Categories of Portfolio Management in India: A Complete Classification Guide

Portfolio management has become an important part of modern investing as individuals seek professional guidance to manage wealth efficiently.

With growing income levels, complex financial products, and volatile markets, investors are increasingly relying on structured portfolio strategies rather than making random investment decisions. Understanding the categories of portfolio management helps investors gain clarity on how their money is managed and what approach best suits their financial goals.

Every investor has different expectations related to returns, risk, involvement, and time horizon. This is why portfolio management is not a one size fits all solution.

A clear understanding of the categories of portfolio management and the various types of portfolio management in india allows investors to choose strategies that align with their lifestyle, financial objectives, and risk appetite, leading to better long term outcomes.

Know the categories - choose the right PMS

Understanding Portfolio Management in India

This section explains the concept of portfolio management and how it functions in the Indian investment environment. It provides a foundation before exploring detailed classifications.

Portfolio management refers to the professional management of an investor’s assets such as equities, bonds, mutual funds, and other securities to achieve specific financial goals. In India, portfolio management services are offered by registered entities that follow regulatory guidelines to ensure transparency and investor protection.

Key elements of portfolio management include

• Asset allocation to balance risk and return

• Risk management to control downside exposure

• Return optimization based on market conditions

• Continuous monitoring and rebalancing of the portfolio

Once investors understand these fundamentals, it becomes easier to explore the categories of portfolio management and evaluate different types of portfolio management in india with confidence.

Categories of Mutual Funds in India: A Complete Classification Guide

Why Categories of Portfolio Management Matter for Investors

This section explains why categorizing portfolio management strategies is essential for informed investing. It highlights how classifications help investors make better decisions.

The categories of portfolio management provide a structured framework that defines how investments are selected, managed, and monitored. Each category follows a specific approach toward risk, returns, and investor involvement. Without this classification, investors may choose strategies that do not align with their expectations.

Reasons classification is important

1 Helps align investment strategy with financial goals

2 Enables better risk control and diversification

3 Improves understanding of expected returns

4 Supports disciplined long term planning

By understanding the categories of portfolio management, investors can select from suitable types of portfolio management in india instead of relying on trial and error.

Why Mutual Funds Are Popular in India: Benefits, Risks and Long Term Potential

Broad Categories of Portfolio Management

This section introduces the overall classification framework used in India. It provides a high level view before detailed discussion.

The categories of portfolio management in India are broadly classified based on management style, client involvement, and investment objective. These classifications help investors understand how decisions are made and how actively their portfolio is managed. Knowing this framework simplifies comparison across different types of portfolio management in india.

Categories of Portfolio Management Based on Management Style

This section explains how portfolio management is classified based on how actively investments are managed. Management style plays a key role in return generation and risk control.

Active Portfolio Management

Active portfolio management involves continuous buying and selling of securities with the objective of outperforming the market.

Key characteristics of active portfolio management

• Frequent monitoring of market trends and economic indicators

• Higher involvement of portfolio managers in decision making

• Focus on identifying undervalued or high growth opportunities

• Potential for higher returns along with higher costs and risk

This approach forms a core part of the categories of portfolio management and is commonly used in growth oriented strategies among the types of portfolio management in india.

Passive Portfolio Management

Passive portfolio management follows a buy and hold strategy where investments track a specific index or benchmark.

Key characteristics of passive portfolio management

• Limited buying and selling of securities

• Focus on long term market returns rather than short term gains

• Lower management and transaction costs

• Reduced risk of frequent decision making errors

Passive strategies are an important part of the categories of portfolio management and are increasingly popular among conservative types of portfolio management in india.

SIP vs Mutual Fund Know Where to Start Your Investment Journey

Categories of Portfolio Management Based on Client Involvement

This section explains classification based on how much control and involvement the investor has in decision making.

