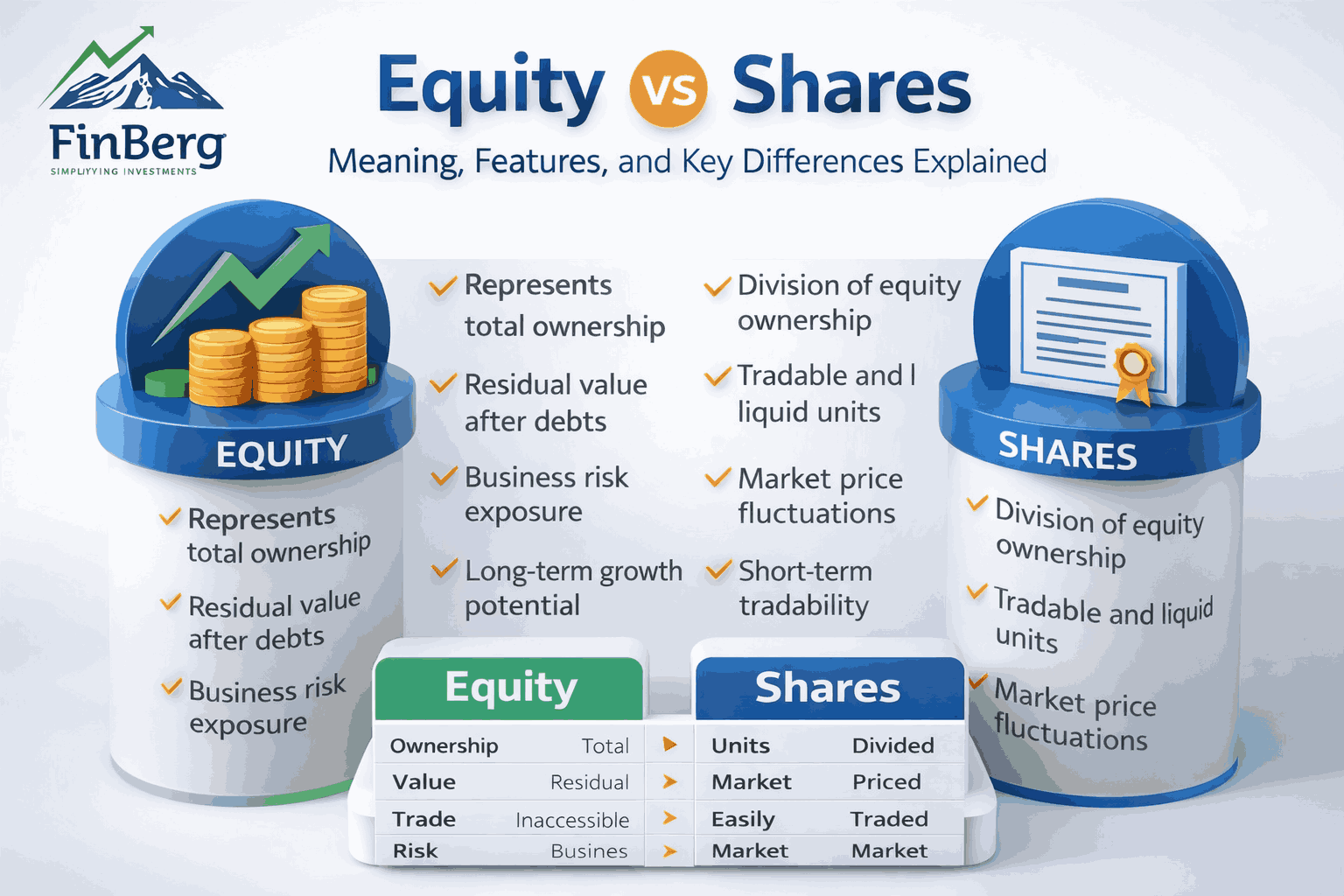

Equity vs Shares: Meaning, Features, and Key Differences Explained

For many investors, especially beginners, the stock market can feel overwhelming because of confusing terminology. One of the most common sources of confusion is equity vs shares. These terms are often used interchangeably in conversations, news, and even by experienced investors, yet they carry different meanings depending on context.

