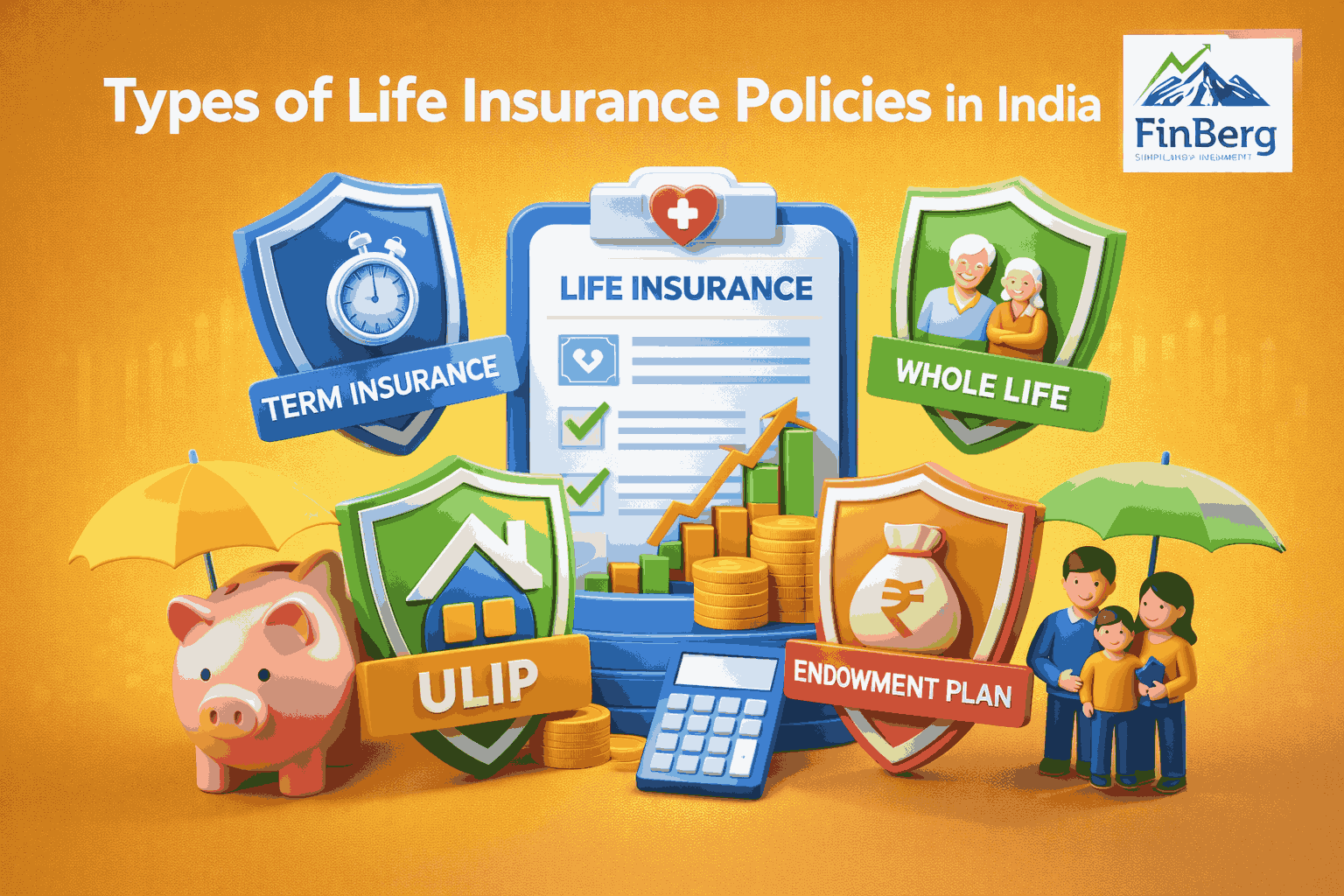

Types of Life Insurance Policies in India

Life insurance plays a critical role in financial planning by providing protection, stability, and long term security for families. It ensures that loved ones are financially supported in case of unforeseen events and also helps individuals plan for future goals. Choosing the right life insurance policy is essential because each policy type serves a different purpose, from pure protection to savings and investment.

