund Sites

Investing in mutual funds has become significantly easier with the rise of digital platforms. Today, investors no longer need to visit offices or fill out lengthy paperwork to start their investment journey. Mutual fund sites allow individuals to explore schemes, compare options, complete KYC, and invest from the comfort of their homes. This shift has made mutual fund investing more accessible to first time and experienced investors alike.

Understanding how to invest mutual funds online is now an essential financial skill. With the right guidance and reliable platforms, investors can build diversified portfolios aligned with their goals. This step by step guide explains how mutual fund sites work, how to use them effectively, and what to keep in mind while investing online.

Start your mutual fund journey easily with trusted online investment platforms

Why Mutual Fund Sites Are Preferred for Online Investing

Mutual fund sites are increasingly preferred because they simplify the investment process and improve transparency.

Online platforms eliminate manual paperwork and reduce dependency on intermediaries. Investors can access information, track performance, and make informed decisions independently.

Key benefits of online platforms

• Paperless onboarding and quick account setup

• Real time access to portfolio and transaction history

• Wide selection of funds across categories

• Easy comparison of schemes and performance

Because of these advantages, mutual fund sites have become the primary choice for investors learning how to invest mutual funds online efficiently.

How a Portfolio Management System Helps Track, Optimize, and Grow Your Investments Efficiently

Understanding How to Invest Mutual Funds Online

Online mutual fund investing refers to buying and managing mutual fund units through digital platforms.

When you invest through mutual fund sites, the entire process is handled digitally, from registration to payment and tracking. This method offers more control and visibility compared to traditional offline investing.

Online investing basics

• Digital registration using PAN and Aadhaar

• Selection between direct and regular plans

• Secure online payment systems

• Instant confirmation and portfolio access

Learning how to invest mutual funds online helps investors save time, reduce costs, and stay informed at every stage of their investment journey.

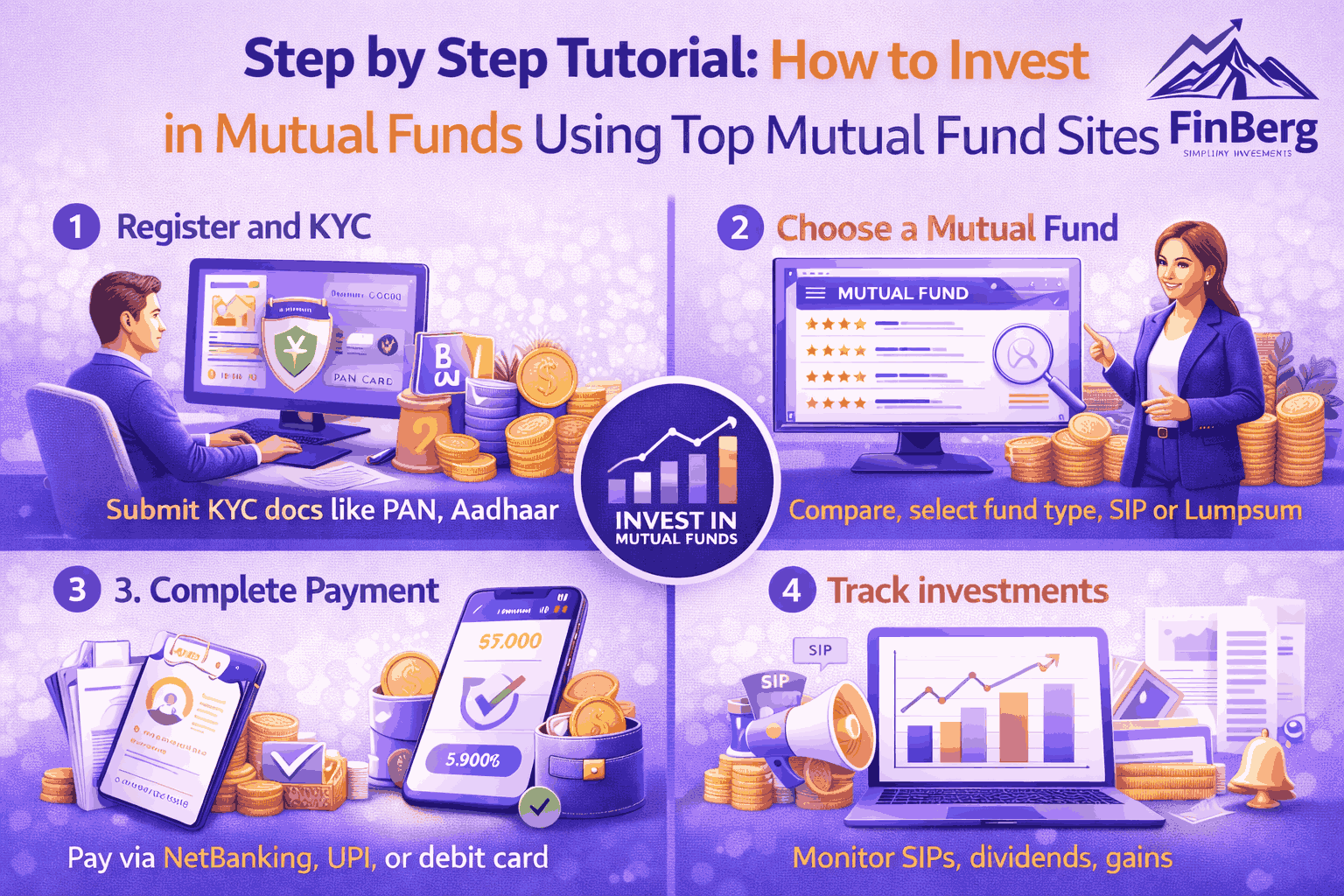

Step by Step Process to Invest Using Mutual Fund Sites

This section explains the complete process of investing in mutual funds using online platforms.