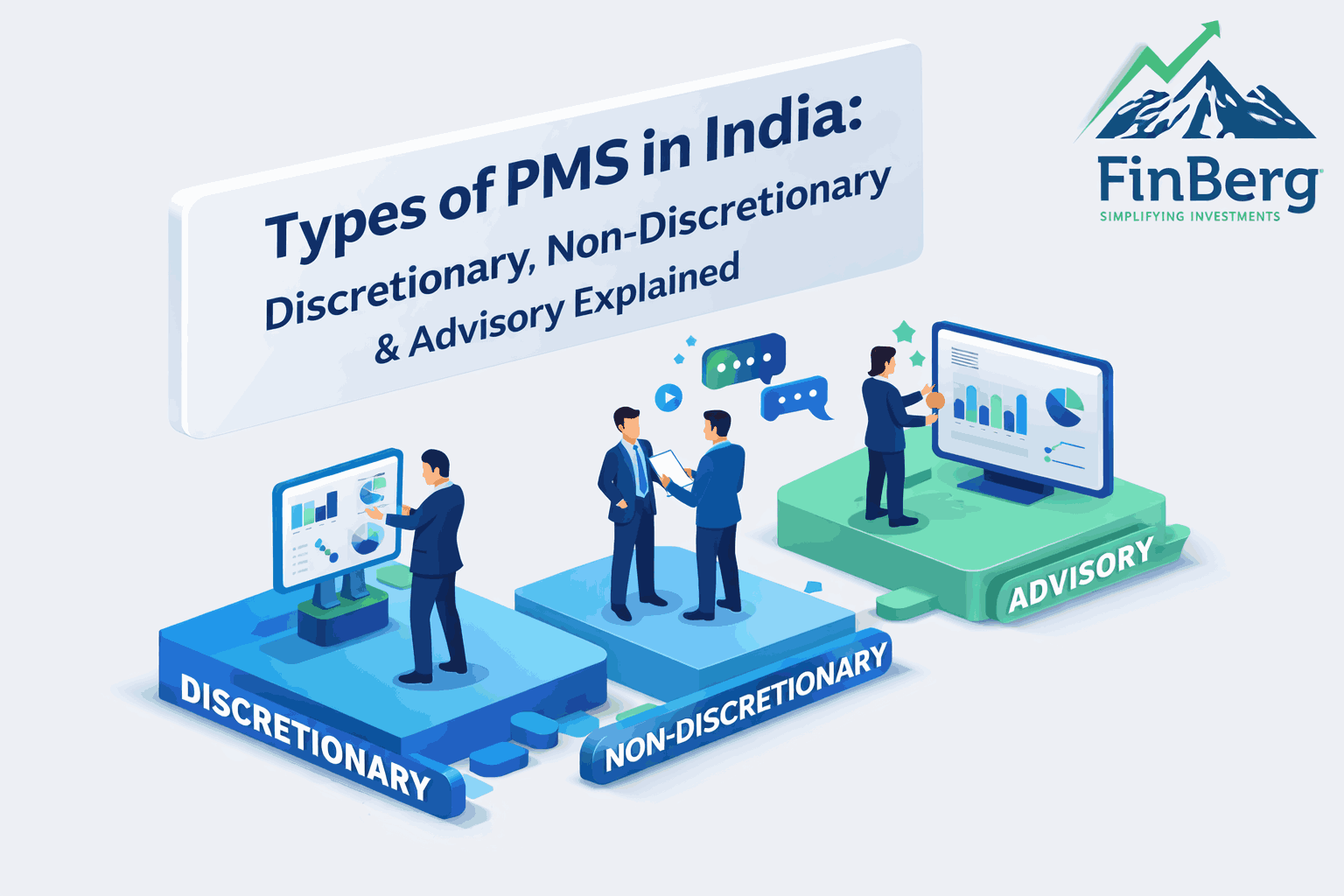

Discretionary Portfolio Management

In discretionary portfolio management, the portfolio manager takes full responsibility for investment decisions on behalf of the client.

Key features of discretionary portfolio management

• Complete authority rests with the portfolio manager

• Decisions are made quickly without client approval

• Suitable for investors with limited time or market knowledge

• Relies heavily on professional expertise and trust

This approach is a widely used option within the categories of portfolio management and suits investors seeking professional handling among the types of portfolio management in india.

Non Discretionary Portfolio Management

In non discretionary portfolio management, investment decisions are made jointly by the investor and the portfolio manager.

Key features of non discretionary portfolio management

• Portfolio manager provides recommendations

• Final decisions require client approval

• Higher investor involvement and transparency

• Suitable for informed investors who want control

This model expands the categories of portfolio management by offering flexibility and personalization within the types of portfolio management in india.

Learn More: Why You Need a Health Insurance Advisor in 2025: Smart Planning for Rising Medical Costs

Categories of Portfolio Management Based on Investment Objective

This section explains how portfolio management strategies are classified according to financial goals and expected outcomes.

Growth Oriented Portfolio Management

Growth oriented portfolio management focuses on capital appreciation over the long term.

Key features of growth oriented portfolios

• High allocation to equities and growth assets

• Suitable for long term wealth creation

• Higher exposure to market volatility

• Ideal for investors with high risk tolerance

This objective driven strategy is an important part of the categories of portfolio management and is common in aggressive types of portfolio management in india.

