Term Insurance Policy Explained: Benefits, Features and How to Choose the Best Plan

Financial security is one of the most important pillars of long term stability, yet many individuals focus more on saving and investing than protecting their income. A term insurance policy india is designed to provide financial protection to your family in case of unexpected events. It ensures that your dependents can maintain their lifestyle, pay off debts, and meet future financial obligations even in your absence. Understanding the importance of protection early helps build a strong and secure financial foundation.

In today’s fast paced financial environment, income plays a central role in supporting both short term needs and long term goals. A term insurance policy india helps protect that income and reduces financial risk. Many individuals underestimate the term insurance benefits available through these plans, which include affordable premiums, flexible coverage, and reliable financial support for families. Choosing the right policy is essential for achieving financial security and peace of mind.

Protect your future today with the right term insurance policy tailored to your financial goals

What Is Term Insurance Policy India and How It Works

Term insurance provides life coverage for a fixed duration.

A term insurance policy india offers financial protection to your nominee if something happens to you during the policy period. It is a pure protection plan, meaning it does not include investment or savings components. Instead, it focuses entirely on providing financial security.

Key features of term insurance

• Provides financial coverage for a fixed duration such as 20, 30, or 40 years

• Offers high coverage amounts at relatively affordable premium rates

• Ensures financial support to family members during unexpected situations

• Helps protect long term financial goals and obligations

These term insurance benefits make term insurance one of the most essential financial protection tools.

Best Financial Planner in India for Young Professionals and Startups

Key Term Insurance Benefits You Should Know

Financial protection is the primary purpose of term insurance.

A term insurance policy india ensures that your family remains financially secure even if you are no longer present. It helps cover essential expenses and long term financial commitments.

Major term insurance benefits include

• Income replacement

A term insurance policy india ensures that your family continues to receive financial support even in your absence. This helps maintain their lifestyle and financial stability.

• Debt protection

Outstanding loans such as home loans, personal loans, or education loans can be covered using term insurance benefits. This prevents financial burden on family members.

• Financial security

A reliable term insurance policy india ensures that your dependents have sufficient financial resources to meet daily expenses and long term needs.

• Peace of mind

Knowing that your family is financially protected provides emotional and financial confidence.

These term insurance benefits play a critical role in securing your financial future.

Main Features of Term Insurance Policy India

Understanding features helps individuals choose the right plan.

A term insurance policy india offers flexibility, affordability, and reliable financial protection. It is designed to suit different income levels and financial goals.

Important features include

• Flexible coverage duration

You can select policy terms based on your financial goals and career timeline.

• Affordable premium structure

Premium rates remain affordable compared to other insurance types, making protection accessible.

• High coverage amount

A term insurance policy india allows individuals to secure high coverage at reasonable costs.

• Simple claim process

Insurance companies provide straightforward claim procedures to ensure quick financial support.

These features enhance term insurance benefits and provide dependable protection.

Step by Step Guide to Investing Through India’s Largest Mutual Fund Distributor

How Term Insurance Policy India Supports Financial Planning

Insurance plays a vital role in long term financial strategy.

A term insurance policy india ensures that your financial goals remain protected even during unexpected situations. It allows individuals to invest confidently without worrying about financial risk.

Financial planning advantages

• Protects income and ensures financial continuity

• Supports long term wealth creation strategies

• Helps secure retirement and family financial goals

These term insurance benefits strengthen financial planning and stability.

Comparison Table: Term Insurance Policy vs Other Insurance Plans

Understanding differences helps make better financial decisions.

This comparison highlights how term insurance benefits provide efficient financial protection.

