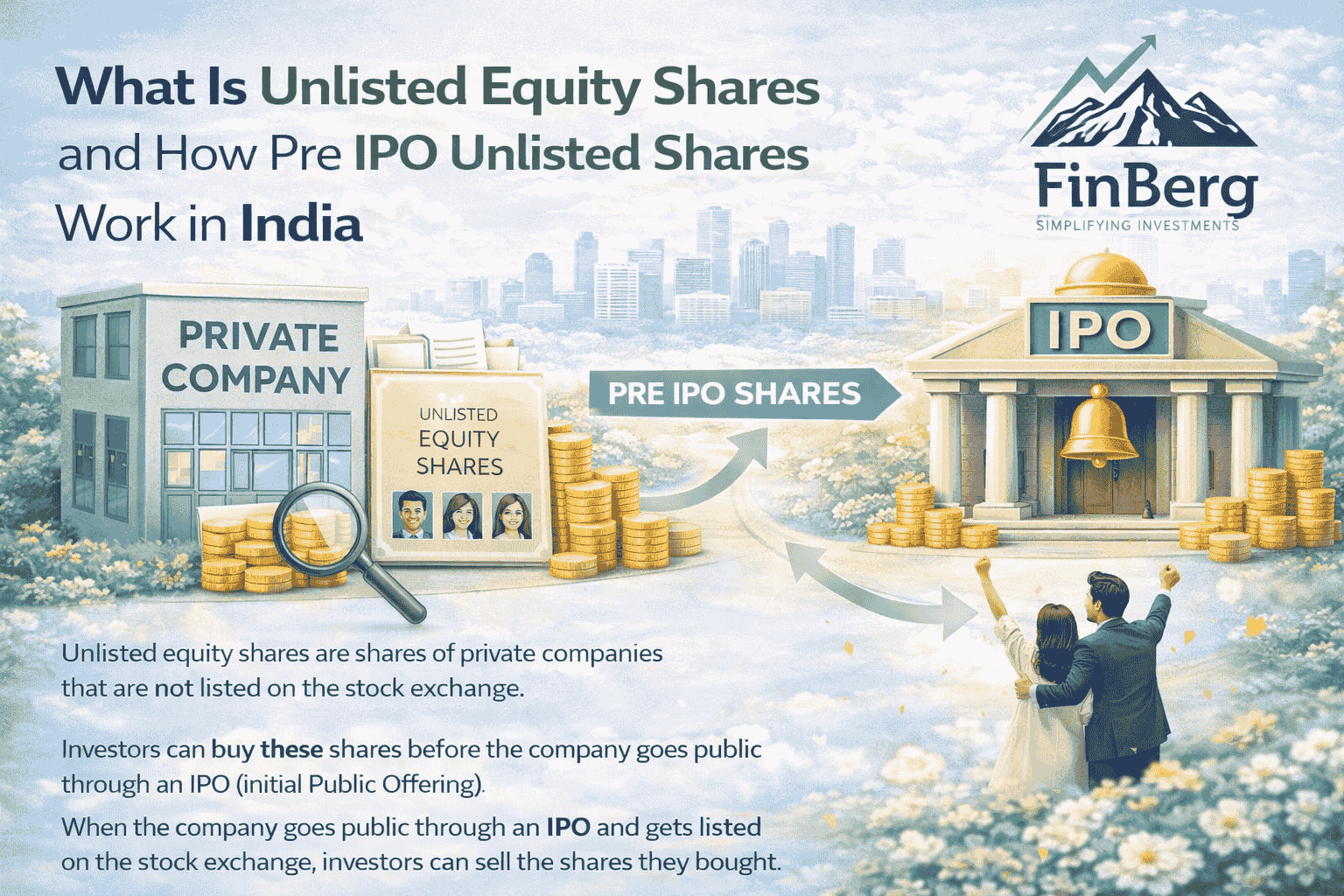

What Is Unlisted Equity Shares and How Pre IPO Unlisted Shares Work in India

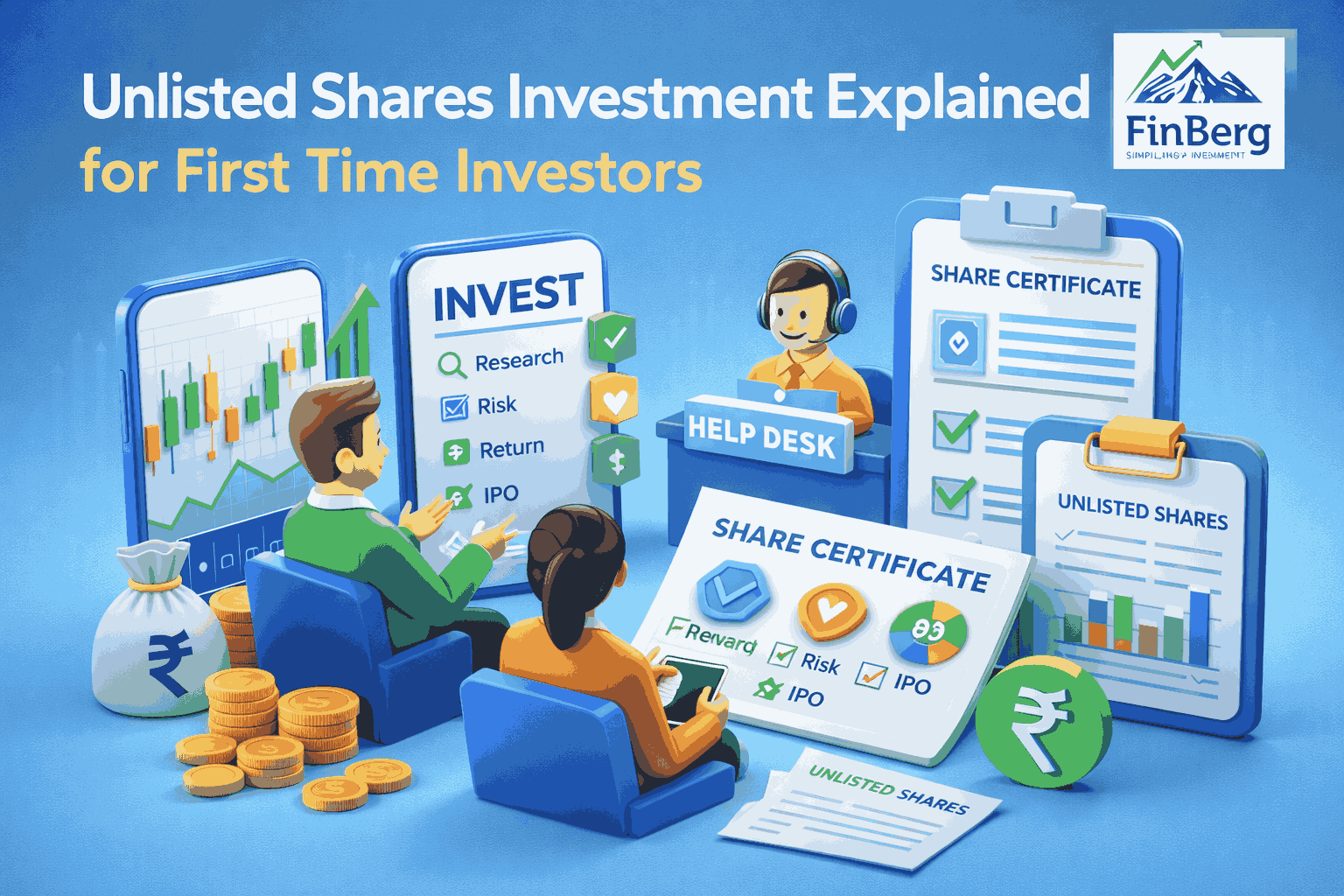

Investors are increasingly looking beyond traditional stock markets to access early stage opportunities, and pre IPO investing has become a popular choice in India. Many people want to understand what pre IPO shares are and how to buy pre ipo shares india before a company lists on the stock exchange. While pre ipo shares india can offer early entry valuations and strong growth potential, they also come with unique risks related to legality, liquidity, and pricing. This guide explains how to buy pre ipo shares india, how the unlisted market works, and what investors should know before investing in the best unlisted shares to buy in india in 2026.

