Top Unlisted IPO Shares to Watch in 2026

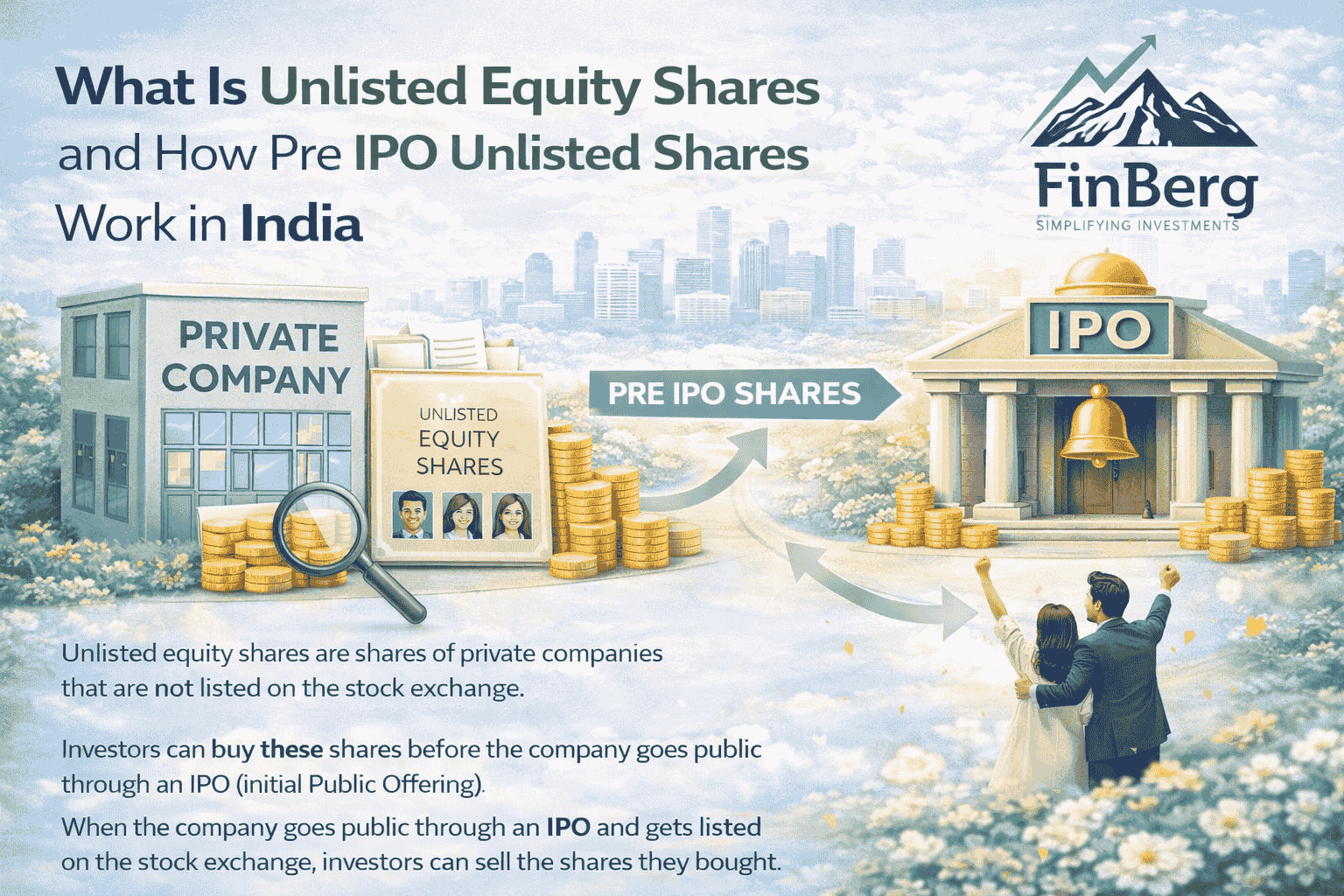

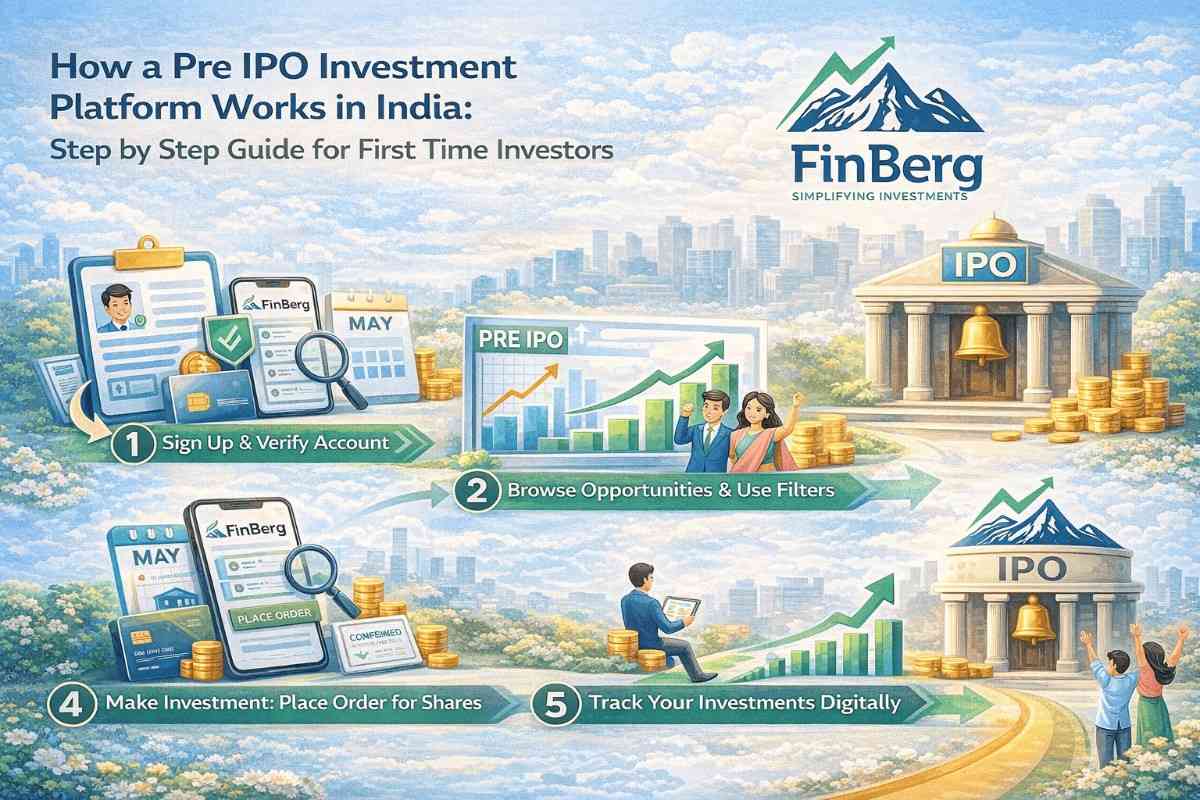

The investment landscape has evolved significantly over the past decade, with investors increasingly exploring opportunities beyond traditional stock markets. One of the most exciting opportunities today involves investing in top unlisted IPO shares in 2026. These shares belong to companies that are expected to go public in the future, offering early investors a chance to participate in their growth journey before they become available to the general public. This approach allows investors to potentially benefit from valuation growth once the company launches its IPO.

Interest in unlisted ipo investments has grown as startups and private companies continue to expand rapidly. Investors who identify top unlisted IPO shares in 2026 early can benefit from long term growth potential and early entry advantages. Understanding how unlisted ipo investments work helps investors make informed decisions and diversify their portfolios effectively.

