Best Financial Planner in India for Young Professionals and Startups

Starting a career or building a startup comes with ambition, uncertainty, and financial complexity. Salaries may grow rapidly, business income may fluctuate, and expenses often rise faster than expected. In such a scenario, working with the best financial planner in India can provide structure, clarity, and direction. Instead of making random investment decisions, young earners benefit from professional guidance that aligns money with long term goals.

For founders and salaried individuals alike, investment planning India is no longer optional. Early financial mistakes can delay wealth creation by years. A qualified financial planner for young professionals helps create discipline around savings, risk management, and asset allocation. Choosing the best financial planner in India at an early stage ensures smarter decisions and stronger financial foundations.

Plan smarter today with expert guidance from the best financial planner in India

Why Young Professionals and Startups Need a Financial Planner

Modern income patterns are unpredictable and fast changing.

Young professionals often face lifestyle inflation, education loans, and limited knowledge of long term planning. Startup founders deal with irregular cash flow and reinvestment decisions. The best financial planner in India helps bring structure to these uncertainties.

Key financial challenges

• Managing inconsistent or growing income streams

• Balancing high risk investments with stability

• Planning taxes efficiently

• Building emergency reserves

With proper investment planning India strategies, both salaried individuals and founders can reduce financial stress. A financial planner for young professionals ensures early discipline that compounds over time.

Step by Step Guide to Investing Through India’s Largest Mutual Fund Distributor

Qualities of the Best Financial Planner in India

Not every advisor is suitable for early career professionals.

The best financial planner in India understands the unique needs of millennials, startup founders, and young executives. Experience, certifications, and client focus matter significantly.

Important qualities

• Goal based planning aligned with life milestones

• Transparent fee structure without hidden commissions

• Strong risk assessment and asset allocation skills

• Long term strategic thinking rather than short term gains

A financial planner for young professionals must simplify complex financial concepts. The best financial planner in India also integrates tax efficiency into investment planning India to maximize net returns.