Unlock the Future of Your Unlisted Shares After IPO

What Are Pre IPO Shares in India

Pre IPO shares in India refer to the equity shares of companies that are not yet listed on any recognised stock exchange but are available to investors before the company launches its Initial Public Offering. These pre IPO shares India are usually offered through private transactions rather than public markets, making them different from regular listed stocks.

Unlike listed companies whose shares are traded openly on stock exchanges, companies offering pre IPO shares India operate in the unlisted space. This means pricing is determined through negotiation, liquidity is limited, and information disclosure is comparatively lower. Many companies issue pre IPO shares India to raise capital early, reward early supporters, or prepare for future expansion before going public.

Learn More: Best Portfolio Management Services in India [2025]

How Pre IPO Shares Are Issued

Pre IPO shares India are issued through specific non public methods that allow companies to raise funds or distribute ownership before listing.

• Private placements to select investors

• Employee stock option plans for employees

• Allotments to early stage or strategic investors

These issuance methods form the foundation of how the pre IPO market functions in India and determine how investors access such opportunities.

Learn More: Top Mutual Fund Distributors in India [2025]

Why Investors Buy Pre IPO Shares India

Many investors choose to buy pre ipo shares india to enter promising companies before they reach the public market. This early entry allows investors to participate in a company’s growth journey at a stage when valuations are often more attractive compared to the IPO price. As a result, buying early can create opportunities for both listing gains and long term capital appreciation.

Another reason investors buy pre ipo shares india is the ability to access companies that are not yet available on stock exchanges but already show strong business fundamentals. For long term investors, buy pre ipo shares india strategies are often aligned with wealth creation goals rather than short term trading. When selected carefully, these investments can complement traditional equity portfolios and add diversification beyond listed stocks.

Benefits of Investing in Pre IPO Shares India

• Entry at lower valuations compared to public issue prices

• Early access to fast growing and emerging companies

• Opportunity to diversify portfolio beyond listed equities

• Potential for listing gains and long term wealth creation

Learn More: How to Invest in Mutual Funds Online [Step-by-Step Guide in 2025]

Is It Legal to Buy Pre IPO Shares in India

Yes, it is legal to buy pre ipo shares india, provided the transaction follows the rules laid down under Indian corporate and securities laws. Pre IPO investments are permitted when shares are transferred through valid private arrangements and all regulatory requirements are fulfilled. However, legality depends on how the transaction is executed rather than the investment idea itself.

When investors buy pre ipo shares india, they must ensure that the company allows share transfers, proper approvals are in place, and documentation is completed correctly. These transactions are governed mainly by the Companies Act, while SEBI plays an indirect role in regulating disclosures, insider trading, and post listing compliance. Understanding the legal framework helps investors avoid disputes, penalties, and future transfer issues.

Regulatory Framework Governing Pre IPO Shares India

• Provisions under the Companies Act governing private share transfers

• SEBI regulations related to insider trading and disclosures

• Shareholder agreements that define transfer rights and restrictions

• Company specific rules that may limit or condition share transfers

This regulatory structure ensures that pre IPO transactions remain lawful while protecting both companies and investors when conducted correctly.

Learn More: Why have Unlisted shares gained momentum in last few years

SEBI Guidelines for Pre IPO Share Investments

SEBI plays an indirect but important role in pre IPO shares india transactions. While SEBI does not regulate the unlisted market directly, it ensures investor protection through various regulations.

SEBI rules apply when companies approach listing and when shareholders deal with sensitive information. Investors dealing with pre IPO shares india must be aware of insider trading restrictions and lock in rules that apply after listing.