Step 1 Selecting the Right Mutual Fund Site

Choosing a reliable platform is the foundation of successful online investing.

• Check whether the platform is registered and regulated

• Review the range of funds available on different mutual fund sites

• Evaluate ease of use, research tools, and customer support

• Prefer platforms offering transparent pricing and reporting

Selecting the right mutual fund sites ensures safety and convenience while learning how to invest mutual funds online.

Step 2 Completing Online KYC

KYC is mandatory before investing in mutual funds online.

• Provide PAN details and Aadhaar verification

• Link your bank account for transactions

• Complete video or OTP based KYC process

• Receive confirmation once verification is successful

Once KYC is complete, you can freely use mutual fund sites for investments.

Step 3 Choosing Mutual Funds

Fund selection should be based on goals, not trends.

• Identify financial goals such as wealth creation or income

• Assess risk tolerance and investment horizon

• Compare fund performance, expense ratio, and category

• Avoid selecting funds solely based on short term returns

Mutual fund sites provide tools that simplify how to invest mutual funds online with informed decision making.

Private Equity Investment in India 2026: Trends, Sectors, and Opportunities Investors Should Watch

Step 4 Making the Investment

The final step is executing your investment.

• Choose between lump sum or SIP investment

• Select the investment amount

• Use secure payment gateways

• Confirm transaction and view portfolio instantly

After completion, mutual fund sites allow continuous tracking and management of investments.

Types of Mutual Fund Sites Available in India

Different types of platforms cater to different investor preferences.

Mutual fund sites in India broadly fall into three categories based on their structure and services.

Types of platforms

• AMC websites offering direct investments

• Third party aggregators providing multiple fund options

• Advisory platforms combining guidance with execution

Each category supports how to invest mutual funds online, but investors should choose based on convenience and support needs.

Important Features to Look for in Mutual Fund Sites

Not all platforms offer the same experience.

Choosing the right mutual fund sites requires evaluating specific features that enhance usability and security.

Key platform features

• Simple and intuitive user interface

• Detailed research and comparison tools

• Strong data security and privacy standards

• Responsive customer support and education resources

These features make it easier to understand how to invest mutual funds online confidently.

Types of Life Insurance Policies in India

Common Mistakes to Avoid When Using Mutual Fund Sites

Mistakes can reduce returns even with good platforms.

Many investors make avoidable errors while using mutual fund sites, especially beginners.

Common errors

• Ignoring risk assessment and suitability

• Choosing funds only based on past performance

• Not reviewing portfolio periodically

• Overdiversifying without purpose

Avoiding these mistakes helps investors make better use of mutual fund sites.

Comparison Table of Mutual Fund Sites vs Offline Investing

Understanding the difference helps investors choose the right approach.

This comparison shows why more investors prefer mutual fund sites to learn how to invest mutual funds online.

Unlisted Shares Investment Explained for First Time Investors

Who Should Use Mutual Fund Sites for Investing

Online platforms are suitable for a wide range of investors.

Mutual fund sites are especially beneficial for individuals who value convenience and control.

Ideal for

• First time investors learning online investing

• Working professionals with limited time

• Long term investors managing multiple funds

• Tech comfortable users seeking transparency

These platforms simplify how to invest mutual funds online for diverse investor profiles.

Unlisted Shares Investment in India: How to Get Started Step by Step

Conclusion

Online investing has transformed the way individuals build wealth through mutual funds. Mutual fund sites provide a seamless, transparent, and cost effective way to start and manage investments. With the right platform and disciplined approach, investors can confidently navigate the digital investment landscape.

Learning how to invest mutual funds online empowers investors to make informed decisions and take charge of their financial future. By using trusted mutual fund sites and following a structured process, long term wealth creation becomes more accessible and manageable.

Need help investing through mutual fund sites? Contact us for expert guidance

FAQs on How to Invest Mutual Funds Online

1. What are mutual fund sites?

Mutual fund sites are online platforms that allow investors to research, buy, and manage mutual fund investments digitally.

2. Is it safe to invest using mutual fund sites?

Yes, investing through regulated mutual fund sites is safe when platforms follow security and compliance standards.

3. How to invest mutual funds online for beginners?

Beginners can start by completing KYC, selecting a reliable platform, choosing suitable funds, and investing small amounts.

4. Do mutual fund sites charge extra fees?

Most mutual fund sites offer direct plans with lower costs, though some advisory platforms may charge service fees.

5. Can I invest without a demat account?

Yes, most mutual fund sites allow investment without a demat account.

6. What documents are required for online investment?

PAN, Aadhaar, and bank account details are typically required.

7. Are SIPs available on mutual fund sites?

Yes, SIP investments are easily available and manageable through mutual fund sites.

8. Can I track my portfolio online?

Yes, mutual fund sites provide real time portfolio tracking and reports.

9. What happens if I change platforms?

Your investments remain with the fund house and can be accessed through another platform.

10. Is online mutual fund investment better than offline?

For most investors, online investing offers greater convenience, transparency, and control.

Powered by Froala Editor