In a diverse market like India, insurers offer multiple options to suit varying needs, income levels, and life stages. Understanding the different types of life insurance policies in india helps individuals make informed decisions and avoid buying unsuitable products. A well chosen life insurance policy in india can provide peace of mind, financial discipline, and long term wealth security when aligned correctly with personal goals.

Choose the right life insurance for lasting family security

Understanding Life Insurance Policy in India

This section explains what life insurance is and how it functions within the Indian financial system. It also highlights the basic structure of a policy.

A life insurance policy is a contract between an individual and an insurance company where the insurer promises to pay a specified sum in return for regular premium payments. In India, life insurance policies are regulated to protect policyholders and ensure transparency in benefits and obligations.

Core elements of a life insurance policy include

• Policyholder who buys the insurance

• Insurer who provides coverage

• Premium paid periodically

• Sum assured payable on death or maturity

• Policy term defining coverage duration

Understanding these elements makes it easier to evaluate any life insurance policy in india and choose the right one.

Why Choosing the Right Life Insurance Policy Matters

This section explains the importance of selecting a suitable policy rather than buying insurance without planning.

Choosing the right life insurance policy ensures that financial protection matches actual needs. An unsuitable policy may lead to insufficient coverage or unnecessary costs. A well matched policy supports both protection and long term financial goals.

Key reasons why life insurance is essential

1 Provides income replacement for dependents

2 Helps repay loans and liabilities

3 Supports long term savings and planning

4 Offers peace of mind during uncertainties

Selecting the right life insurance policy in india helps individuals balance protection, affordability, and future planning.

Unlisted Shares Investment Explained for First Time Investors

Major Types of Life Insurance Policies in India

This section introduces the broad classification of life insurance plans available in the Indian market. It provides an overview before detailed discussion.

The types of life insurance policies in india can be broadly divided into protection oriented plans and savings or investment oriented plans. Each life insurance policy category serves a specific financial purpose, making it important to understand how they differ.

Types of Life Insurance Policies in India Based on Coverage

This section explains life insurance plans classified by the extent and duration of coverage they provide.

Term Life Insurance Policy

Term insurance is a pure protection plan designed to provide financial security to dependents.

Key features of term insurance

• Offers high coverage at affordable premium levels

• Provides payout only in case of death during policy term

• No maturity benefit at the end of the term

• Suitable for income replacement and family protection

A term life insurance policy is often considered the foundation of financial planning due to its simplicity and affordability.

Unlisted Shares Investment in India: How to Get Started Step by Step

Whole Life Insurance Policy

Whole life insurance provides coverage for the entire lifetime of the policyholder.

Key features of whole life plans

• Coverage extends up to a specified high age or lifelong

• Combines protection with a savings component

• Death benefit paid to nominees whenever death occurs

• Suitable for estate planning and legacy creation

A whole life insurance policy in india is ideal for those seeking long term coverage beyond retirement.

Endowment Life Insurance Policy

Endowment plans combine insurance coverage with savings benefits.

Key features of endowment plans

• Pays maturity benefit if policyholder survives the term

• Provides death benefit during policy period

• Encourages disciplined long term savings

• Suitable for goal based planning such as education or marriage

An endowment life insurance policy balances protection and guaranteed savings.

Categories of Portfolio Management in India: A Complete Classification Guide

Types of Life Insurance Policies in India Based on Investment Component

This section explains policies that combine insurance with investment or periodic payouts.

Unit Linked Insurance Plans

ULIPs combine life cover with market linked investment opportunities.

Key features of ULIPs

• Investment in equity and debt funds

• Flexibility to switch between fund options

• Potential for higher returns over long term

• Suitable for investors comfortable with market risks

A ULIP life insurance policy in india suits individuals seeking growth along with protection.