Important SEBI Rules Investors Must Know

Insider trading regulations apply to pre IPO shareholders

Certain pre IPO shares are subject to lock in after IPO

Disclosure norms apply to significant shareholders

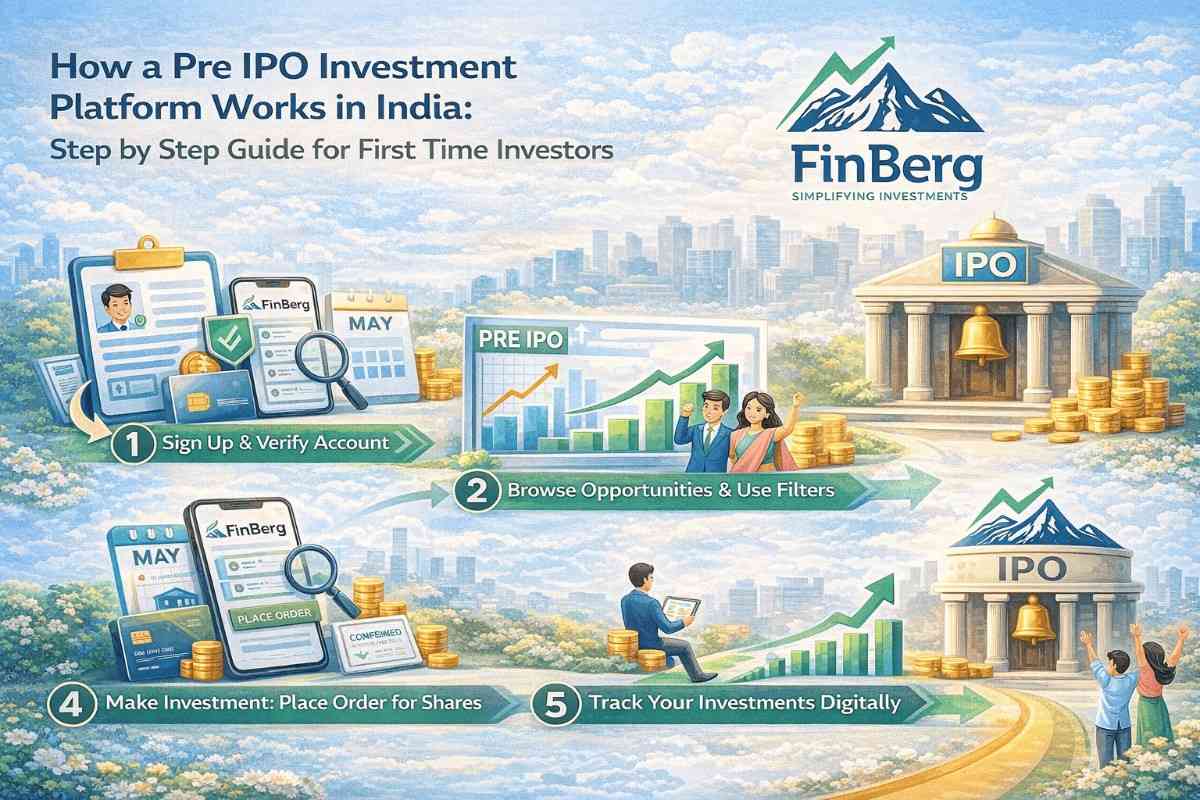

How to Buy Pre IPO Shares India Step by Step

Understanding how to buy pre ipo shares india requires clarity on process, documentation, and due diligence. Unlike listed stocks, buying pre IPO shares does not happen instantly through an exchange. Investors who want to buy pre ipo shares india must follow a structured approach to ensure legality, proper ownership transfer, and risk control.

When investors buy pre ipo shares india, the process usually involves private transactions facilitated by intermediaries. Each step plays a critical role in protecting the investor’s capital and ensuring the shares are valid and transferable. A disciplined method helps investors avoid common pitfalls associated with unlisted markets.