Understanding equity vs shares meaning is essential for anyone who wants to invest confidently. When investors clearly understand the difference between equity and shares, they are better equipped to evaluate ownership, risk, and long-term return potential. This clarity helps avoid costly mistakes and builds a strong foundation for financial decision-making.

Explore Finberg’s equity services for smarter equity investing

Understanding Equity and Shares

Equity and shares are closely related concepts, but they represent ownership from different perspectives. One focuses on value and ownership, while the other focuses on division and tradability.

What equity means in investing

Equity refers to the ownership interest that shareholders have in a company. It represents the portion of a company’s assets that belong to shareholders after all liabilities are paid.

Equity reflects ownership in the business

It represents the residual value after debts

Equity grows as the company performs well

It plays a major role in long-term wealth creation

Equity holders benefit from both growth and profitability

From an investor’s point of view, equity is about long-term participation in a company’s success rather than short-term price movements.

What shares represent

Shares are the units into which a company’s equity is divided. When investors buy shares, they are buying a portion of the company’s equity.

• Shares act as measurable ownership units

• They are traded on stock exchanges

• Share prices fluctuate daily based on demand and supply

• Shares provide liquidity to equity ownership

• They allow investors of all sizes to participate

Shares make equity accessible and tradable, which is why they are central to stock market activity.

Equity vs Shares Meaning Explained Clearly

To fully understand equity vs shares meaning, it helps to look at how these terms function together rather than separately.

How equity and shares are interconnected

Equity represents total ownership, while shares are the method used to distribute that ownership.

Equity is the broader concept of ownership

Shares divide equity into smaller parts

Buying shares gives the investor equity ownership

The equity and shares difference lies in scope versus measurement

Equity shows value, shares show quantity

Read More: What is PMS in Stock Market A Complete Guide in 2025

Why investors use the terms interchangeably

The confusion around equity vs shares meaning arises because both terms refer to ownership, just from different angles.

• Market discussions focus on share trading

• Equity is implied rather than explicitly stated

• Informal usage ignores technical distinctions

• Media and casual investors blur definitions

Equity vs Shares: Key Conceptual Differences

Although related, equity and shares differ in how they describe ownership and financial rights.

Ownership perspective

Equity defines the ownership relationship, while shares define how that ownership is divided.

Equity represents total ownership in the company

Shares represent ownership portions

Voting rights stem from equity ownership

Dividend rights are linked to shares

Control increases with higher equity stake

Financial and legal interpretation

The equity and shares difference becomes clearer when viewed from accounting and legal perspectives.

• Equity appears on the balance sheet

• Shares appear in trading and ownership records

• Equity measures net company value

• Shares determine investor participation

Read More: Difference Between SIP and Mutual Fund Explained: A Complete Guide for New Investors

Difference Between Equity and Shares in Practice

The difference between equity and shares is not just theoretical; it affects how companies raise money and how investors earn returns.

Role in company structure

Companies issue shares to raise equity capital, which is then used for growth and operations.

Equity reflects company valuation

Shares divide ownership among investors

Issuing shares increases equity capital

Equity and shares difference affects dilution

Ownership percentage changes with share issuance

Impact on investors

The difference between equity and shares influences both risk and reward for investors.

• Shareholders gain exposure to equity growth

• Share prices fluctuate daily

• Equity value changes with business performance

• Ownership percentage affects voting power

• Long-term returns depend on equity growth

Features of Equity

Equity has several defining features that attract long-term investors.

Core characteristics of equity

• Represents ownership interest

• Residual claim on company assets

• Linked to long-term growth

• Subject to business risk

• Reflects company profitability and value

Benefits of holding equity

Holding equity allows investors to participate in a company’s long-term success through appreciation and potential dividends.

Read More: How to Buy and Sell Unlisted Shares in India: A Step-by-Step Investor’s Guide

Features of Shares

Shares act as the vehicle through which equity is bought and sold.

Core characteristics of shares

Divisible ownership units

Easily tradable in markets

Market-determined pricing

High liquidity compared to direct ownership

Transparent pricing mechanisms

Advantages of investing in shares

• Lower capital requirement to invest

• Flexibility to buy or sell

• Easy portfolio diversification

• Access to listed companies

Equity vs Shares Meaning in the Stock Market

The stock market highlights the functional difference between equity and shares very clearly.

How equity appears in financial statements

Equity is recorded as shareholder equity on the balance sheet.

