Who Is a Mutual Fund Distributor in India and What Do They Do?

The mutual fund industry in India has grown rapidly over the last decade, attracting millions of new investors. While online platforms and apps have made investing easier, many investors still struggle with selecting the right schemes, understanding risk, and staying disciplined over the long term. This is where a mutual fund distributor in India plays an important role.

Despite their importance, many investors are unsure about who is a mutual fund distributor and what does a mutual fund distributor do in real-world investing. This blog explains the role, responsibilities, benefits, and regulations surrounding mutual fund distributors, helping investors decide whether distributor support is right for them.

Expert guidance for smarter mutual fund investing.

Who Is a Mutual Fund Distributor in India

A mutual fund distributor in India is an intermediary authorized to distribute mutual fund schemes to investors. They act as a bridge between asset management companies and investors by helping individuals access suitable mutual fund products based on their needs.

Understanding who is a mutual fund distributor is essential for anyone new to investing. A distributor is not the fund manager and does not control market performance. Instead, they guide investors through product selection, paperwork, and long-term investing discipline.

Meaning and definition of a mutual fund distributor

To understand who is a mutual fund distributor, it helps to break the role into simple terms. A mutual fund distributor in India is a registered individual or entity that sells mutual fund schemes on behalf of asset management companies.

Their core identity includes:

Being registered with AMFI

Holding a valid ARN number

Being authorized to distribute schemes

Acting as an investor-facing support channel

Every mutual fund distributor in India must meet regulatory requirements to ensure investor safety and transparency.

SIP vs Mutual Fund Know Where to Start Your Investment Journey

Types of mutual fund distributors in India

A mutual fund distributor in India can operate in different formats, depending on scale and business model.

Common types include:

Individual mutual fund distributors

Independent financial advisors

Bank-affiliated distributors

Online platforms acting as distributors

Regardless of format, the core responsibility remains the same, which reinforces who is a mutual fund distributor across all channels.

What Does a Mutual Fund Distributor Do

Many investors ask what does a mutual fund distributor do beyond selling mutual funds. The role extends far beyond transactions and includes ongoing guidance and support.

Core responsibilities of a mutual fund distributor

To clearly explain what does a mutual fund distributor do, it is important to look at their daily responsibilities.

Key responsibilities include:

Understanding investor goals and risk appetite

Recommending suitable mutual fund schemes

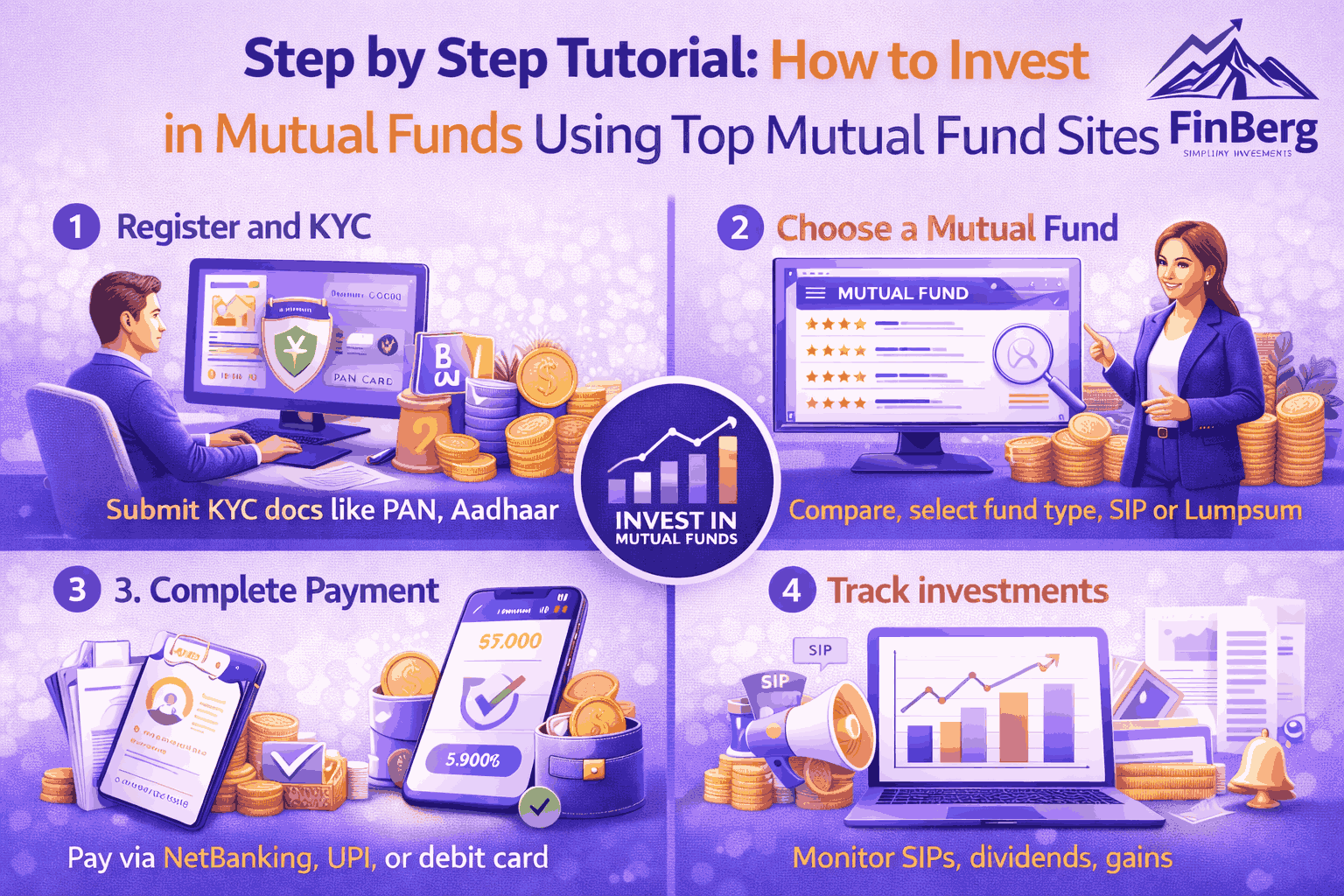

Assisting with KYC and onboarding

Helping set up SIPs and lump sum investments

A mutual fund distributor in India simplifies the investment journey, especially for first-time investors.

Read More: Comparing the Best PMS Companies in India: Performance, Fees, and Services Explained

Ongoing support provided to investors

Another important aspect of what does a mutual fund distributor do is post-investment support. Investing is not a one-time decision, and distributors help investors stay on track.

Ongoing support includes:

Monitoring portfolio performance

Advising on SIP modifications

Guiding scheme switches

Assisting with redemptions

This long-term involvement highlights why a mutual fund distributor in India is often seen as a financial partner rather than just a seller.

How Mutual Fund Distributors Are Regulated in India

Regulation ensures trust and accountability in the mutual fund ecosystem. Every mutual fund distributor in India operates under a defined regulatory framework.

Role of AMFI and SEBI

To understand who is a mutual fund distributor legally, investors must know about AMFI and SEBI. AMFI registers distributors, while SEBI oversees investor protection.

Key regulatory requirements include:

Mandatory AMFI registration

ARN number issuance

Adherence to ethical standards

Regular compliance updates

A regulated mutual fund distributor in India provides assurance of legitimacy.

Learn More: Equity Fund Investment vs. Mutual Fund: Which Is Better for 2025?

Why regulation matters for investors

Regulation ensures that a mutual fund distributor in India follows fair practices, transparent disclosures, and investor-first conduct. This reduces mis-selling and builds long-term trust.

Difference Between Mutual Fund Distributor and Direct Investing

Investors often compare distributor investing with direct mutual fund investing. Understanding the difference helps clarify who is a mutual fund distributor and their value.

Distributor route explained

When investing through a mutual fund distributor in India, investors receive guidance, recommendations, and support.

Benefits include:

Personalized advice

Goal-based planning

Reduced confusion

Long-term discipline

This explains what does a mutual fund distributor do differently from self-investing.

Direct mutual fund route explained

Direct investing involves choosing schemes independently. While it may reduce expense ratios, it requires research, discipline, and confidence. For many investors, distributor support adds more value than cost savings.

How Mutual Fund Distributors Earn Money

Many investors misunderstand distributor compensation, leading to hesitation.