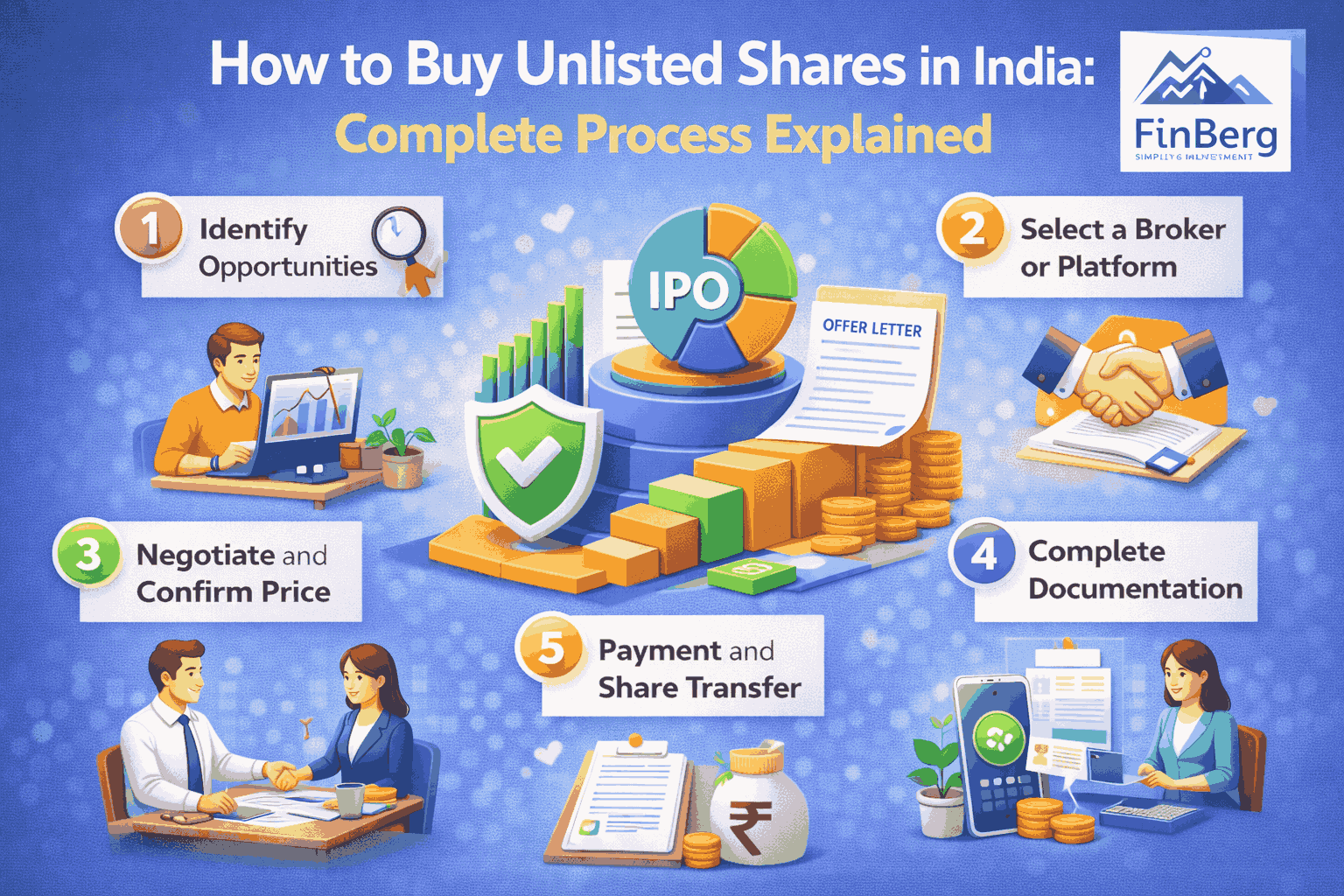

Step by Step Process to Buy Pre IPO Shares India

Identify reliable intermediaries or platforms that facilitate transactions in unlisted shares and have a track record of compliant dealings.

Evaluate company fundamentals carefully by reviewing financials, business model, growth prospects, and IPO visibility before deciding to buy pre ipo shares india.

Check share transfer eligibility to confirm whether the company allows share transfers and whether any lock in or approval conditions apply.

Complete KYC requirements and execute legal agreements such as share purchase agreements to ensure proper documentation when you buy pre ipo shares india.

Transfer funds through verified banking channels and ensure the shares are credited to your demat account, confirming successful completion of the process.

Following these steps helps investors buy pre ipo shares india safely while maintaining compliance, transparency, and long term investment discipline.

Smart investors know which portfolio mistakes to avoid

Best Unlisted Shares to Buy in India How to Identify Opportunities

Identifying the best unlisted shares to buy in india requires careful evaluation rather than following market hype. Many investors rush into unlisted investments based on popular names, but selecting the best unlisted shares to buy in india depends on fundamentals, business quality, and long term potential. The unlisted market does not offer daily price discovery, which makes research even more important.

When investors look for the best unlisted shares to buy in india, they must focus on companies that demonstrate strong financial discipline, scalability, and a realistic path toward listing. Choosing the best unlisted shares to buy in india based on data rather than speculation significantly improves investment outcomes.

