Portfolio Management Explained: Definition, Importance & Examples

Managing money is no longer just about picking a few good investments and hoping for the best. In today’s uncertain and fast-moving markets, investors need structure, discipline, and clarity. This is where the importance of portfolio management becomes impossible to ignore. A well-managed portfolio helps investors control risk, align investments with goals, and stay focused during market ups and downs.

For beginners and experienced investors alike, portfolio management explained in simple terms helps remove confusion and emotional decision-making. When investors understand the portfolio management definition clearly, they are better equipped to make informed choices that support long-term financial stability.

Turn strategy into results with expert portfolio management support.

Portfolio Management Explained in Simple Terms

Portfolio management explained simply means planning, selecting, monitoring, and adjusting investments to meet financial goals. It is not a one-time activity but an ongoing process that evolves with markets and life stages.

The importance of portfolio management lies in creating balance. Instead of relying on a single asset, portfolio management spreads investments across different instruments to reduce risk and improve consistency.

What portfolio management means for investors

Selecting the right mix of assets

Aligning investments with goals

Managing risk exposure

Reviewing performance regularly

Making adjustments when required

Why portfolio management is relevant today

• Markets are highly volatile

• Investment choices are increasing

• Emotional investing can cause losses

• The importance of portfolio management grows during uncertainty

Portfolio Management Definition and Core Concept

The portfolio management definition refers to the systematic process of managing a collection of investments to achieve specific financial objectives while controlling risk.

Understanding the portfolio management definition helps investors see the bigger picture rather than focusing on individual returns.

Formal portfolio management definition

Portfolio management involves asset allocation, diversification, monitoring, and rebalancing of investments to optimize returns within acceptable risk limits.

Focuses on overall portfolio performance

Considers risk and return together

Aligns investments with objectives

Requires continuous evaluation

How portfolio management works in practice

Portfolio management explained in practice includes choosing assets, tracking performance, and making informed changes.

• Asset selection based on goals

• Periodic portfolio review

• Rebalancing to maintain allocation

• Risk management adjustments

Importance of Portfolio Management for Investors

The importance of portfolio management becomes clear when investors face market fluctuations, economic changes, or personal financial transitions.

Without structure, investors often react emotionally. Portfolio management provides discipline and direction.

Why portfolio management is essential

Reduces overall investment risk

Improves return consistency

Prevents overexposure to one asset

Encourages long-term thinking

Impact on long-term wealth creation

The importance of portfolio management lies in its ability to support compounding. Proper management allows investors to stay invested, rebalance gains, and protect capital during downturns.

Read More: What is PMS in Stock Market A Complete Guide in 2025

Objectives of Portfolio Management

Every portfolio is built with specific objectives in mind. Portfolio management explained clearly helps investors understand these objectives.

Key objectives of portfolio management

Capital appreciation

Income generation

Liquidity management

Capital protection

Risk control

Aligning objectives with investor goals

Portfolio management explained properly ensures that objectives match the investor’s time horizon, income needs, and risk tolerance.

Read More: Difference Between SIP and Mutual Fund Explained: A Complete Guide for New Investors

