Why Mutual Funds Are Popular in India: Benefits, Risks and Long Term Potential

Mutual funds have become one of the most trusted and widely adopted investment options in the country. From first time earners to seasoned investors, people across income groups are exploring market linked investments to grow wealth over time.

A major reason behind this shift is the growing awareness of the benefits of mutual funds in india and how they align with long term financial goals.

As traditional saving instruments struggle to beat inflation, investors are actively looking for smarter alternatives. Mutual fund investment in india offers a balance of professional management, diversification, and accessibility, making it a preferred choice. At the same time, understanding the risks of mutual fund investment is equally important for making informed decisions and building sustainable wealth.

Why mutual funds work for long term wealth in India.

Understanding Mutual Fund Investment in India

Mutual funds are investment vehicles that pool money from multiple investors and invest it across various assets such as stocks, bonds, and money market instruments. These investments are managed by professional fund managers who aim to generate returns based on the fund’s objective.

Mutual fund investment in india allows individuals to participate in financial markets without requiring deep market knowledge. Investors buy units of a mutual fund scheme, and the value of these units fluctuates based on the performance of the underlying assets.

Types of mutual funds available in India include

• Equity mutual funds that invest mainly in stocks

• Debt mutual funds that focus on fixed income securities

• Hybrid mutual funds that combine equity and debt

• Index funds that track market indices

• ELSS funds that offer tax saving benefits

The benefits of mutual funds in india become evident as investors gain access to diversified portfolios, professional expertise, and flexible investment options through a single product.

Why Mutual Fund Investment in India Is Growing Rapidly

The popularity of mutual fund investment in india has grown significantly over the last decade. Several economic and behavioral factors have contributed to this rapid adoption.

The increasing culture of systematic investment plans has made investing disciplined and affordable. Digital platforms have simplified account opening and tracking investments, while financial literacy initiatives have helped investors understand the advantages of mutual funds.

Top reasons behind this growth include

1 Easy access through mobile apps and online platforms

2 Low starting investment amounts

3 Better long term return potential compared to traditional savings

4 Transparency and regulatory oversight

The advantages of mutual funds are not limited to returns alone. Flexibility, liquidity, and choice across risk profiles make them suitable for a wide range of investors. Combined with the benefits of mutual funds in india, these factors explain why more households are choosing mutual funds as a core investment option.

SIP vs Mutual Fund Know Where to Start Your Investment Journey

Key Benefits of Mutual Funds in India

The benefits of mutual funds in india go beyond simple wealth creation. They offer a structured and efficient way to invest across markets while managing risks effectively.

Professional Fund Management

One of the biggest advantages of mutual funds is professional management. Fund managers are experienced professionals who track market trends, analyze companies, and make informed decisions.

Key benefits include

• Expert research driven decision making

• Continuous monitoring of investments

• Strategic asset allocation

This professional approach enhances the benefits of mutual funds in india, especially for investors who lack the time or expertise to manage portfolios themselves.

Diversification Across Assets

Diversification is a core strength of mutual funds. By investing across multiple securities, mutual funds reduce the impact of poor performance by any single asset.

Benefits of diversification include

• Lower portfolio volatility

• Reduced dependency on one stock or sector

• More stable long term returns

These advantages of mutual funds make them safer compared to investing in individual stocks.

Read More: Comparing the Best PMS Companies in India: Performance, Fees, and Services Explained