Commission structure explained

A mutual fund distributor in India earns through commissions paid by AMCs, not directly by investors.

The structure typically includes:

Trail-based commissions

Earnings linked to assets under management

No upfront billing to investors

Understanding what does a mutual fund distributor do financially builds transparency.

Impact of commissions on investors

SEBI mandates disclosure of commissions, ensuring investors know how a mutual fund distributor in India is compensated.

Read More: How a Life Insurance Advisor Can Help You Secure Your Family’s Future in 2025

Benefits of Investing Through a Mutual Fund Distributor in India

There are clear advantages to working with a mutual fund distributor in India, especially for certain investor profiles.

Benefits for new investors

For beginners, understanding who is a mutual fund distributor can reduce anxiety.

Benefits include:

Simplified fund selection

Education and awareness

Structured investing habits

Benefits for experienced investors

Even experienced investors benefit from portfolio reviews, rebalancing, and behavioral guidance, reinforcing what does a mutual fund distributor do beyond basic advice.

When Should You Consider a Mutual Fund Distributor

Not every investor needs the same level of support, but many situations justify distributor involvement.

Ideal investor profiles

A mutual fund distributor in India is particularly helpful for:

First-time investors

Long-term planners

Goal-oriented investors

Understanding who is a mutual fund distributor helps identify fit.

Situations where distributor support adds value

Complex goals, tax planning, and multiple schemes make distributor guidance valuable.

Common Misconceptions About Mutual Fund Distributors

There are myths surrounding the role of a mutual fund distributor in India.

Misconception vs reality

Common misconceptions include:

Distributors push biased products

Distributor investing is expensive

Distributors limit fund choice

In reality, a regulated mutual fund distributor in India offers transparency and choice.

Learn More: Why You Need a Health Insurance Advisor in 2025: Smart Planning for Rising Medical Costs

How to Choose the Right Mutual Fund Distributor in India

Choosing the right distributor is as important as choosing the right fund.

Key factors to evaluate

Before selecting a mutual fund distributor in India, evaluate:

AMFI registration

Experience

Transparency

Communication approach

Questions to ask before selecting

Ask questions that clarify who is a mutual fund distributor you are dealing with and how they operate.

Investing With vs Without a Distributor

Read More: What Happens to Unlisted Shares After an IPO in 2025? A Complete Investor Guide

Role of Mutual Fund Distributors in Long-Term Wealth Creation

A mutual fund distributor in India plays a critical role in ensuring consistency, discipline, and patience, which are key to wealth creation.

How distributors support consistency

They help investors:

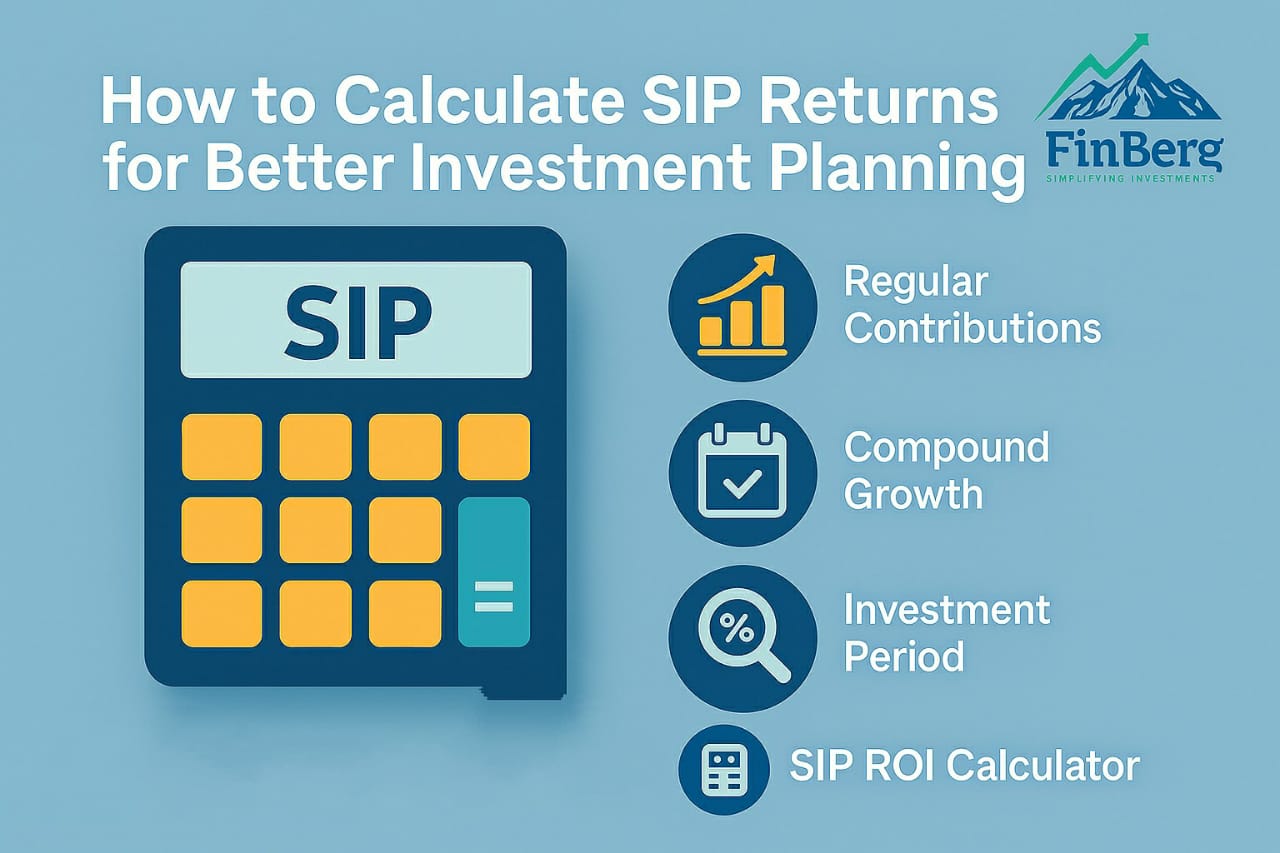

Maintain SIP discipline

Avoid emotional decisions

Review portfolios periodically

This reinforces what does a mutual fund distributor do beyond transactions.

Conclusion

Understanding who is a mutual fund distributor and what does a mutual fund distributor do helps investors make informed decisions. A mutual fund distributor in India provides guidance, structure, and long-term support that many investors need to succeed. While direct investing works for some, distributor support can simplify investing, reduce mistakes, and improve long-term outcomes.

Need expert guidance on mutual fund investing? Contact us today.

Frequently Asked Questions

1. Who is a mutual fund distributor in India?

A mutual fund distributor in India is a registered intermediary authorized to distribute mutual fund schemes and assist investors with selection, transactions, and ongoing support.

2. What does a mutual fund distributor do for investors?

A mutual fund distributor helps investors choose suitable schemes, complete KYC formalities, set up SIPs or lump sum investments, and manage portfolios over time.

3. Is it mandatory to invest through a mutual fund distributor in India?

No, investing through a mutual fund distributor in India is optional. Investors can also choose the direct route if they are confident in managing investments independently.

4. How does a mutual fund distributor earn income?

A mutual fund distributor earns income through commissions paid by asset management companies based on the assets managed, not through direct charges to investors.

5. Are mutual fund distributors regulated in India?

Yes, every mutual fund distributor in India must be registered with AMFI and operate under regulations overseen by SEBI to ensure investor protection.

6. Can a mutual fund distributor help with SIP investments?

Yes, setting up, modifying, and monitoring SIP investments is a key responsibility of a mutual fund distributor.

7. Is investing through a distributor more expensive than direct investing?

While expense ratios may be slightly higher, many investors find the guidance and discipline provided by a distributor valuable enough to justify the cost.

8. How can I verify whether a mutual fund distributor is registered?

You can verify a distributor’s ARN number on the official AMFI website to confirm their registration status.

9. Who should consider using a mutual fund distributor in India?

First-time investors, long-term planners, and individuals with limited time or financial knowledge benefit most from using a mutual fund distributor in India.

10. Can experienced investors benefit from a mutual fund distributor?

Yes, experienced investors can benefit from portfolio reviews, rebalancing advice, and support in maintaining investment discipline.

Powered by Froala Editor