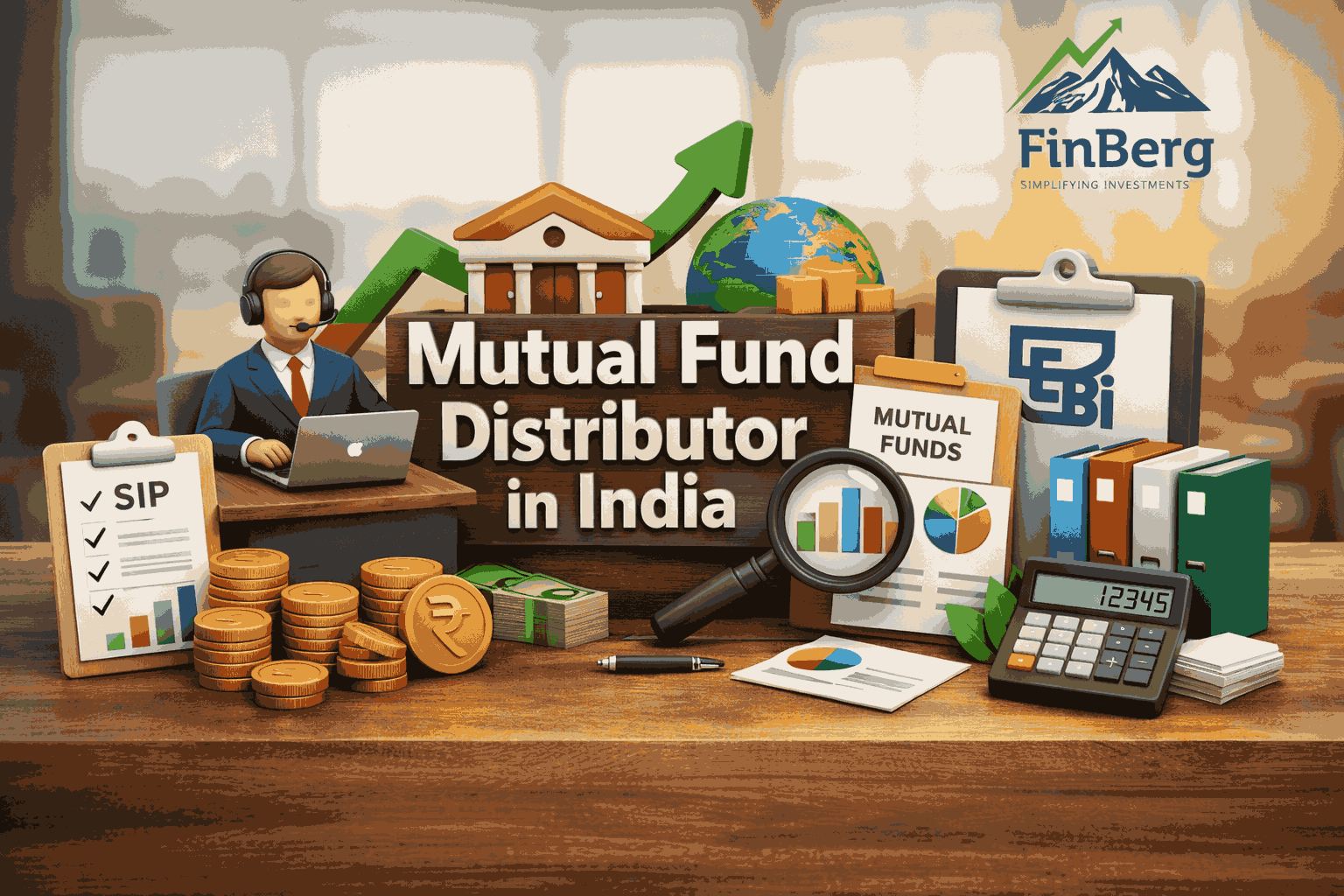

How Mutual Fund Distributors Help Investors Build Long-Term Wealth

Building wealth is a gradual process that requires discipline, patience, and informed decision-making. Many investors struggle to stay consistent due to market volatility, lack of clarity, or emotional reactions. Mutual fund distributors play a critical role in helping investors remain focused and aligned with their financial goals. Through structured planning and ongoing mutual fund investment guidance, they support sustainable long-term wealth creation.

Explore mutual fund solutions for smarter, goal-focused investing

Understanding the Role of Mutual Fund Distributors

Mutual fund distributors act as a bridge between investors and mutual fund houses. They simplify complex investment choices and ensure investors follow a structured path instead of reacting impulsively to market movements.