Key Factors to Evaluate Before Investing

• Revenue growth consistency over multiple years

• Profitability trends and cash flow stability

• Industry leadership and competitive advantage

• Visibility of IPO plans and regulatory readiness

• Quality, experience, and credibility of management

Risks Involved When You Buy Pre IPO Shares India

Before you buy pre ipo shares india, it is important to understand the downside risks involved. Unlike listed stocks, unlisted investments come with limited liquidity and higher uncertainty. Many investors buy pre ipo shares india expecting quick listing gains, but timelines and outcomes are never guaranteed.

When investors buy pre ipo shares india without fully assessing risk, they may face delays, valuation issues, or difficulty exiting the investment. A clear understanding of risk is essential before committing capital.

Major Risks Associated With Pre IPO Shares India

• Liquidity risk due to limited buyers and sellers

• IPO delays or cancellation of listing plans

• Valuation uncertainty in the absence of market pricing

• Regulatory or compliance changes impacting listing

Taxation on Pre IPO Shares in India

Taxation plays a significant role when investing in pre ipo shares india. The tax treatment depends on the holding period and whether the shares are sold before or after listing. Investors dealing with pre ipo shares india should plan taxation in advance to avoid surprises at the time of exit.

Understanding how capital gains apply to pre ipo shares india helps investors estimate post tax returns more accurately.

Capital Gains Tax on Pre IPO Shares

Documentation Required to Buy Pre IPO Shares India

To buy pre ipo shares india legally and securely, proper documentation is mandatory. These documents help establish ownership, ensure compliance, and support future tax filings when you buy pre ipo shares india.

• Share purchase agreement outlining transaction terms

• Active demat account details of the buyer

• Payment proof through banking channels

• Share transfer confirmation from the company

Common Mistakes to Avoid While Buying Pre IPO Shares India

Many investors make avoidable errors when they buy pre ipo shares india due to excitement or lack of information. These mistakes often reduce returns or increase risk unnecessarily.

Investing without thorough due diligence

Overpaying due to hype or limited supply

Ignoring lock in restrictions and transfer rules

Poor tax planning and documentation gaps

Avoiding these mistakes improves outcomes when investing in pre IPO shares.

Who Should Consider Buying Pre IPO Shares India

Buying pre ipo shares india is suitable only for specific types of investors. These investments are not meant for short term traders or those seeking immediate liquidity.

• Long term investors with patience

• Investors comfortable with higher risk levels

• Portfolio diversifiers seeking unlisted exposure

Understanding suitability helps investors decide whether to buy pre ipo shares india based on personal goals.

Turn Unlisted Shares into Public Profits in 2025!

Should You Buy Pre IPO Shares India in 2026

Whether you should buy pre ipo shares india in 2026 depends on your risk tolerance, investment horizon, and research capability. The unlisted market offers attractive opportunities, but it also demands discipline and compliance.

Investors who carefully evaluate the best unlisted shares to buy in india and follow legal processes are better positioned for long term gains. Buying pre ipo shares india can be rewarding when approached with realistic expectations and thorough analysis.

FAQs on Pre IPO Shares and How to Buy Them

What are pre IPO shares india

Pre IPO shares are shares of companies that are not yet listed on stock exchanges.Is it safe to buy pre ipo shares india

It can be safe if transactions are done legally through verified intermediaries.How can beginners buy pre ipo shares india

Beginners should start small and use reliable platforms with proper documentation.Are pre IPO shares india regulated by SEBI

SEBI regulates them indirectly through disclosure and insider trading rules.What is the lock in period for pre IPO shares

Usually one year from the IPO allotment date.How are pre IPO shares taxed in India

They are taxed under capital gains based on holding period.Can pre IPO shares be sold before IPO

Yes if the company permits private transfers.How to find best unlisted shares to buy in india

By analysing financials, management quality, and IPO readiness.Are pre IPO shares better than IPO investments

They offer early entry but carry higher risk.What happens to pre IPO shares after listing

They become listed shares subject to lock in rules.

Reach out to finberg to know more about pre ipo shares and internlink it to pre ipo service page

Powered by Froala Editor