Step by Step Tutorial: How to Invest in Mutual Funds Using Top Mutual Fund Sites

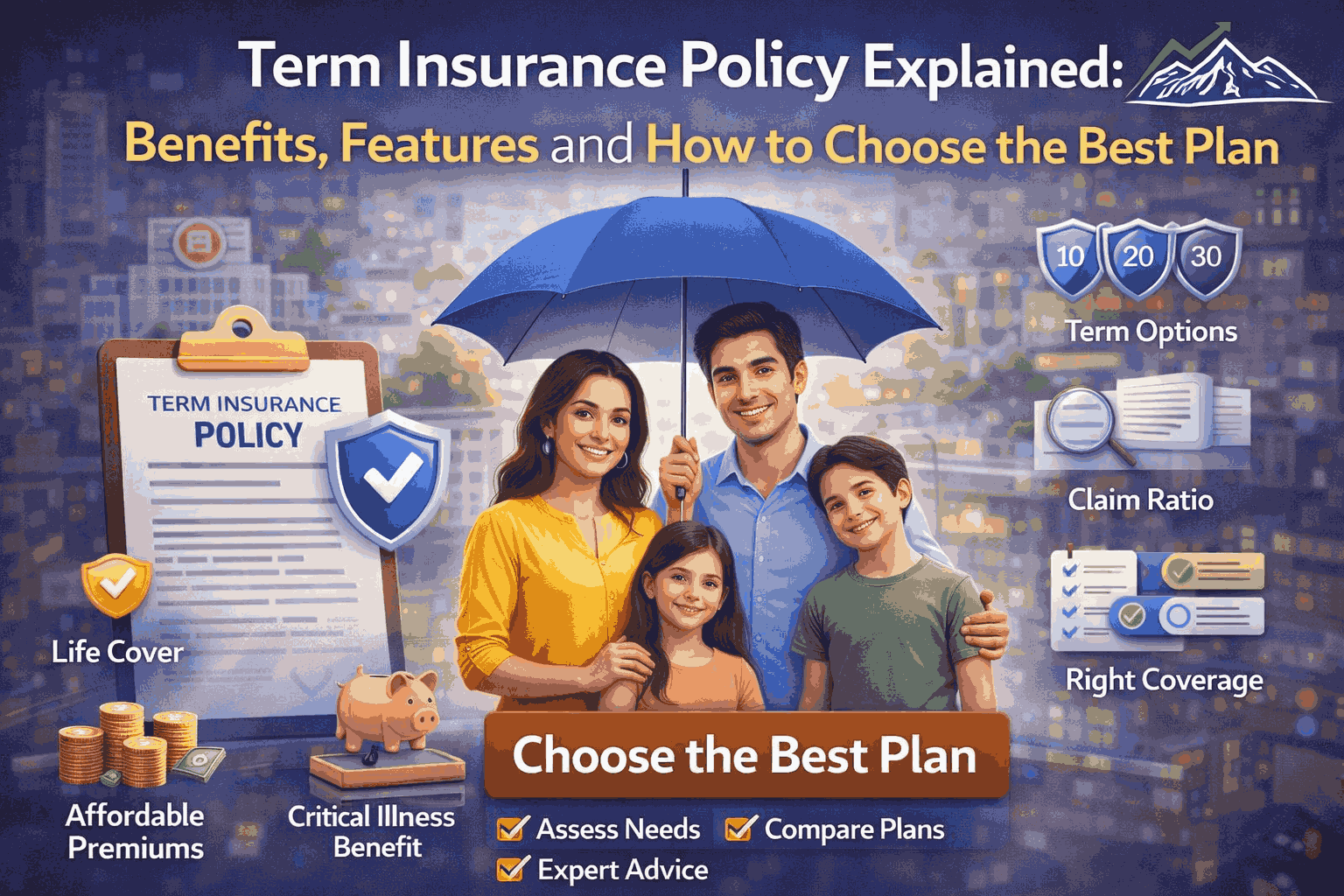

How to Choose the Best Term Insurance Policy India

Choosing the right policy requires careful evaluation.

1 Determine coverage amount based on income and financial responsibilities

2 Compare premium rates across insurers

3 Review claim settlement ratio

4 Understand policy terms and conditions

Selecting the right term insurance policy india ensures maximum term insurance benefits and financial protection.

Common Mistakes to Avoid When Buying Term Insurance Policy India

Avoiding mistakes improves policy effectiveness.

Common mistakes include

• Choosing insufficient coverage amount

• Delaying purchase until premiums increase

• Ignoring policy terms and conditions

• Selecting policies without proper comparison

Understanding term insurance benefits helps individuals avoid these errors.

Conclusion

A term insurance policy india is one of the most effective ways to protect your family and secure your financial future. It provides affordable coverage and ensures financial stability.

The long term term insurance benefits include income protection, financial security, and peace of mind. Choosing the right policy ensures reliable protection and supports long term financial planning goals.

Contact us to get expert guidance on choosing the right term insurance policy

FAQs on Term Insurance Policy India

1. What is term insurance policy india?

A term insurance policy india is a life insurance plan that provides financial protection for a fixed period and ensures family security.

2. What are term insurance benefits?

Term insurance benefits include financial protection, income replacement, and family support.

3. Who should buy term insurance?

Anyone with financial responsibilities should consider term insurance.

4. How much coverage is needed?

Coverage should match income and financial obligations.

5. Is term insurance expensive?

No, term insurance policy india is affordable compared to other insurance plans.

6. Can term insurance be bought online?

Yes, many insurers offer online purchase options.

7. What happens after policy term ends?

Coverage ends unless renewed or extended.

8. Is medical test required?

It depends on coverage amount and insurer requirements.

9. Can coverage be increased later?

Some policies allow coverage upgrades.

10. Is term insurance necessary?

Yes, it provides essential financial protection.

Powered by Froala Editor