Who mutual fund distributors are

Certified professionals registered under regulatory authorities

Intermediaries between investors and asset management companies

Providers of structured mutual fund investment guidance

Long-term partners rather than one-time product sellers

Why investors rely on mutual fund distributors

Limited time to research funds independently

Need for clarity during volatile market conditions

Desire for consistent long-term wealth creation

Requirement of disciplined investment support

Why Long-Term Investing Matters for Wealth Creation

Long-term investing allows investors to ride out market fluctuations and benefit from compounding. Short-term strategies often fail due to emotional decision-making and inconsistent discipline.

Benefits of staying invested long term

Compounding works effectively over longer periods

Market volatility smooths out with time

Transaction costs reduce with fewer exits

Wealth accumulation becomes more predictable

Role of patience in long-term wealth creation

Avoids panic selling during downturns

Prevents overtrading in bull markets

Encourages goal-oriented investing

Learn More: Small-Cap vs. Mid-Cap vs. Large-Cap Investments in India: Risk and Reward

How Mutual Fund Distributors Support Long-Term Wealth Creation

Mutual fund distributors provide structure and direction at every stage of the investment journey, ensuring investors stay aligned with their objectives.

Goal-based financial planning

Identifying short-term and long-term financial goals

Mapping goals to suitable mutual fund categories

Defining timelines for each goal

Reviewing progress periodically

Asset allocation strategies

Balancing equity, debt, and hybrid funds

Aligning allocation with risk tolerance

Adjusting exposure based on life stages

Supporting long-term wealth creation through diversification

SIP planning and discipline

Encouraging regular investments

Reducing market timing risks

Supporting rupee cost averaging

Building consistent investment habits

Mutual Fund Investment Guidance Across Life Stages

Investor priorities change with age and responsibilities. Mutual fund distributors adapt strategies to match these evolving needs.

Early career stage

Higher equity exposure for growth

Focus on wealth accumulation

Education on market volatility

Mid-career stage

Balancing growth and stability

Planning for multiple financial goals

Adjusting asset allocation periodically

Pre-retirement and retirement stage

Reducing exposure to high-risk assets

Focus on income generation

Protecting accumulated capital

Learn More: Why have Unlisted shares gained momentum in last few years

Risk Management Through Mutual Fund Distributors

Risk management is essential for protecting investments and ensuring steady progress toward goals.

Assessing investor risk profiles

Evaluating income stability

Understanding risk tolerance

Matching funds to comfort levels

Preventing emotional investment decisions

Avoiding panic during market corrections

Controlling greed during bull phases

Maintaining focus on long-term wealth creation

Portfolio Review and Rebalancing Support

Portfolios require regular evaluation to remain aligned with goals and market conditions.

Importance of periodic portfolio reviews

Tracking fund performance

Identifying underperforming assets

Ensuring alignment with goals

Rebalancing for stability and growth

Restoring target asset allocation

Protecting gains after market rallies

Reducing risk exposure when needed

Value of Mutual Fund Investment Guidance During Market Cycles

Market cycles often test investor discipline. Professional guidance ensures consistency.