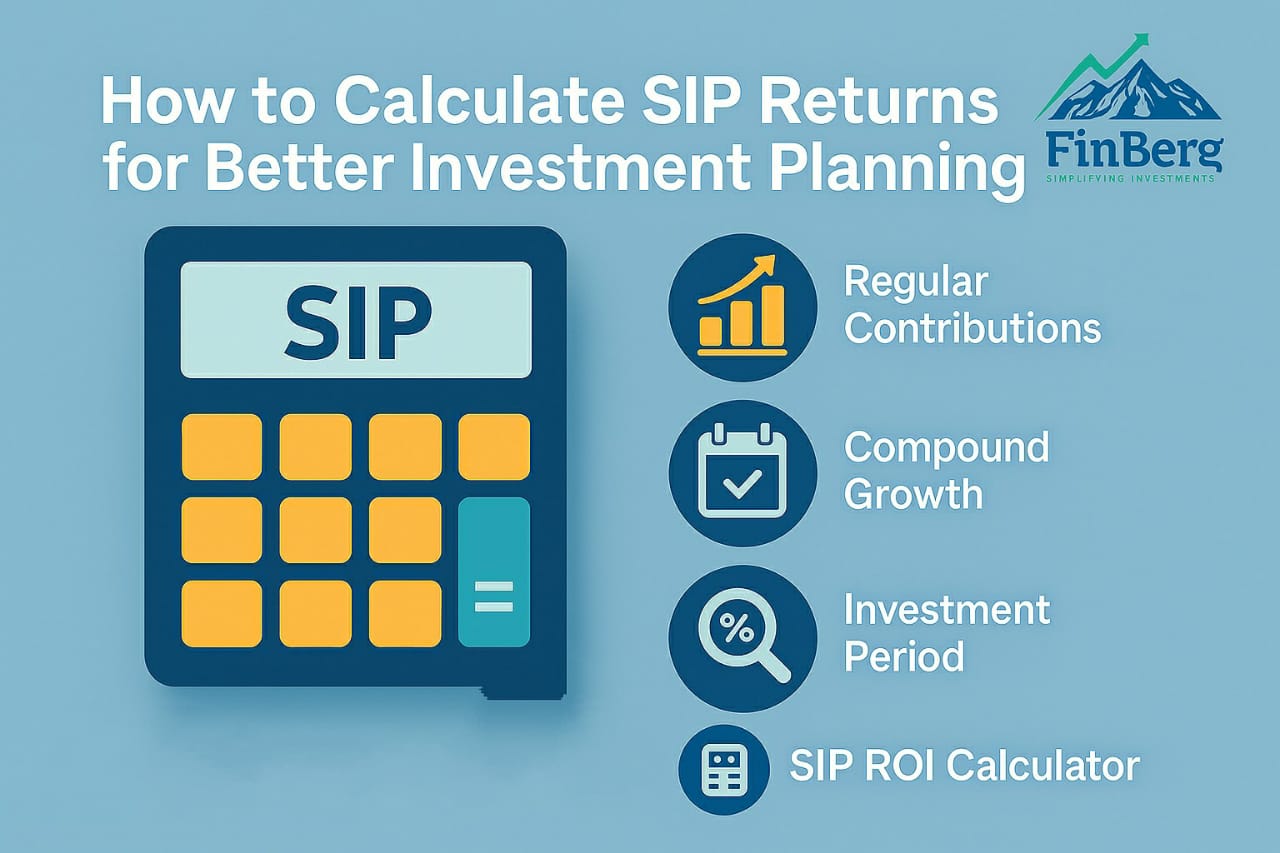

Affordability Through SIPs

Systematic investment plans allow investors to start with small amounts and invest regularly.

Key advantages include

1 Investment discipline

2 Reduced market timing risk

3 Compounding benefits over time

SIPs play a major role in highlighting the benefits of mutual funds in india for salaried individuals and young investors.

Liquidity and Flexibility

Mutual funds offer easy entry and exit options. Most open ended funds allow investors to redeem units at prevailing net asset value.

Liquidity benefits include

• Access to funds during emergencies

• Flexible investment amounts

• Option to switch between schemes

This flexibility adds to the advantages of mutual funds over rigid investment products.

Tax Efficiency

Certain mutual funds offer tax benefits under existing tax laws. Equity linked savings schemes provide deductions while also offering growth potential.

Tax related benefits of mutual funds in india include

• Tax deductions on investments

• Favorable long term capital gains treatment

• Efficient tax planning

Advantages of Mutual Funds Compared to Traditional Investments

When compared with traditional investment avenues, mutual funds often offer superior growth potential and flexibility.

Traditional options like fixed deposits and gold provide stability but limited returns. Real estate requires large capital and lacks liquidity.

Comparison table

The advantages of mutual funds lie in their ability to combine growth, liquidity, and professional oversight. The benefits of mutual funds in india become more evident when investors seek long term wealth creation rather than short term safety.

Learn More: Equity Fund Investment vs. Mutual Fund: Which Is Better for 2025?

Risks of Mutual Fund Investment You Should Know

While mutual funds offer multiple benefits, investors must also understand the risks of mutual fund investment before committing capital.

Market Risk

Market fluctuations directly affect equity oriented funds. Economic events, interest rate changes, and global factors can impact returns.

Market related risks of mutual fund investment include

• Short term volatility

• Impact of economic cycles

• Sector specific downturns

Credit Risk

Debt funds may face credit risk if issuers fail to meet obligations.

Key points include

• Risk of default by bond issuers

• Lower returns in poor credit conditions

Liquidity Risk

Some funds invest in instruments that may not be easily sold.