Invest early in top unlisted IPO shares with expert support

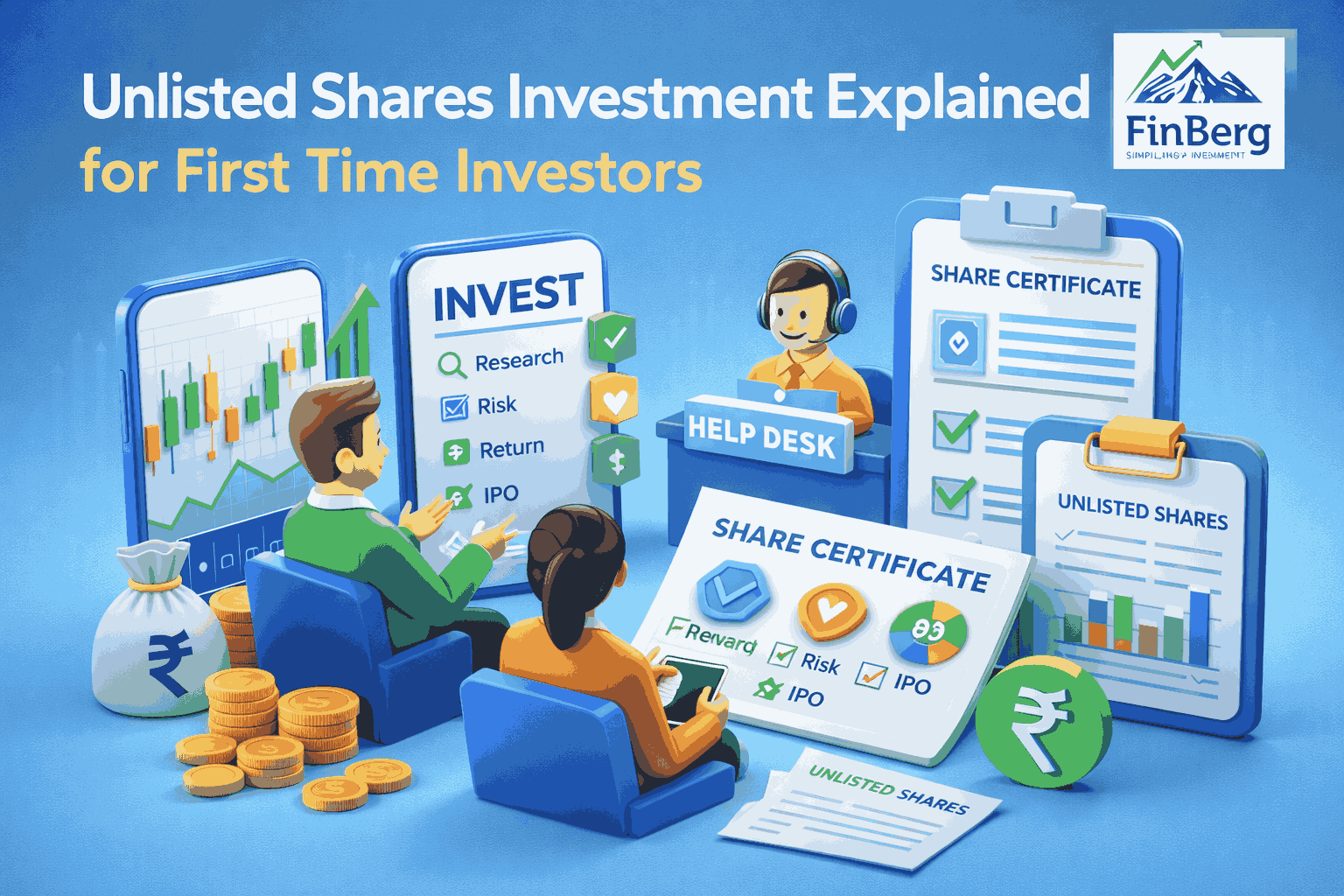

What Are Unlisted IPO Shares and How They Work

Unlisted shares belong to companies that are not yet publicly traded.

An unlisted ipo refers to shares of companies available before they officially list on a stock exchange. Investors purchase these shares privately, often through specialized platforms or intermediaries. Top unlisted IPO shares in 2026 represent companies preparing for public listings.

Key characteristics of unlisted IPO shares

• Early stage investment opportunity

Investors can enter before public listing, allowing participation in potential valuation growth.

• Higher growth potential

Many unlisted ipo companies are expanding rapidly, offering opportunities for strong returns.

• Limited liquidity

Unlike listed shares, unlisted shares cannot be sold easily in open markets.