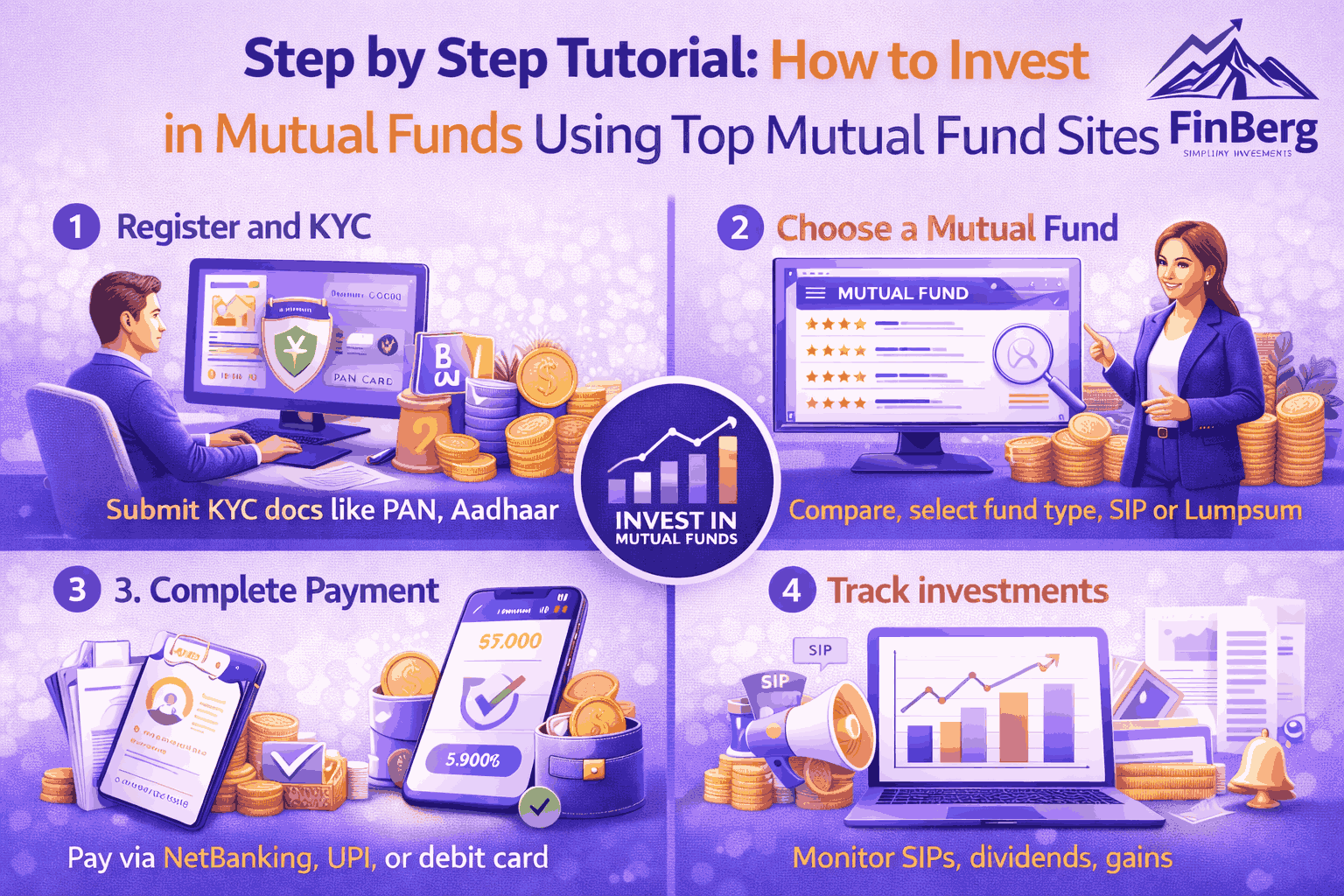

Step by Step Tutorial: How to Invest in Mutual Funds Using Top Mutual Fund Sites

How Investment Planning India Supports Long Term Growth

Early planning accelerates wealth creation.

Investment planning India focuses on structured asset allocation, disciplined investing, and long term compounding. The best financial planner in India ensures that clients diversify across equity, debt, and other instruments according to risk profile.

Core areas of investment planning

• Equity exposure for growth oriented portfolios

• Debt instruments for capital preservation

• Emergency fund creation for liquidity

• Retirement planning from an early age

A financial planner for young professionals emphasizes starting small but consistent. Over time, disciplined investment planning India creates substantial wealth.

Services Offered by the Best Financial Planner in India

Comprehensive services ensure holistic financial management.

Personal Financial Planning

• Budgeting and expense tracking systems tailored to income patterns

• Emergency fund creation to handle sudden expenses

• Insurance planning to protect against unexpected risks

The best financial planner in India builds a strong financial base before aggressive investing begins.

Investment Advisory

• Mutual fund and equity allocation based on goals

• Portfolio diversification to balance risk and return

• Continuous performance monitoring and rebalancing

Through structured investment planning India, a financial planner for young professionals ensures disciplined wealth creation.

How a Portfolio Management System Helps Track, Optimize, and Grow Your Investments Efficiently

Startup Financial Strategy

• Founder compensation and salary structuring

• Business cash flow planning alongside personal finances

• Tax optimization for entrepreneurs

The best financial planner in India understands startup challenges and integrates personal and business financial planning seamlessly.

Financial Planner vs DIY Investing

Understanding the difference helps young professionals make informed choices.

Investment planning India becomes more systematic with professional guidance compared to self directed investing.

How to Choose the Right Financial Planner for Young Professionals

Selecting the right advisor requires careful evaluation.

1 Check credentials and certifications

2 Review experience with startups and salaried professionals

3 Understand fee structure and transparency

4 Assess communication style and clarity

The best financial planner in India will align advice with your career stage. A reliable financial planner for young professionals focuses on long term partnership rather than quick sales. Structured investment planning India should always be the core of the advisory model.

Private Equity Investment in India 2026: Trends, Sectors, and Opportunities Investors Should Watch

Common Mistakes Young Professionals Make Without Financial Planning

Lack of guidance often leads to avoidable errors.

Common mistakes

• Investing without clear goals

• Ignoring risk tolerance

• Delaying retirement planning

• Overlooking tax efficiency

Without the best financial planner in India, many individuals depend on random tips instead of strategic investment planning India. A financial planner for young professionals helps avoid emotional and impulsive decisions.

Conclusion

Early financial discipline creates long term independence. Working with the best financial planner in India allows young professionals and founders to build structured portfolios aligned with life goals.

Through disciplined investment planning India and strategic advice from a financial planner for young professionals, wealth creation becomes predictable rather than accidental. Choosing the right advisor today can shape financial success for decades to come.

Have questions about your financial goals? Contact us to speak with a trusted financial planner

FAQs on Best Financial Planner in India

1. Who is the best financial planner in India?

The best financial planner in India is one who aligns strategies with your goals, offers transparent fees, and focuses on structured investment planning India.

2. Do young professionals need financial planning?

Yes, a financial planner for young professionals helps build early discipline and long term wealth.

3. What is investment planning India?

Investment planning India refers to structured allocation of assets to achieve financial goals.

4. How much does a financial planner charge?

Charges vary depending on experience and services offered.

5. Is financial planning different from wealth management?

Yes, financial planning focuses on goals and structure, while wealth management is broader.

6. Can startups benefit from financial planners?

Yes, startup founders benefit from structured planning and tax efficiency.

7. When should I start investing?

Early investing enhances compounding benefits.

8. Are online financial planners reliable?

Many certified advisors offer reliable digital services.

9. What documents are required?

Income details, tax records, and existing investment information are usually required.

10. How to measure financial planning success?

Success is measured by goal achievement, portfolio growth, and financial stability.

Powered by Froala Editor