Shows company net worth

Includes retained earnings

Reflects financial strength

Used in valuation analysis

How shares trade in markets

Shares are traded daily and reflect investor sentiment.

• Prices respond to earnings and news

• Influenced by supply and demand

• Enable liquidity for equity investors

• Serve as a price discovery mechanism

Read More: Comparing the Best PMS Companies in India: Performance, Fees, and Services Explained

Equity and Shares Difference for Beginners

Beginners often misunderstand equity vs shares meaning due to overlapping usage.

Common misunderstandings

• Assuming equity and shares are identical

• Confusing share price with equity value

• Ignoring ownership implications

• Overlooking balance sheet equity

How to remember the difference

Equity means ownership

Shares are units of that ownership

Buying shares equals owning equity

Equity shows value, shares show division

Types of Equity and Shares

Equity and shares come in different forms, each with unique features.

Equity types

• Common equity

• Preference equity

Types of shares

• Equity shares

• Preference shares

Learn More: Equity Fund Investment vs. Mutual Fund: Which Is Better for 2025?

Equity vs Shares: Risk and Return Comparison

Risk and return are central to understanding equity vs shares.

Risk exposure

Equity investments are exposed to business performance and market conditions.

• Business risk affects equity value

• Share prices reflect market volatility

• Higher risk can mean higher returns

Return potential

Returns from equity come in two main forms.

Capital appreciation through share price growth

Dividends from company profits

Long-term compounding benefits

Wealth creation through sustained growth

Equity vs Shares: Taxation and Regulations

Taxation and regulation also highlight the equity and shares difference.

Tax treatment of equity investments

Equity investments are subject to capital gains tax based on holding period.

Regulatory aspects of shares

• Shares are regulated by market authorities

• Disclosure and compliance rules apply

• Investor protection mechanisms exist

Equity vs Shares in Long-Term Investing

Both equity and shares are essential for long-term investment strategies.

Role in wealth creation

Equity investments support long-term wealth creation through business growth and compounding.

Portfolio diversification

Shares allow diversification across sectors, industries, and companies.

Read More: How to Choose the Best Pre-IPO Investment Platform: A Beginner’s Guide

Equity vs Shares Comparison Table

How to Choose Between Equity and Shares

Choosing between equity and shares requires clarity of goals and understanding.

Factors investors should consider

Investment horizon

Risk tolerance

Knowledge level

Capital availability

Financial goals

Role of professional guidance

Professional guidance helps investors understand equity vs shares meaning and apply concepts correctly.

Common Mistakes Investors Make

Mistakes often arise from misunderstanding equity and shares difference.

Misinterpreting equity vs shares meaning

• Treating share price as true value

• Ignoring ownership percentage

• Overlooking long-term perspective

Poor investment decisions

Emotional trading

Short-term focus

Lack of research

Ignoring fundamentals

Conclusion

Understanding equity vs shares is essential for anyone participating in the stock market. Shares are the units that investors trade, while equity represents the actual ownership and value in a company. Clear understanding of equity vs shares meaning removes confusion and supports smarter decision-making.

By learning the difference between equity and shares and applying that knowledge practically, investors can manage risk better, evaluate opportunities accurately, and build long-term wealth with confidence.

Get expert investment guidance- contact Finberg today

Frequently Asked Questions

1. What is the difference between equity and shares?

Equity represents ownership, while shares are the units dividing that ownership.

2. Is equity the same as shares in investing?

They are related but not identical, which is why equity vs shares meaning matters.

3. Why is equity vs shares meaning confusing for investors?

Because the terms are often used interchangeably in everyday discussions.

4. Are equity shares different from other shares?

Yes, equity shares provide ownership and growth participation.

5. How does equity represent ownership?

Equity reflects the net value belonging to shareholders.

6. Can investors buy equity without buying shares?

In public markets, equity ownership is acquired through shares.

7. Which is better for long-term investing?

Equity investments through shares are effective for long-term growth.

8. How does equity and shares difference affect returns?

Returns depend on business performance and market valuation.

9. Are shares riskier than equity?

Shares reflect market volatility, while equity reflects business risk.

10. How should beginners understand equity vs shares?

By remembering that equity is ownership and shares are units of ownership.

Powered by Froala Editor