These features make top unlisted IPO shares in 2026 attractive but require careful evaluation.

Best Financial Planner in India for Young Professionals and Startups

Why Investors Are Watching Top Unlisted IPO Shares in 2026

Investor interest continues to grow due to rising startup valuations.

Top unlisted IPO shares in 2026 offer opportunities to invest in companies during their growth phase. Many investors prefer entering early to maximize returns before public listing.

Reasons investors prefer unlisted IPO investments

• Opportunity to invest in high growth companies early

• Potential for strong returns after IPO listing

• Portfolio diversification beyond traditional stocks

The increasing demand for unlisted ipo investments reflects changing investment strategies.

Top Unlisted IPO Shares in 2026 by Sector

Different sectors offer promising unlisted IPO opportunities.

Technology Sector Unlisted IPO

• Technology companies are expanding rapidly due to digital transformation

• Many startups are achieving high valuations before IPO listing

• Innovation driven growth increases investor interest

Technology represents some of the top unlisted IPO shares in 2026 due to global demand.

Financial Services Unlisted IPO

• Fintech companies are transforming financial services

• Digital payment adoption is increasing globally

• Financial technology companies attract strong investor interest

Financial services remain a key segment in unlisted ipo opportunities.

Consumer and Retail Sector Unlisted IPO

• Consumer demand continues to expand rapidly

• Retail companies are adopting digital platforms

• Brand expansion increases company valuations

Consumer sector companies are often included in top unlisted IPO shares in 2026.

Step by Step Guide to Investing Through India’s Largest Mutual Fund Distributor

Benefits and Risks of Investing in Unlisted IPO Shares

Understanding advantages and risks is essential.

Benefits include

• Early investment in high growth companies

• Potential high returns after IPO listing

• Portfolio diversification

Risks include

• Limited liquidity compared to listed shares

• Uncertain company performance

• Regulatory and valuation risks

Top unlisted IPO shares in 2026 offer growth potential but require careful research.

Comparison Table: Unlisted IPO Shares vs Listed Shares

Understanding differences helps investors evaluate opportunities.

Unlisted ipo investments differ significantly from traditional stock investments.