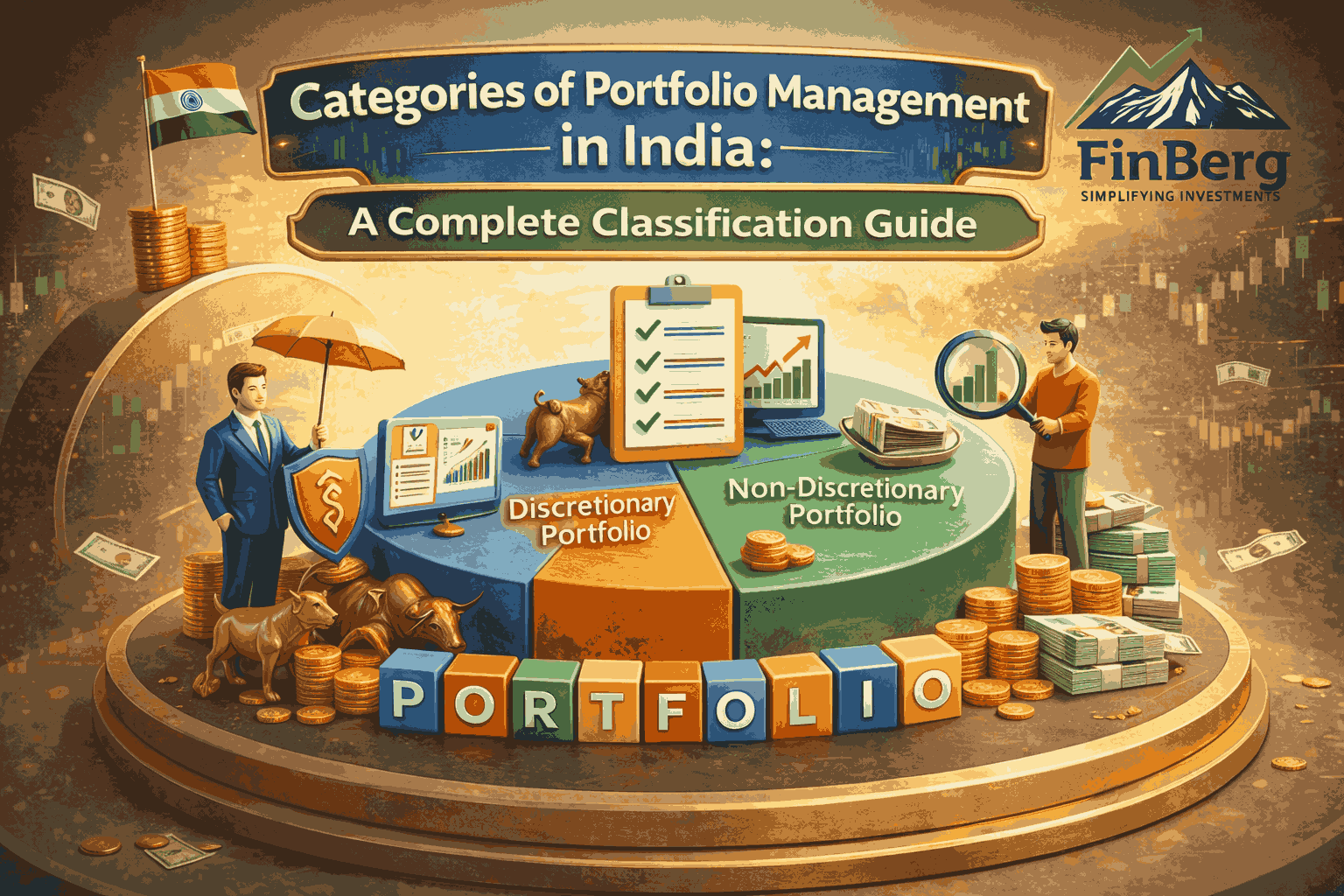

Types of Portfolio Management

There are different approaches to portfolio management, each serving different investor preferences.

Active portfolio management

Active portfolio management involves frequent monitoring and decision-making.

• Regular buying and selling

• Market research and analysis

• Higher involvement

• Aims to outperform benchmarks

Passive portfolio management

Passive portfolio management follows predefined strategies.

Index-based investing

Lower turnover

Reduced costs

Long-term discipline

Both approaches highlight the importance of portfolio management in maintaining structure.

Portfolio Management Explained Through Asset Allocation

Asset allocation is the foundation of portfolio management explained in practical terms.

It determines how investments are distributed across asset classes.

Role of asset allocation

• Balances risk and return

• Diversifies investments

• Aligns portfolio with goals

• Strengthens portfolio stability

Strategic vs tactical allocation

Strategic allocation focuses on long-term goals

Tactical allocation adjusts for short-term opportunities

Both support the importance of portfolio management

Combined approach improves flexibility

Read More: How to Buy and Sell Unlisted Shares in India: A Step-by-Step Investor’s Guide

Risk Management and Portfolio Management

Risk is unavoidable, but it can be managed effectively.

The importance of portfolio management lies in controlling risk rather than eliminating it.

How portfolio management helps control risk

• Diversification across assets

• Limiting concentration risk

• Managing volatility exposure

• Aligning risk with tolerance

Balancing risk and return

Portfolio management explained well shows that higher returns usually involve higher risk. Managing this balance is central to successful investing.

Examples of Portfolio Management

Real-world examples help explain portfolio management explained clearly.