Money Back Life Insurance Policy

Money back plans provide periodic payouts during the policy term.

Key features of money back plans

• Regular survival benefits at fixed intervals

• Life cover continues throughout the term

• Provides liquidity for financial milestones

• Suitable for individuals needing periodic cash flow

This life insurance policy type supports both protection and liquidity needs.

Categories of Mutual Funds in India: A Complete Classification Guide

Child Life Insurance Policy

Child insurance plans focus on securing a child’s future.

Key features of child plans

• Long term savings for education and career goals

• Premium waiver benefit in case of parent’s death

• Financial security for children during uncertainties

• Encourages early financial planning

A child life insurance policy in india helps parents plan for rising education costs.

Types of Life Insurance Policies in India Based on Purpose

This section explains life insurance plans classified by their specific financial objectives.

Retirement and Pension Plans

These plans focus on creating a steady income after retirement.

Key features

• Helps build retirement corpus over time

• Provides regular income post retirement

• Reduces dependence on others during old age

Group Life Insurance Policy

Group insurance is offered by employers or organizations to members.

Key features of group plans

• Covers multiple individuals under one policy

• Lower premium cost compared to individual plans

• Limited customization options

• Provides basic financial protection

A group life insurance policy in india offers affordable coverage but may not replace individual insurance.

Why Mutual Funds Are Popular in India: Benefits, Risks and Long Term Potential

Comparison of Different Life Insurance Policies in India

This section compares major policy types to help readers understand differences clearly.

Comparison table

Comparing options helps in selecting the most suitable life insurance policy in india.

SIP vs Mutual Fund Know Where to Start Your Investment Journey

How to Choose the Best Life Insurance Policy in India

This section guides readers through the process of selecting the right policy.

Choosing the best policy depends on personal factors such as age, income, and responsibilities. A clear assessment ensures the policy meets actual needs.

Steps to choose correctly

1 Calculate required coverage based on income and liabilities

2 Decide policy duration based on dependents

3 Select policy type aligned with financial goals

4 Compare insurers and policy features

A carefully chosen life insurance policy provides long term security and value.

Need help choosing the right life insurance policy? Contact us today

Conclusion

Life insurance is a vital component of a strong financial plan, offering protection and long term stability. Understanding the types of life insurance policies in india helps individuals choose coverage that aligns with personal goals and responsibilities.

By selecting the right life insurance policy in india based on coverage, investment needs, and purpose, individuals can ensure financial security for their families while building a disciplined approach toward long term planning.

FAQs on Life Insurance Policy in India

1. What is a life insurance policy?

A life insurance policy is a financial contract that provides a payout to beneficiaries in case of the policyholder’s death or at maturity.

2. How many types of life insurance policy in India exist?

There are multiple types of life insurance policy in India including term insurance, endowment plans, ULIPs, whole life policies, and money back plans.

3. Which life insurance policy is best for family protection?

Term insurance is generally considered best for family protection due to its high coverage amount and affordable premiums.

4. Is term insurance better than other policies?

Term insurance is ideal for pure protection, while other life insurance policies focus on savings or investment benefits.

5. Can I have multiple life insurance policies?

Yes, individuals can hold multiple life insurance policies to meet different financial goals such as protection, savings, and wealth creation.

6. What is the right age to buy life insurance?

Buying life insurance at an early age helps secure lower premiums and allows longer coverage duration.

7. Are life insurance returns taxable?

The tax treatment of life insurance returns depends on the policy type and prevailing tax laws.

8. How much life insurance coverage do I need?

Life insurance coverage should be decided based on income level, existing liabilities, future family expenses, and financial goals.

9. What happens if I stop paying premiums?

If premiums are not paid, policy benefits may lapse or reduce depending on the policy terms and grace period conditions.

10. Is life insurance mandatory in India?

Life insurance is not mandatory in India, but it is strongly recommended for ensuring long-term financial security.

Powered by Froala Editor