During market corrections

Preventing panic-driven exits

Reinforcing long-term strategies

Identifying rebalancing opportunities

During bull markets

Avoiding excessive risk-taking

Booking profits strategically

Maintaining portfolio balance

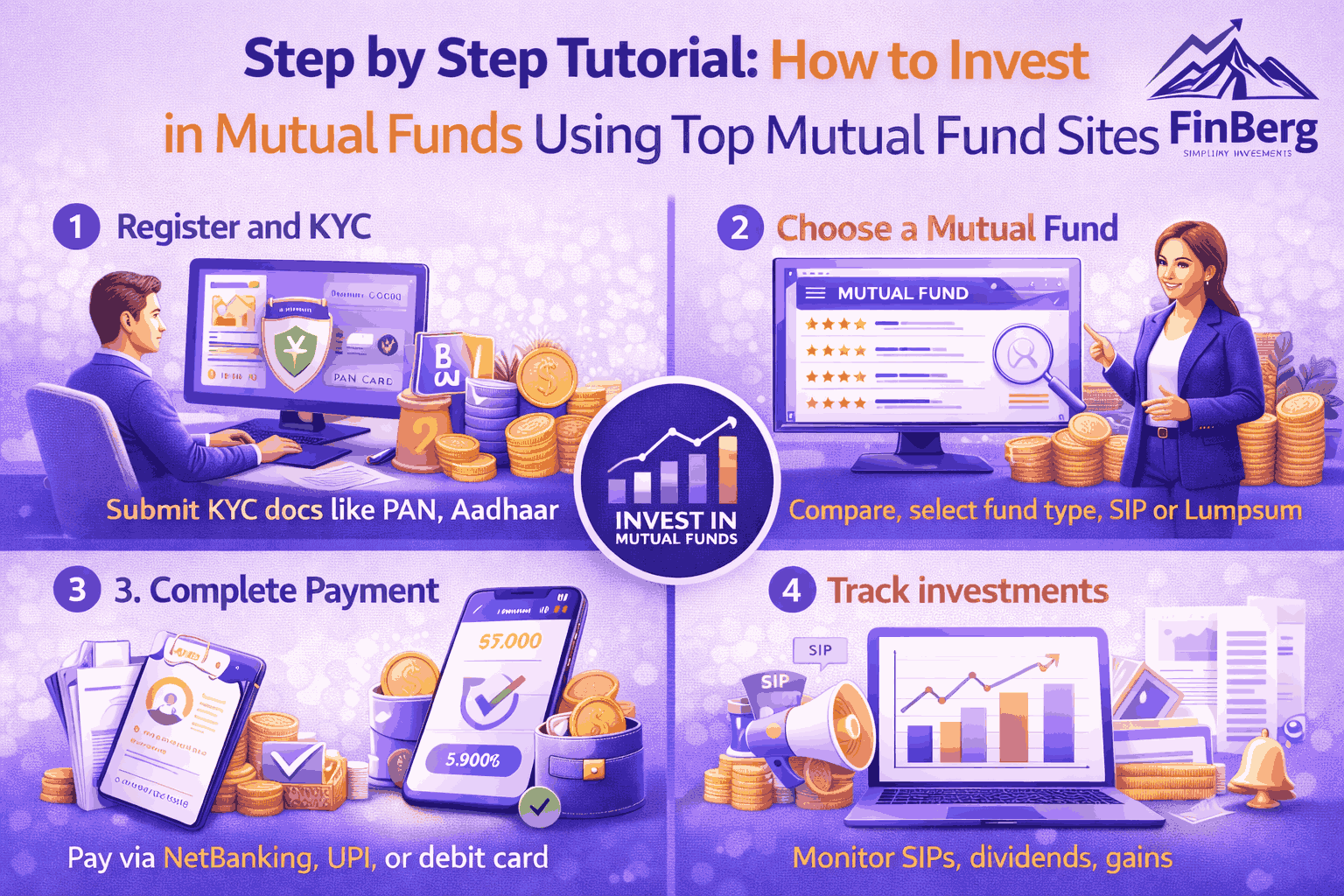

Learn More: How to Invest in Mutual Funds Online [Step-by-Step Guide in 2025]

Transparency, Compliance, and Investor Protection

Trust and transparency are essential elements of successful investing relationships.

Regulatory framework and compliance

Mandatory registrations and disclosures

Ethical distribution practices

Investor protection norms

Educating investors on costs and returns

Explaining expense ratios

Clarifying tax implications

Setting realistic return expectations

DIY Investing vs Investing Through Mutual Fund Distributors

Some investors prefer self-managed investing, but it comes with limitations.

Advantages of professional guidance

Structured investment approach

Time-saving decision-making

Emotional discipline support

Limitations of self-managed investing

Higher chances of poor timing

Limited risk management

Inconsistent long-term wealth creation

How to Choose the Right Mutual Fund Distributor

Selecting the right distributor is crucial for successful investing.

Key qualities to look for

Experience and certification

Transparency and communication

Consistent follow-up and reviews

Questions investors should ask

How often will reviews be conducted

What level of support is provided

How investment strategies are decided

How Mutual Fund Distributors Add Value Over Time

Conclusion

Mutual fund distributors play a vital role in helping investors build financial security. Through disciplined planning, risk management, and continuous mutual fund investment guidance, they support sustainable long-term wealth creation. For investors seeking clarity, consistency, and confidence, mutual fund distributors act as reliable long-term partners.

Frequently Asked Questions

1. How do mutual fund distributors help investors build long-term wealth?

They provide structured planning, investment discipline, and ongoing guidance that supports consistent long-term wealth creation.

2. Are mutual fund distributors suitable for beginners?

Yes, beginners benefit from professional mutual fund investment guidance that simplifies decisions and reduces mistakes.

3. How do distributors manage investment risk?

They align portfolios with individual risk tolerance, investment goals, and time horizons.

4. Do distributors help during market downturns?

Yes, they help investors avoid panic decisions and stay committed to long-term strategies.

5. Is long-term wealth creation possible with SIPs?

Yes, SIPs combined with disciplined guidance support steady and sustainable long-term wealth creation.

6. How often should portfolios be reviewed?

Portfolios should be reviewed periodically to ensure alignment with financial goals and market conditions.

7. Are mutual fund distributors regulated?

Yes, they operate under strict regulatory frameworks designed to protect investors.

8. Can distributors help with retirement planning?

Yes, they focus on income stability, capital protection, and goal-based planning for retirement.

9. Is professional guidance better than DIY investing?

For most investors, structured professional guidance leads to better discipline and outcomes than self-investing.

10. How do distributors ensure goal alignment?

They ensure alignment through regular portfolio reviews, rebalancing, and ongoing communication.

Powered by Froala Editor