Example 1: Conservative investor portfolio

Higher allocation to debt

Lower equity exposure

Focus on income stability

Low volatility

Example 2: Moderate investor portfolio

• Balanced equity and debt

• Moderate risk

• Stable growth

• Long-term orientation

Example 3: Aggressive growth portfolio

Higher equity allocation

Greater volatility

Long-term horizon

Focus on capital appreciation

Each example reinforces the importance of portfolio management.

Portfolio Management Explained for Different Life Stages

Investment needs change over time.

Portfolio management explained by life stage helps investors adapt strategies.

Early-career investors

• Higher risk capacity

• Long investment horizon

• Focus on growth

• Equity-heavy portfolios

Mid-career investors

Balance between growth and safety

Increasing responsibilities

Gradual risk reduction

Retired or near-retirement investors

• Income focus

• Capital preservation

• Lower volatility

• Stable allocation

Portfolio Monitoring and Rebalancing

Portfolio management does not end after investing.

The importance of portfolio management includes continuous monitoring.

Why regular portfolio reviews matter

Track performance

Identify allocation drift

Respond to market changes

Stay aligned with goals

Rebalancing strategies

• Periodic rebalancing

• Threshold-based rebalancing

• Market-driven adjustments

Read More: Comparing the Best PMS Companies in India: Performance, Fees, and Services Explained

Common Portfolio Management Mistakes

Many investors overlook the importance of portfolio management.

Mistakes investors make without proper management

• Overconcentration

• Emotional decisions

• Ignoring asset allocation

• Chasing short-term returns

How portfolio management helps avoid these errors

Portfolio management explained properly promotes discipline, planning, and rational decision-making.

Tools and Techniques Used in Portfolio Management

Modern investing uses tools to improve efficiency.

Tools used by investors and advisors

Risk profiling tools

Asset allocation models

Performance tracking systems

Analytics platforms

Role of professional guidance

Professionals apply the portfolio management definition systematically, ensuring alignment with objectives and market conditions.

Learn More: Equity Fund Investment vs. Mutual Fund: Which Is Better for 2025?

Portfolio Management Overview

Importance of Portfolio Management in Volatile Markets

Market volatility tests investor patience.

The importance of portfolio management increases during uncertain times.

Managing market uncertainty

• Reduces panic decisions

• Protects capital

• Maintains allocation discipline

Maintaining long-term focus

Portfolio management explained helps investors stay committed to long-term goals despite short-term fluctuations.

Read More: How to Choose the Best Pre-IPO Investment Platform: A Beginner’s Guide

How to Build an Effective Portfolio Management Strategy

Building a strategy requires clarity and structure.

Key factors to consider

Financial goals

Risk tolerance

Time horizon

Liquidity needs

Market conditions

Step-by-step portfolio management approach

Define objectives

Assess risk profile

Allocate assets

Monitor performance

Rebalance periodically

Contact us to get expert guidance for your investment goals

Conclusion

Portfolio management explained clearly shows that investing success depends on structure, discipline, and adaptability. Understanding the portfolio management definition allows investors to move beyond guesswork and emotional decisions.

The importance of portfolio management lies in its ability to manage risk, support long-term wealth creation, and keep investments aligned with goals. Whether an investor is conservative or aggressive, effective portfolio management remains the foundation of sustainable financial success.

Frequently Asked Questions

1. What is portfolio management explained in simple terms?

Portfolio management explained means managing investments systematically to achieve financial goals while controlling risk.

2. Why is the importance of portfolio management high for investors?

Because it reduces risk, improves consistency, and supports long-term financial planning.

3. What is the correct portfolio management definition?

It is the process of selecting, monitoring, and adjusting investments to optimize returns within acceptable risk levels.

4. How does portfolio management help reduce risk?

Through diversification, proper asset allocation, and regular rebalancing of investments.

5. Can beginners benefit from portfolio management explained clearly?

Yes, beginners gain structure, discipline, and clarity when portfolio management is explained properly.

6. How often should portfolios be reviewed?

Portfolios should be reviewed at least once a year or whenever major financial or market changes occur.

7. Is professional guidance necessary for portfolio management?

Professional guidance helps improve structure, discipline, and decision-making, especially for long-term goals.

8. What assets are included in portfolio management?

Equity, debt instruments, and alternative investments are commonly included.

9. How does portfolio management differ by age?

Younger investors focus more on growth, while older investors prioritize stability and income.

10. What happens without proper portfolio management?

Without proper portfolio management, investors face higher risk, emotional decisions, and inconsistent returns.

Powered by Froala Editor