Income Oriented Portfolio Management

Income oriented portfolio management aims to generate regular income while preserving capital.

Key features of income oriented portfolios

• Higher allocation to debt and income generating assets

• Lower volatility compared to growth strategies

• Suitable for retirees and conservative investors

• Focus on stability and predictable cash flow

Income strategies diversify the categories of portfolio management and suit conservative types of portfolio management in india.

Read More: Comparing the Best PMS Companies in India: Performance, Fees, and Services Explained

Balanced Portfolio Management

Balanced portfolio management combines growth and income strategies to achieve stability and moderate returns.

Key features of balanced portfolios

• Allocation across equity and debt instruments

• Moderate risk and return profile

• Suitable for investors seeking steady growth

• Helps reduce extreme market impact

Balanced strategies strengthen the categories of portfolio management and offer flexibility within the types of portfolio management in india.

Read More: How a Life Insurance Advisor Can Help You Secure Your Family’s Future in 2025

Types of Portfolio Management in India Based on Asset Allocation

This section explains how portfolios are structured based on asset allocation preferences. Asset allocation determines overall portfolio behavior.

Equity Oriented Portfolio Management

Equity oriented portfolio management focuses primarily on investments in stocks and equity related instruments.

Key features

• Higher growth potential over the long term

• Greater exposure to market fluctuations

• Suitable for aggressive investors

• Requires longer investment horizon

Debt Oriented Portfolio Management

Debt oriented portfolio management focuses on fixed income securities.

Key features

• Lower risk compared to equity focused portfolios

• Stable and predictable returns

• Suitable for capital preservation

• Ideal for short to medium term goals

Hybrid Portfolio Management

Hybrid portfolio management combines equity and debt investments.

Key features

• Balanced risk and return approach

• Diversification across asset classes

• Suitable for moderate investors

• Helps smooth market volatility

These asset based approaches form an important part of the categories of portfolio management and define common types of portfolio management in india.

Learn More: Equity Fund Investment vs. Mutual Fund: Which Is Better for 2025?

How to Choose the Right Category of Portfolio Management

This section helps investors apply classification knowledge to real world decision making.

Choosing the right portfolio management category depends on personal financial goals, risk appetite, and investment horizon. Understanding the categories of portfolio management helps investors avoid mismatched strategies.

Steps to choose the right category

1 Clearly define financial objectives

2 Assess personal risk tolerance

3 Decide investment time horizon

4 Select suitable portfolio category

5 Review and adjust strategy periodically

By following these steps, investors can confidently select from the available types of portfolio management in india.

Ready to choose the right PMS? Get in touch with us

Conclusion

Understanding the categories of portfolio management is essential for building a structured and goal aligned investment strategy. Each category offers a unique approach to managing risk, returns, and investor involvement.

By gaining clarity on the categories of portfolio management and the various types of portfolio management in india, investors can make informed decisions, stay disciplined during market cycles, and achieve long term financial stability with confidence.

FAQs on Categories of Portfolio Management

1. What are the main categories of portfolio management?

The main categories of portfolio management include active and passive management, discretionary and non-discretionary management, and objective-based strategies such as growth, income, and balanced portfolios.

2. How many types of portfolio management exist in India?

There are several types of portfolio management in India, classified based on management style, level of client involvement, asset allocation approach, and investment objectives.

3. Which portfolio management category is best for beginners?

Beginners often prefer passive or balanced portfolio management because these strategies involve lower risk and simpler investment structures.

4. What is the difference between active and passive portfolio management?

Active portfolio management involves frequent buying and selling of securities to outperform the market, while passive portfolio management focuses on tracking market indices with minimal trading.

5. Is discretionary portfolio management better than non-discretionary management?

Discretionary portfolio management suits investors who prefer professional control over investment decisions, whereas non-discretionary management is ideal for those who want to stay involved in decision-making.

6. Which portfolio management category suits long-term investors?

Growth-oriented portfolio management is generally suitable for long-term investors seeking capital appreciation over time.

7. Can investors switch between portfolio management categories?

Yes, investors can switch between portfolio management categories as their financial goals, risk tolerance, or investment priorities change.

8. How risky is growth-oriented portfolio management?

Growth-oriented strategies carry higher risk due to greater equity exposure but offer higher potential returns over the long term.

9. Are portfolio management services regulated in India?

Yes, portfolio management services in India are regulated to ensure transparency, investor protection, and compliance with regulatory standards.

10. How often should portfolio management categories be reviewed?

Portfolio management categories should be reviewed periodically or whenever there is a change in financial goals, risk appetite, or market conditions.

Powered by Froala Editor