Liquidity related risks of mutual fund investment include

• Delayed redemptions

• Impact during market stress

Behavioral Risk

Investor behavior plays a major role in returns.

Common mistakes include

1 Panic selling during market falls

2 Chasing short term performance

3 Ignoring long term goals

Understanding these risks of mutual fund investment helps investors avoid emotional decisions and improve outcomes.

How to Reduce Risks of Mutual Fund Investment

Managing risks effectively is essential to enjoy the benefits of mutual funds in india over the long term.

Key strategies to reduce risks of mutual fund investment include

• Diversifying across fund categories

• Investing through SIPs

• Aligning investments with financial goals

• Staying invested for the long term

Long term investing helps smooth market volatility and allows compounding to work effectively. By focusing on asset allocation and consistency, investors can balance risks and rewards while maximizing the benefits of mutual funds in india.

Read More: How a Life Insurance Advisor Can Help You Secure Your Family’s Future in 2025

Long Term Potential of Mutual Fund Investment in India

The long term potential of mutual fund investment in india is closely linked to economic growth and market expansion.

India’s growing economy, rising consumption, and increasing corporate earnings provide a strong foundation for long term equity growth. Mutual funds enable investors to participate in this growth efficiently.

Investment duration and expected behavior

The benefits of mutual funds in india become more pronounced with longer investment horizons. Compounding and disciplined investing significantly enhance return potential.

Learn More: Why You Need a Health Insurance Advisor in 2025: Smart Planning for Rising Medical Costs

Who Should Invest in Mutual Funds

Mutual funds are suitable for a wide range of investors due to their flexibility and variety.

They are ideal for

• Salaried professionals seeking disciplined savings

• Business owners looking for scalable investments

• Young investors building long term wealth

• Retirees seeking balanced income and growth

The advantages of mutual funds allow customization based on risk appetite and financial goals. With proper planning, the benefits of mutual funds in india can be enjoyed by investors at every life stage.

Have questions about mutual fund investing or long term planning? Get in touch with us today

Conclusion

Mutual funds have emerged as a powerful investment tool for Indian investors seeking growth, flexibility, and professional management. While understanding the risks of mutual fund investment is essential, a disciplined and long term approach can significantly reduce uncertainty.

The advantages of mutual funds combined with accessibility and transparency make them suitable for modern financial planning. By focusing on goals and consistency, investors can fully realize the benefits of mutual funds in india and build sustainable wealth over time.

FAQs on Mutual Fund Investment in India

1. What are the key benefits of mutual funds in India?

Mutual funds in India offer multiple advantages such as diversification across asset classes, access to professional fund managers, affordability through SIP investments, easy liquidity, and strong potential for long term wealth creation when investors remain consistent.

2. Is mutual fund investment in India safe for beginners?

Mutual fund investment in India can be beginner friendly when individuals select schemes based on their risk appetite, start with small SIP contributions, and maintain a long term approach rather than reacting to short term market fluctuations.

3. What are the common risks involved in mutual fund investment?

Mutual fund investment carries risks such as market volatility, credit risk in certain debt funds, liquidity challenges during stressed market conditions, and emotional decision making like panic selling during corrections.

4. How much should I invest every month in mutual funds?

The ideal monthly investment depends on factors such as income level, financial objectives, and risk tolerance. Even modest amounts invested consistently can grow substantially over time due to the power of compounding.

5. Are mutual funds better than fixed deposits?

Mutual funds usually provide higher return potential compared to fixed deposits over the long term. However, they involve market linked risks, making them suitable for investors comfortable with short term fluctuations.

6. What is the ideal time horizon for mutual fund investment?

A time horizon of five years or more is generally considered ideal, as it helps smooth market volatility and maximizes the long term benefits of mutual funds in India through compounding.

7. Can I lose money in mutual funds?

Yes, mutual funds may experience short term losses due to market movements. Staying invested for the long term reduces the impact of volatility and improves the chances of generating positive returns.

8. How do SIPs help reduce investment risks?

SIPs help reduce risk by spreading investments over time, averaging purchase costs, and promoting disciplined investing across different market cycles.

9. Which mutual funds are suitable for long term goals?

Equity oriented mutual funds are commonly preferred for long term financial goals as they offer higher growth potential aligned with extended investment horizons.

10. Are mutual funds taxable in India?

Mutual funds are subject to capital gains tax depending on the fund category and holding period. Some schemes provide tax efficiency and benefits under applicable Indian tax regulations.

Powered by Froala Editor