Step by Step Tutorial: How to Invest in Mutual Funds Using Top Mutual Fund Sites

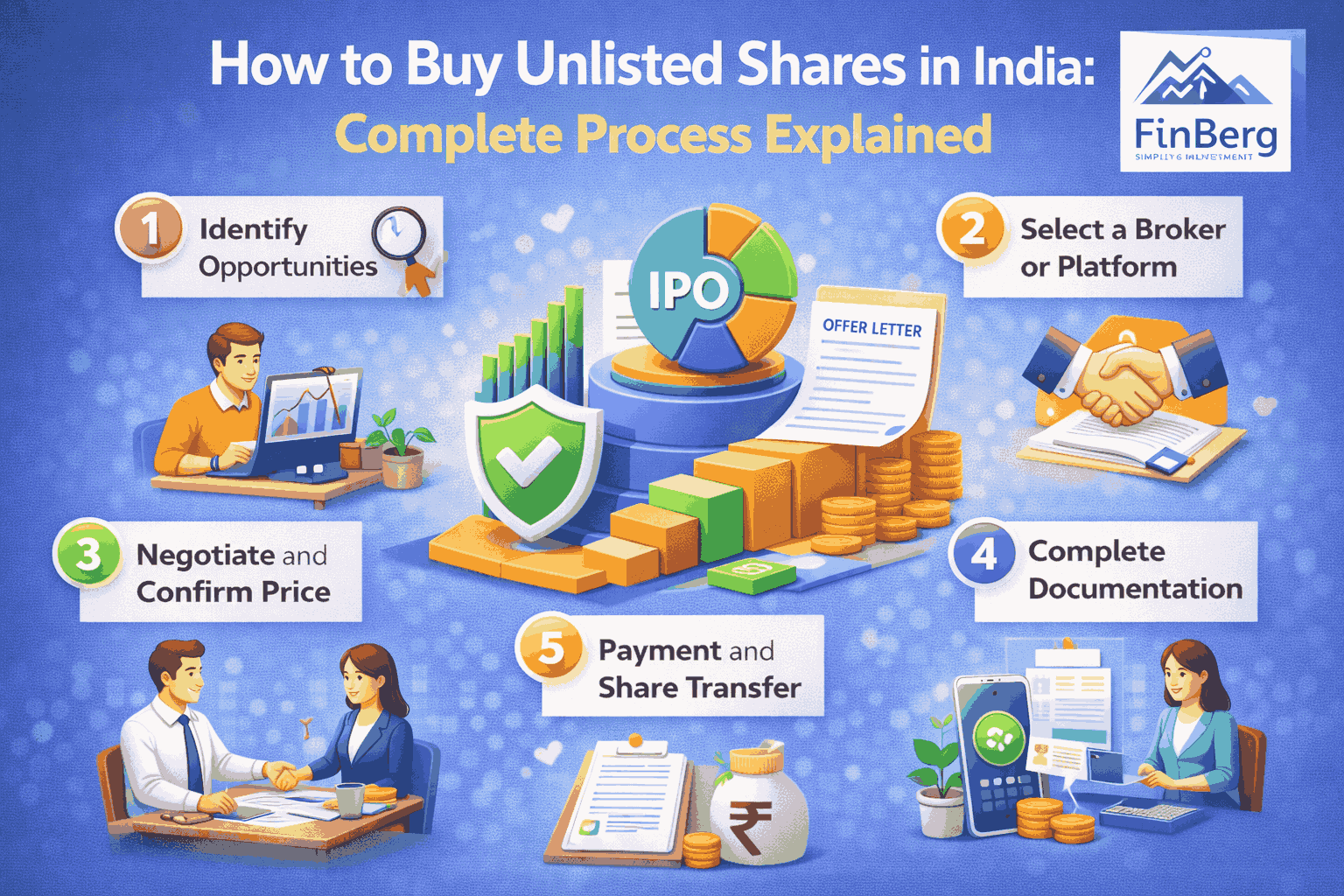

How to Invest in Top Unlisted IPO Shares in 2026

Investment requires careful planning and research.

Steps to invest

1 Research companies preparing for IPO

• Evaluate company growth potential and financial performance

2 Use trusted investment platforms

• Select reliable platforms specializing in unlisted ipo investments

3 Diversify investments

• Avoid investing entire capital in a single company

4 Monitor company performance

• Track progress until IPO listing

Top unlisted IPO shares in 2026 require disciplined investment strategy.

Term Insurance Policy Explained: Benefits, Features and How to Choose the Best Plan

Factors to Consider Before Investing in Unlisted IPO

Careful evaluation improves investment outcomes.

Important considerations include

• Company financial performance

• Market potential and growth opportunities

• Management team and leadership

These factors influence performance of top unlisted IPO shares in 2026.

Conclusion

Top unlisted IPO shares in 2026 offer exciting opportunities for investors seeking early entry into high growth companies. These investments provide diversification and long term growth potential.

However, unlisted ipo investments require careful research and risk management. By understanding opportunities and risks, investors can make informed decisions and benefit from emerging investment opportunities.

Contact us to get expert help investing in unlisted IPO shares

FAQs on Top Unlisted IPO Shares in 2026

1. What are top unlisted IPO shares in 2026?

These are shares of companies expected to go public in the future.

2. What is unlisted ipo?

It refers to shares of companies not yet listed on stock exchanges.

3. Are unlisted IPO shares safe?

They carry higher risk but offer strong growth potential.

4. How to invest in unlisted shares?

Through specialized investment platforms and intermediaries.

5. What are risks of unlisted IPO?

Risks include limited liquidity and uncertain valuation.

6. Can retail investors invest?

Yes, retail investors can participate through investment platforms.

7. Are returns guaranteed?

No, returns depend on company performance and market conditions.

8. How to sell unlisted shares?

Through private transactions or after IPO listing.

9. Are unlisted IPO legal?

Yes, they are legal and regulated.

10. Why invest before IPO?

Early investment offers potential for higher returns.

Powered by Froala Editor